Portfolio Rebalance / April 23

Following the Signal Sigma Process

The approach to this article follows the step by step process described here. All visuals are sourced from various instruments available in the platform. If you are using the Portfolio Tracker, you’ll be able to see how we set it up for our own portfolio at the end of this article.

At today’s rebalance, by the market’s close, our automated strategies will be “buying the dip” quite aggressively. This course of action runs counter to our own thinking and actions in real life, marking the first major divergence between the models and the Sigma Portfolio.

We explore the merits and the flaws of raising equity exposure at this juncture. While the markets don’t offer any guarantees, we believe there are still many “trapped longs” waiting to exit positions on a reflexive bounce (which we are getting as of this writing). Our strategy for the medium term leans defensive, as another decline is likely to retest recent lows before this whole episode is over. That would be our preferred entry point for a rally into the end of the year.

Asset Class Allocation

The first step in determining optimal portfolio positioning is taking a look at the performance of the main asset classes, and determining which are suitable for investment. The Asset Class Overview Instrument gives us a clear macro picture.

Gold becomes investible once again, along with Equities and Commodities; Treasuries are too close to our stop levels to consider initiating new positions;

SPY’s 5%+ correction has broken through a couple of key support levels: the 20 and 50 day moving averages and the R1 retracement level. After 6 down sessions, yesterday saw the market gain some footing and finally bounce, as short-covering activity began. Despite being oversold on a short and medium-term, we don’t yet see real panic or fear from market participants. We’d be reluctant to buy equity exposure here, unless conditions dramatically improve and we’re proven wrong. Better to wait for a confirmation that $495 are indeed the lows we are looking for on SPY.

Fundamentally, we’d like to get a 9% upside on both our market scenarios, where the lowest median price target for Q1 2025 is $525. 9% upside to $525 would imply a $481 buy target, aligning with technical support.

Commodities (DBC) have slipped below the pivot level, being short term inversely correlated with equities. The +20% rally in oil in the past couple of months has been an important driver of inflation, the resurgence of which has spooked both the bond and the stock market. By the looks of it (technicals only), Commodities are taking a breather, consolidating for the final leg of a rally to $25.

That would probably align with the bottom of the equity market correction, and be our cue to rotate to the likes of QQQ and MTUM.

Gold (GLD) has suffered a slight pullback since reaching all-time-highs last week. This correction in the yellow metal is long overdue and could extend to $208 to the downside. The green line on the chart is the 50-DMA, just to point out the extreme deviation gold has undergone.

While technically investible, we wouldn’t initiate a position in GLD at the moment.

Treasuries (TLT) are hanging to support by a thread. While we believe the current “reflation” scare to be overblown, technicals suggest caution for now. Friday’s Core PCE reading will be instrumental in the evolution of the bond market and could cause a lot more volatility. If that datapoint takes the benchmark ETF lower, we’ll need to exit this position in our live portfolio.

Enterprise, our core investment strategy, will dramatically increase risk exposure at today’s market close. The main adjustment comes from the equity side of the portfolio, since bonds are deemed uninvestible for now.

At today’s market close, SPY goes from 67% previously to 85% portfolio NAV.

Bonds exposure (IEF) remains at 0% similar to last week.

The position in GLD is reduced, from 4.6% to 3%.

The position in DBC is also reduced, from 2% to 1.3%.

Cash goes from 26.8% previously, to 11.2% after the rebalance is complete.

Since this model only trades 4 ETFs, we use it to judge overall portfolio positioning. The strategy’s risk profile now leans near maximum aggressive. Textbook dip-buying.

2. Sector / Industry Selection

The next step in creating our portfolio positioning is to break down each broad asset class into more granular groups of assets. This will help us understand which pocket of the market is outperforming or underperforming and make our selection accordingly.

Since Equities are an investible asset class, we’ll take a look at how different Factors are performing and check for any notable opportunities.

We have included tables for this week and the prior 3 article editions in order to help you compare developments (click on the arrows or thumbnails to cycle through the tables).

All factors have now transitioned to a negative medium term trend. We would expect this condition to last for a while (3-4 weeks at least), as investor enthusiasm fizzles out.

The good news from this predicament is that in the short term, no factors are overbought. In fact, all factors are trading below their 20 and 50 daily moving averages (while holding above the 200-DMA). There are no extreme extensions at the moment.

Longer term, deviations have also decreased to normal and sustainable levels. Nasdaq (QQQ) and Foreign Developed Markets (EFA) have started underperforming SPY, as profit taking takes its toll. Mid-Caps (MDY) and Growth Stocks (IVW) have proven to be resilient.

There are now some interesting tactical trades emerging.

Among more granular Factor Returns, Operating Margin was preferred in the short term, ranking high up to the 1 month mark. Companies with high operating margins are (obviously) more inflation proof than their competitors so thier outperformance makes sense given the current “reflation” outlook.

Ranking shown for Operating Margin

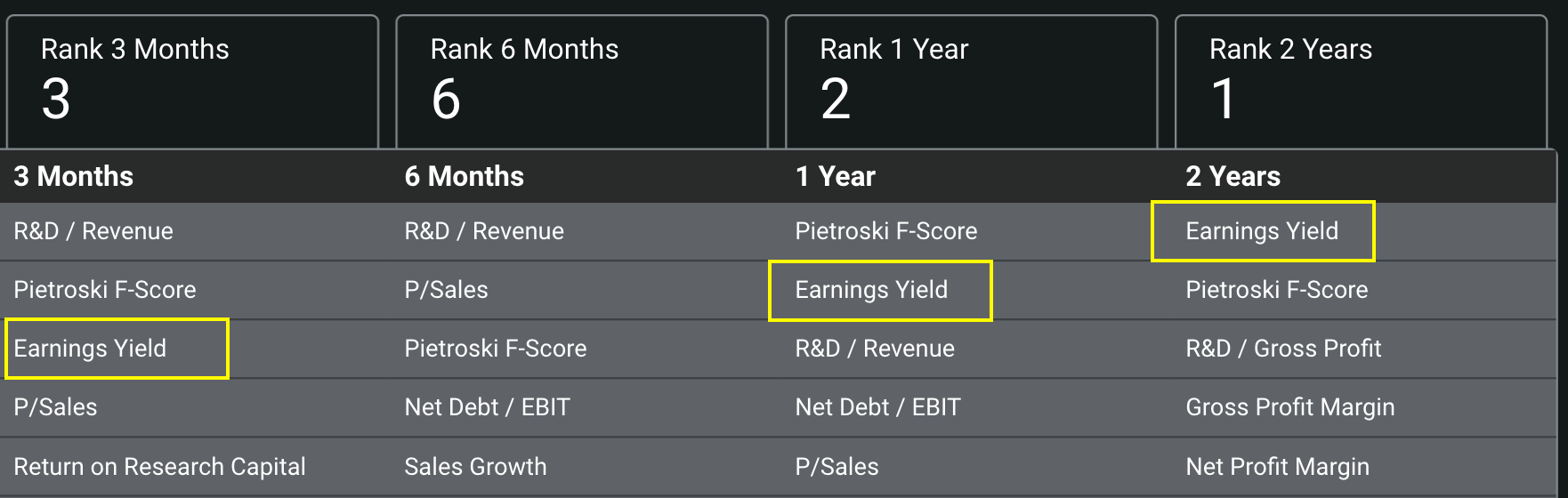

On longer timeframes, high earnings yield companies have had an edge. This typically denotes safer bets, as these companies are less reliant on rapid growth to justify their valuation.

Ranking shown for Earnings Yield

Across all timeframes, we’d like to highlight a formerly “hot” factor, namely R&D / Revenue. In the medium term (3 months to one year), these hyper growth stocks have outperformed. However, in the short term (1 week to 1 month) and long term (2 years), this factor has ranked at the bottom of all 46 factors. A relative buy the dip moment?

Here’s how we stand on the Sectors front:

We have included 3 former tables from previous articles, for your convenience.

Almost all sector ETFs have now transitioned to a negative medium term trend, save for Energy (XLE) and Utilities (XLU). The run in Energy is justified by high commodity prices, but the relative outperformance of XLU is eye-catching. Similarly, defensive sector Staples (XLP) has also outperformed while Tech (XLK) and Communications (XLC) have dragged. This risk-off rotation doesn’t look over right now.

Short term, Utilities (XLU) is the only overbought sector ETF, while none are exactly oversold. Real Estate (XLRE) is the sector under most pressure, trading below all key moving averages.

Longer term, Financials (XLF) are outperforming and overbought on an absolute scale. The whole sector is in recovery mode following the CRE crisis of 2023, so XLF is merely catching up.

Nostromo, our tactical allocation model, has gone shopping recently.

From 100% allocated to cash, the model has bought the dip in both high yield corporate bonds (HYG), tips (TIP) and the Equally Weighted S&P500 (RSP).

On the equity side, the strategy is looking for buy signals in MDY, IVW and MTUM and will buy positions in these once the correction appears over.

For bonds, Nostromo is waiting for a bounce in LQD, MBB and IEI.

While underperforming in real life, this quirky model has its uses as a decision support tool. There is a clear case to be made here that equities are overbought and due for a correction. Nostromo is the only strategy to have almost zero drawdown during the Covid-19 crash in 2020, owing to its “unconventional” decision making style.

3. Individual Stock Selection

Our Millennium strategies have started to post sizable drawdowns lately, as momentum plays a certain part in each model’s stock selection system. As the former “high flyers” suffer from profit taking, these equity-only portfolios are now generating losses in the short term.

Millennium Alpha has closed the gap to its growth trend for the last 2 years and is posting a -10.1% drawdown currently. We would expect losses in this model to continue, as positions are still heavily MTUM correlated on the factors side. An extra -10% to the downside would not be surprising during this correction episode. We have avoided a high MTUM correlation in our own live portfolio precisely for this reason.

There will come a time to buy the dip here, but we need to be patient.

As per usual, you can tweak this system using your own inputs if you wish.

4. Market Environment

The next step in our process is to take into account the type of market environment that we are currently trading in. For these purposes we use the Market Internals and the Market Fundamentals Instruments. Comments on the overall state of the market can usually be found in our Weekly Preview Article.

We’re getting a slight rebound in the number of stocks trading above key moving averages. The deterioration so far has not affected the 200-DMA metric too badly, as you can only see a slight drop in the orange part of the graph. This tells us that more damage could be incoming, as this metric usually goes down to 400-500 during a corrective process. Now, 690 stocks are trading above their 200-DMAs, a number which is relatively high.

Neutral Signal in Stocks trading above their 200-day Moving Averages

As a contrarian indicator, sentiment works best near extremes. The current correction episode has pushed sentiment toward apparent “Extreme Fear” conditions, but we need to put these metrics into a proper context.

Markets have experienced a “double dip” before. Stocks got oversold, then got oversold again, as the lows were retested (see yellow highlights). This is what we’re currently expecting to see happen next. Rather than saying that “now’s a good time to buy”, this indicator is telling us “it’s not the worse time to buy”, hence the slightly bullish interpretation.

Slightly Bullish Signal in Sentiment

The comparison of Z-Scores reveals the disparity between large cap performance (SPY) and the top 1000 stocks by dollar volume (the broad market), equally weighted.

As the correction has gathered steam, large caps have been hit disproportionately. The steep correction in SPY has pushed our Z-Score divergence metric close to 0. This signals relative strength in the broad market, and gives us confidence to buy dips going forward. At some point (after the November elections?), mid caps and small caps could even outperform!

Bullish Signal in Market Internals Z-Score

Dollar Transaction Volume continues to trend below average, as the correction is orderly, on relatively low volatility (see lower panel). The lack of panic is actually a net bullish signal, with the VIX reading 15.7, a completely calm figure.

Neutral Signal in Dollar Transaction Volume

5. Trading in the Sigma Portfolio (Live)

After reviewing all of the above factors, it’s time to decide on the actual investing strategy for our real-life portfolio.

Automated models are going full throttle, allocating an average of 96% to risk assets. From a strictly mechanical point of view, this makes sense, since >5% corrections happen rarely. The strategies only rely on deviations and relative performance in order to generate allocation decisions.

On the other hand, we believe we can outsmart them this time. Yes, our models did a good job of identifying a reasonable entry point for stocks. Longer term, it won’t matter if we get a 5% or 10% correction episode. But for ourselves and our clients, we’d like to capture as much upside as possible, so the current decision is to be patient and use a reflexive bounce to sell, instead of adding risk to portfolios.

Automated Strategies and Market Outlooks

The Sigma Portfolio (Live)

At the moment, there is no need to trade in our portfolio. There are no positions violating stop levels, nor is there a need to take profits since we’ve already done that earlier. In case our “further correction” thesis is proven wrong by the markets, we will increase risk exposure at a later date.

Click here to access our own tracker for the Sigma Portfolio and understand how the positions contribute to the overall exposure profile. De-risking the portfolio at the start of April has deflated both the win and the loss figures.

In total, we stand to gain $10.021 by risking $4.401 if our targets are correct. The risk-reward ratio is higher than 2-1, meaning that for every dollar risked, we stand to gain at least 2.