Portfolio Rebalance / March 06

Following the Signal Sigma Process

The approach to this article follows the step by step process described here. All visuals are sourced from various instruments available in the platform. If you are using the Portfolio Tracker, you’ll be able to see how we set it up for our own portfolio at the end of this article.

With multiple risk markets hovering near all time highs and a full reflation trade signaled by the surge in Gold and Bitcoin, bullish sentiment is starting to look euphoric on many measures. Before we get into the details of this week’s article, let’s quickly recap our broad strategy, outlined back in October 2023:

On October 19 2023, Sigma Portfolio Equity Exposure reached 80%, significantly overweighting our benchmark in terms of risk; this was happening as sentiment was getting extremely pessimistic. In our Weekly Preview article from a couple of days later, we made the following note:

“Behavioral bias is the #1 cause of poor returns and faulty decision making. If anything, our analysis system is designed to bring objectivity and harness data science in order to combat our irrational (and human) behavioral mistakes. […] Currently, our analysis suggests a reflexive rally into the end of the year is more probable than not. […] Periods like this are never fun or pleasant. But we need to trade the market that we have, not the one that we want. We know that the stock market never goes straight up or down, and avoiding psychological mistakes is of paramount importance in volatile times.”

We are very close to fully reversing the psychological disposition that prevailed in late October’23. Instead of fear, we are dealing with a high level of optimism. Our analysis suggests further upside is limited, hard to achieve and fundamentally difficult to make sense of. Behavioral bias is still the #1 cause of poor returns, but that bias is currently manifesting as panic buying, not panic selling.

Let’s see what our systems make of this environment.

Asset Class Allocation

The first step in determining optimal portfolio positioning is taking a look at the performance of the main asset classes, and determining which are suitable for investment. The Asset Class Overview Instrument gives us a clear macro picture.

Equities, Gold and Treasuries are investible ; commodities look like they have found a bottom for now, but still remain below our key stop level;

SPY briefly fell out of medium-term overbought territory, but remains highly extended above key averages and is trading richly within its technical channel (remember, this is the most optimistic growth trajectory envisioned in the chart). Support should kick in at around $495 (R2 level, -2.4% downside), while resistance stands at $531 (High Trend-Line, +4.69% upside).

Momentum continues to show signs of deterioration, as the MACD signal has turned negative from a fairly high reading; this would normally be a “dangerous” disposition, but there have been multiple failed negative crossover signals recently that did not amount to much

No news is good news for commodities (DBC), which appear to have found a bottom. DBC is close to punching through the mid-section of its trend channel ($22.39), a clearly bullish move, should it occur.

Physical commodities haven’t yet had their “true” rally. Just look at Gold for what could be in store for oil, gas and other hard assets.

Gold (GLD) has staged an impressive rebound, as the yellow metal has notched a fresh record ($2141.40/ozt). As a scarce and limited asset, Gold has been catching up with bitcoin (BTC-USD) in terms of price performance. Between the two, there is a sense of something important going on with the market's understanding of the value of money, which is odd given that the price of money (rates) has not been moving in any significant way over the same period.

Because Gold pays no dividends, investors carry a significant opportunity cost when deciding to allocate toward this asset class. The fact that a good number of market participants decide to forgo risk free yields of 4%-5% and instead opt for the capital appreciation of Gold is certainly something to watch closely.

The surge in Gold should be signaling that rates are not high enough (making the opportunity cost to hold Gold low). We would expect to find bonds trading poorly by this logic. But that’s not exactly the case.

TLT, the benchmark ETF for long dated government bonds, has reversed its previous slump and is challenging heavy resistance at $95 (S2 level and 200-DMA). Previously, virtually all rallies in TLT have failed to meaningfully break above the 200-DMA, which is still sloping downward.

Enterprise, our core investment strategy, has significantly altered its portfolio composition, choosing to dial down risk exposure. Enterprise has lowered SPY from 81% last week to 64% today.

Bonds exposure has been increased from 12.25% last week to 22.6% today.

Gold has also been slightly increased, from 3.79% last week to 4.91% today.

Cash went from 3.4% last week to 8.6% today.

Since this model only trades 4 ETFs, we use it to judge overall portfolio positioning. The strategy has allocated its portfolio much closer to a 60% stocks /40% bonds benchmark, in a clear risk-off set of transactions. We can call this overall disposition as “neutral”.

2. Sector / Industry Selection

The next step in creating our portfolio positioning is to break down each broad asset class into more granular groups of assets. This will help us understand which pocket of the market is outperforming or underperforming and make our selection accordingly.

Since Equities are an investible asset class, we’ll take a look at how different Factors are performing and check for any notable opportunities.

We have included tables for this week and the prior 3 article editions in order to help you compare developments (click on the arrows or thumbnails to cycle through the tables).

We’re back to all factors trading on a positive Medium Term Trend and above all of the key moving averages. The strength of the market is indisputable, at least in the very short term.

Multiple factor ETFs look extended: Growth Stocks (IVW), Value Stocks (IVE), Mid-Caps (MDY), Momentum Factor (MTUM) and the Equally Weighted S&P 500 (RSP).

Momentum’s (MTUM) near-vertical ascent looks almost comical, when viewed with a bit of historical perspective. This ETF is now trading 3 standard deviations away from its regression mean. Needless to day, such a deviation is unsustainable longer term. The top 5 stocks correlated with MTUM are: NVDA, CDNS, AMD, VRT and SNPS.

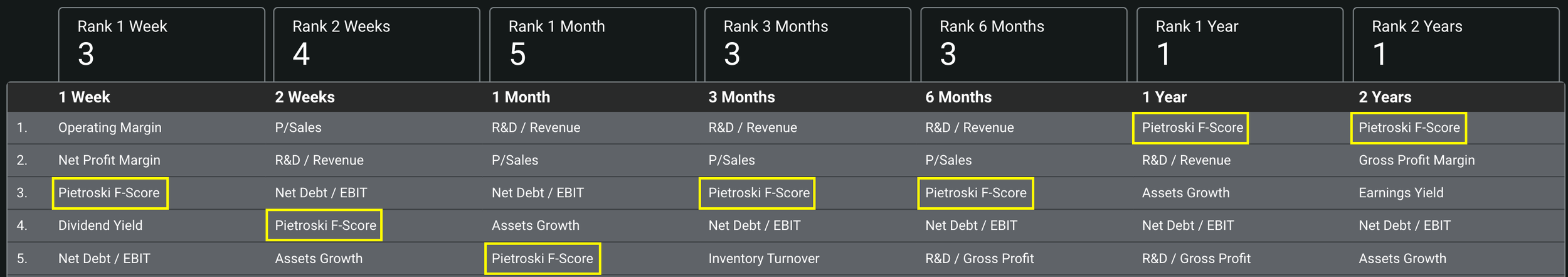

Among more granular Factor Returns, the R&D budget of a company in relation to its sales has been a great indicator of performance as far back as 1 year. In the last week, this factor has viciously reversed, as profit taking hit “expensive” stocks that are investing in growth.

Ranking shown for R&D / Revenue

On longer timeframes, it’s interesting to see a factor like Net Debt / EBIT score consistently higher. The net debt-to-EBIT ratio is a measurement of leverage, calculated as a company's interest-bearing liabilities minus cash or cash equivalents, divided by its EBIT. The net debt-to-EBIT ratio is a debt ratio that shows how many years it would take for a company to pay back its debt if net debt and EBIT are held constant.

In a high interest rate environment, we would have expected a negative impact from a high Net Debt / EBIT ratio, but the market contradicts us.

Ranking shown for Net Debt / EBIT

A high Pietroski F-Score correlates with positive performance across all timeframes, confirming the market’s preference for high quality companies.

Here’s how we stand on the Sectors front:

We have included 3 former tables from previous articles, for your convenience.

In the short term, Basic Materials (XLB) and Industrials (XLI) look most extended, with Financials (XLF) and Tech (XLK) not far behind. Energy (XLE) has regained some technical footing, now trading above all key moving averages.

On a longer term horizon, Healthcare (XLV) is extended on an absolute basis, but still lags SPY on a relative basis. In fact, only 2 sector ETFs (XLK and XLC) have outperformed SPY in the past year - and they’ve done so by double digit returns!

Nostromo, our tactical allocation model, is only holding treasuries, via TLT.

The model will also initiate a position in SPY on the next available BUY signal.

For more info about how Nostromo targets sectors or factors within a broader asset class, read this article. The first part sheds some light on the selection process going on in the background.

While underperforming in real life, this quirky model has its uses as a decision support tool. There is a clear case to be made here that equities are overbought. Nostromo is the only strategy to have almost zero drawdown during the Covid-19 crash in 2020.

3. Individual Stock Selection

With the Momentum Factor gaining traction, we’ll highlight Millennium Momentum as this week’s stock selection strategy. This variant of Millennium picks stocks on a purely technical basis, with only the Pietroski F-Score acting as the “quality screen” in the ranking process. Compared to the MTUM ETF, our system does not emphasise market cap at all - a reason for its short term underperformance relative to MTUM.

However, we can easily alter the factors in the ranking process. By attributing 5 points to “Market Cap” and another 5 points to diluted EPS…

4. Market Environment

The next step in our process is to take into account the type of market environment that we are currently trading in. For these purposes we use the Market Internals and the Market Fundamentals Instruments. Comments on the overall state of the market can usually be found in our Weekly Preview Article.

As markets hover near all-time-highs, there is a growing divergence that stands out. For all of 2024, the S&P 500 has basically gone straight up. Yet the number of stocks trading above key averages has remained the same. We have not seen any increased participation since the beginning of January, and even less participation when compared to late December. Breadth is shaky here.

Neutral Signal in Stocks trading above their 200-day Moving Averages

As a contrarian indicator, sentiment works best near extremes. Right now, sentiment is “not great, not terrible”. There’s sufficient fear in the market of a coming correction. The fact that stocks are due for a pullback is well understood and acts to dampen risk-taking. We are not seeing exuberant / euphoric levels of optimism just yet.

Neutral Signal in Sentiment

The comparison of Z-Scores reveals the disparity between large cap performance (SPY) and the top 1000 stocks by dollar volume (the broad market).

Our working thesis appears to be playing out. Small and mid-caps have done some catching up to their large and mega-cap peers. This is pushing the Z-Score divergence lower, as the two series align. However, there’s a lot of performance to be caught up, and small caps have a long way to go. This divergence can also be closed in a correction where large caps underperform relative to the rest of the market.

Bearish Signal in Market Internals Z-Score

Dollar transaction volume has surged on Tuesday’s selloff. Given that markets have bounced in the subsequent session, we’d chalk this up as a win for the “buy the dip” crowd, with plenty of liquidity being there to absorb losses. This is bullish for now, but volumes are nearing elevated levels from where they have receded in the past.

Bullish Signal in Dollar Transaction Volume

5. Trading in the Sigma Portfolio (Live)

After reviewing all of the above factors, it’s time to decide on the actual investing strategy for our real-life portfolio.

Signal Sigma automated strategies have now aligned better with our own thinking and Live Portfolio positioning. The models are still more aggressive on risk exposure than we are, but this is entirely expected of momentum driven models.

There are a couple of trades that we are following, but for today, there’s little to change up. Expect alerts to hit near the end of the week.

Automated Strategies and Market Outlooks

The Sigma Portfolio (Live)

Our portfolio is very closely aligned with the Enterprise strategy at the moment, in terms of overall asset allocation. We have started to pull back on equity risk exposure earlier in the year, whereas Enterprise has gone risk-on for a lot longer. The plan is to aggressively reduce exposure further, by the end of Q1, if markets get exuberant.

As noted earlier in the article, we are not currently seeing extreme levels of optimism in the broad market. Even “magnificent 7” stocks like Apple (AAPL) and Google (GOOG) are showing drawdowns of around 13-14% currently. This is highly unusual with markets hovering near records. There is an increasing likelihood of a leadership rotation going forward, and we are aiming to position our portfolio ahead of this rotation.

But ultimately, it does come down to the amount of risk present in the portfolio when an inevitable correction hits. And there is no reason to carry unnecessary risk. The next major move in the markets will most likely be down, not up. In our opinion, Energy positions (RRC, VLO, XOM) are least exposed to a pullback. ETFs like EFA, XLV and IVE complete the defensive positioning. We may even buy AAPL on the dip if pricing becomes attractive enough.

On a personal note, there are specific goals financial goals that we’ve set for ourselves back in October, and they have mostly come to fruition. This may drive some excess selling on our part, but locking in profits is the reason we’re in the markets to begin with. Setting goals for your portfolio is 100% healthy.

Click here to access our own tracker for the Sigma Portfolio and understand how the positions contribute to the overall exposure profile.

In total, we stand to gain $12.140 by risking $7.288 if our targets are correct. As expected, the risk/reward calculus is not moving in our favor as markets go higher.

The factor exposure profile has now been balanced so that value stocks, mid caps and foreign names are favored in comparison to tech and growth names. If profit taking hits MTUM, QQQ and IVW type stocks, our portfolio should be well shielded.