Portfolio Rebalance / September 12

Following the Signal Sigma Process

The approach to this article follows the step by step process described here. All visuals are sourced from various instruments available in the platform. If you are using the Portfolio Tracker, you’ll be able to see how we set it up for our own portfolio at the end of this article.

We’ll kick off this edition of our Portfolio Rebalancing process by taking a closer look at the latest inflation data.

We’d like to work with an alternate data source in the form of the Adobe Digital Price Index. Adobe utilizes data from over one trillion online consumer transactions, which includes more than 100 million unique product SKUs. While this represents significant online activity, Statista projects that only 16% of retail sales will originate from online transactions in 2024. Nevertheless, online shopping remains prevalent, with over 75% of adults participating and more than half making online purchases at least weekly. This dynamic forces in-store retailers to maintain competitive pricing with online offerings. Consequently, Adobe's price index serves as a valuable gauge for consumer goods prices and may act as a leading indicator of overall consumer price trends. Below are several notable data points and graphs derived from the latest Adobe insights.

In August, monthly grocery prices decreased by 3.7%, marking the lowest monthly figure recorded since the index began in 2014. Year over year, grocery prices are up by 0.48%;

Out of 18 categories Adobe tracks, 11 have been in decline over the last 3 months

Adobe reports a -0.24% decline in prices for the previous month, resulting in a year-over-year rate of -4.37%

Note: Austan Goolsbee is one of the creators of Adobe’s inflation model. He was recently appointed as the President of the Chicago Federal Reserve, and seems to be more confident that inflation will return to the Fed’s 2% target.

Another alternate inflation data provider (Truflation) echoes the findings of Adobe. According to their model, Year on Year headline inflation is up by just +1.06% (versus +2.5% as reported by the BLS).

Finally, when looking at the official figures, we find that basically all of the monthly gains in inflation are attributed to the lagging shelter data. As illustrated below, CPI excluding shelter has remained at zero for the past two months and has been slightly negative over the preceding three months. As CPI shelter prices catch up with real-time indicators of rents, inflation might take a leg lower into negative territory (deflation).

Asset Class Allocation

The first step in determining optimal portfolio positioning is taking a look at the performance of the main asset classes, and determining which are suitable for investment. The Asset Class Overview Instrument gives us a clear macro picture.

All major asset classes remain investible this week, except Commodities.

Yesterday’s price action for SPY was technically extremely bullish. We had a decent breakout above the M-Trend level and the 50-DMA, along with a “gap close” dating from August 15. Support held at Friday’s lows and sellers were unable to push the market any lower in two key sessions. That successful test of support and break of overhead resistance sets the market up to retest recent highs.

Given that the market is not overbought and the MACD signal is turning higher, we should start to see some follow through buying.

In our last look at the technicals in commodities, we asked the question “Rejection or breakout?”, as DBC was flirting with the stop-loss level at $22.4.

We now have the answer: rejection. Commodities remain uninvestible, as they are trading in a negative long term trend and below the key price point at $22.4. That being said, DBC is oversold, but this is symptomatic of any asset in a bear market.

GLD vs SPY, last 200 trading days -- very different types of assets, almost identical results since Dec'23

TLT is now significantly overbought and near its resistance level at $101. While the overall technical and fundamental picture for bonds remains bullish, we would be inclined to wait for a better opportunity in order to add to our existing position. A retracement to support at $96 would mark an ideal entry point.

Enterprise, our core investment strategy, has increased risk exposure to stocks this week. Bonds exposure has been sacrificed in order to make room for equities.

Stocks exposure via SPY rises from 76% last week to 85% today.

Bonds exposure (IEF) is reduced to around 9% today, from 22%% last week.

The position in GLD is maintained near 3%.

Commodities are uninvestible, so they are excluded from the allocation this week.

Since this model only trades 4 ETFs, we use it to judge overall portfolio positioning. The 85% stocks exposure in Enterprise is very risk-on, almost at the upper limits of this model. The decision to overweight stocks to this extent is based on the stocks to bonds ratio, which dictates that at extremes, the reverse positioning should be implemented.

In this case, the ratio is skewing downward, meaning that bonds have outperformed stocks by a larger extent than usual. Hence, stocks are preferred to bonds. A similar ratio was last observed in December 2023 and has generated a valid BUY signal.

2. Sector / Industry Selection

The next step in creating our portfolio positioning is to break down each broad asset class into more granular groups of assets. This will help us understand which pocket of the market is outperforming or underperforming and make our selection accordingly.

Since Equities are an investible asset class, we’ll take a look at how different Factors are performing and check for any notable opportunities.

We have included tables for this week and the prior 3 article editions in order to help you compare developments (click on the arrows or thumbnails to cycle through the tables).

The factor leaderboard presents a mixed picture. On one hand, all of the factor ETFs are trading above their 200 day moving averages, but only a single ETF -- Growth Stocks (IVW) -- are exhibiting any kind of 6 month excess returns over SPY.

If we sort the table by beta-to-SPY, we’ll get a very interesting result - all of the high beta factors are showing a negative medium term trend, and all of the defensive, low beta factors are showing a positive trend.

Another observation that we rarely come across is that none of these ETFs are especially oversold or overbought on a short or long term basis. Sure, there are some ETFs more extended than others (RSP versus QQQ for example), but overall this seems to be a remarkably well balanced set of factors.

There are some notable tactical opportunities to be aware of in a couple of these ETFs:

All of these factors are relative outperformers and are trading below or very close to their 50-day moving averages.

Nasdaq (QQQ) is the worst performing factor on a relative basis and deserves a closer look. At this moment, the Nasdaq is as oversold versus SPY has it has ever been in the last 2 years. The last time we’ve recorded the same levels of relative weakness was in December of 2022, after a massive re-pricing occured in the tech sector. That was an excellent buying opportunity back then.

Among more granular Factor Returns, high growth stocks are making a comeback - no wonder we are seeing R&D/Revenue rank among the top factors up to the 3 month timeframe.

Here’s how we stand from a Sectors standpoint:

We have included 3 former tables from previous articles, for your convenience.

Looking at the Sectors dashboard, we immediately notice the extreme oversold nature of Energy (XLE), especially in the short term. These kind of extensions are rarely sustainable, and we would expect to see at least a counter-trend rally to more normal levels.

Defensive sectors continue to be fairly overbought both at the short and long term. Utilities (XLU), Staples (XLP) and Real Estate (XLRE) could have a “reckoning” with the forces of “gravity” -- a phenomenon also known as mean-reversion. Extensions of more than 2 standard deviations from the mean are rarely sustainable in the medium and longer term, especially for ETFs which represent entire groups of stocks. For now, we believe the rally in defensives has run its course. This XLRE chart is telling:

Among the higher beta sectors, we note an emerging opportunity in the Consumer Discretionary (XLY) sector, given many investors have avoided exposure to this space, on worries about a recession. In relative-to-SPY terms, XLY has some massive catching up to do, as it has grossly under-performed in the past 2 years. Along with Tech (XLK), this is also a prime pick for an optimistic (no recession) outcome in the next couple of months.

Conclusion: Defensives have had their day, but the higher growth and higher beta sectors that have underperformed lately may be the best picks at current levels.

Nostromo has traded remarkably well in the past couple of months, widely outperforming all of our other models. This performance has come by way of a high allocation to treasuries (at the right time) and no allocation to stocks (also at the right time).

When this model nails it, results are indeed spectacular. Now, Nostromo is only holding bonds (TLT) to the tune of 68% portfolio value. Long term treasuries have done great lately, but they are now reaching the limits of their rally in the short term. So Nostromo is looking to offload the entire position in TLT on the appropriate SELL signal.

Perhaps more interesting is the model’s “shopping list”. It consists of some factor ETFs that we have previously singled out for a tactical allocation:

Each will be bought when the respective BUY signal triggers. The conclusion for now is that Nostromo is looking to switch allocation from entirely from bonds to stocks, a stance that fits with our view as well.

3. Individual Stock Selection

Millennium Alpha has hit a bit of a rough patch lately, as it has underperformed on a 3-month basis (there is no model that outperforms ALL the time). Picks like Diamondback Energy Inc (FANG) have suffered from weak price action in the Energy sector and momentum stocks like IES Holdings Inc (IESC), NVIDIA (NVDA) and Arista Networks (ANET) have been hit by profit taking. Overall, this has led to a larger drawdown in Millennium Alpha, now at around -4% from the high watermark established on September 03.

The portfolio remains unchanged this week, with only minor position size adjustments. On the factors side, correlation with Momentum (MTUM) and Value Stocks (IVE) is almost equally distributed and Industrials (XLI) and Tech (XLK) dominate from a sectors perspective.

4. Market Environment

The next step in our process is to take into account the type of market environment that we are currently trading in. For these purposes we use the Market Internals and the Market Fundamentals Instruments. Comments on the overall state of the market can usually be found in our Weekly Preview Article.

This week, market breadth has shown its resiliency. There is no longer an excessive amount of stocks above their 20-DMAs (that would denote a short term peak) and the number of stocks holding above their 200-DMAs was largely unaffected by the recent volatility. This is bullish.

Bullish Signal in Stocks trading above their 200-day Moving Averages

As a contrarian indicator, sentiment works best near extremes. The current reading (54/100) is close to “Neutral”, so little can be gleaned from this indicator at the moment. Stocks are neither broadly overbought, nor oversold.

Neutral Signal in Sentiment

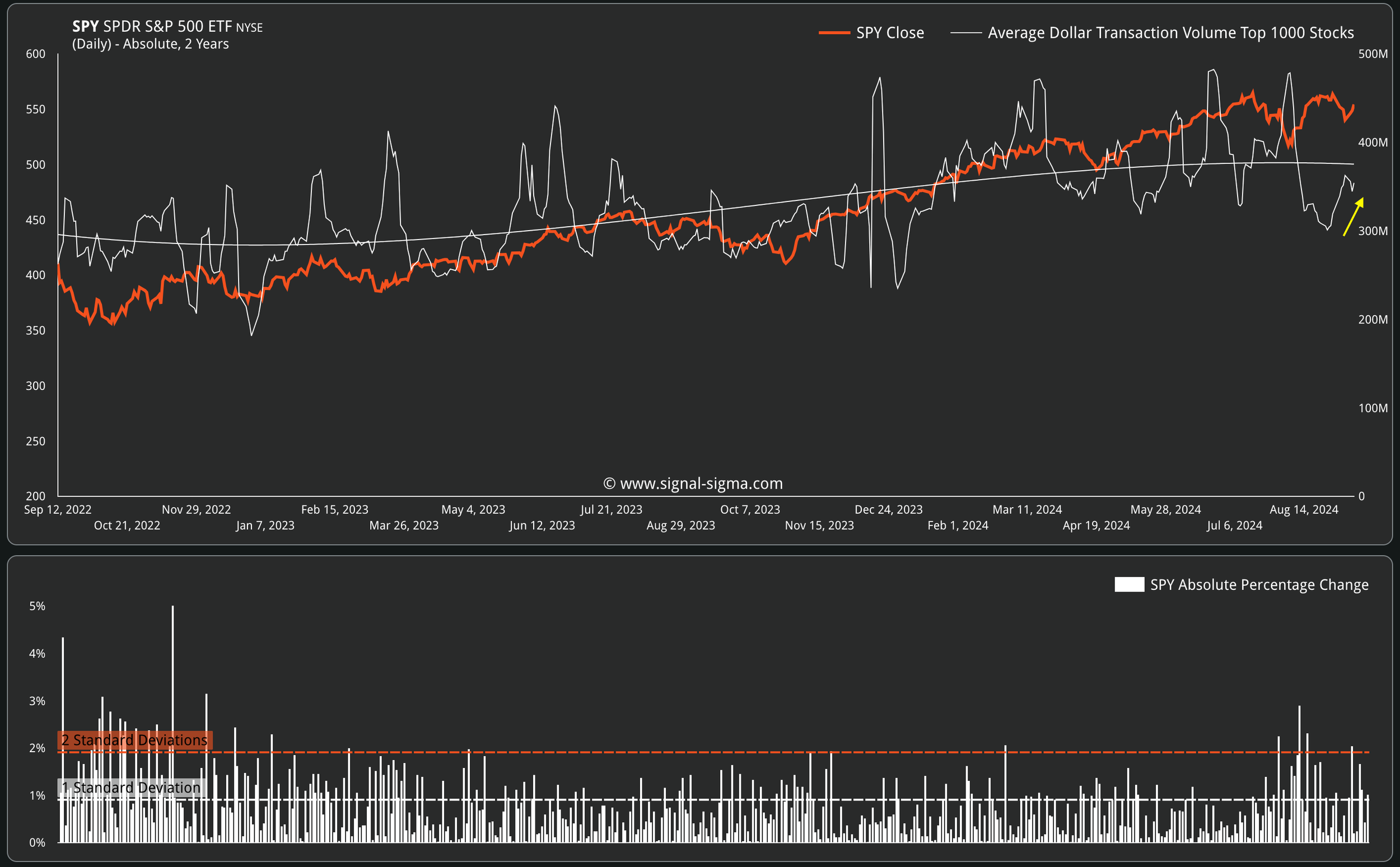

The comparison of Z-Scores reveals the disparity between large cap performance (SPY) and the top 1000 stocks by dollar volume (the broad market), equally weighted.

The trend has increasingly favored the broad market as certain large caps have corrected from previous highs. The resilience shown by most stocks is encouraging, as exemplified by a divergence that is now close to zero. It remains to be seen if small / mid caps lead the way from here (taking this signal to negative values), or large caps bounce to previous highs. Either way, this signal is bullish.

Bullish Signal in Market Internals Z-Score

Dollar Transaction Volume has been boosted recently, as lower market prices have lured investors back in the market. While not higher than average, volume has at least normalized from very bearish readings, indicating that the market has hit “confirmed support” at around $540.

To turn this signal bullish, we’d like to see higher than average volume on fresh record highs (high volume + high prices = bullish).

Neutral Signal in Dollar Transaction Volume

5. Trading in the Sigma Portfolio (Live)

After reviewing all of the above factors, it’s time to decide on the actual investing strategy for our real-life portfolio.

Given the improving technical backdrop and the high equity allocation that our systems are carrying (or planning to carry), there is little need to maintain a defensive posture. The volatility that we have expected has materialized to a decent degree. As such, we are increasing our equity exposure back to target (60%), and buying stocks which offer a mix of good relative value and exposure to the factors that we’ve identified as primed to outperform.

The next steps would probably include a rotation from bonds and defensives to growth oriented holdings. “Magnificent 7” style companies have been under pressure lately and some decent buying opportunities can be found (see AMD). These companies, in particular, generate a vast portion of the overall earnings growth in the S&P 500. With inflation coming down and personal consumption remaining steady, the earnings for these companies will likely continue to drive the markets longer term.

As defensive sectors like staples, utilities, healthcare and real estate are already far stretched to the upside, the market won’t be able to climb meaningfully without the positive influence of growth-oriented / tech companies. For now, our optimistic scenario implies a further +20% price appreciation for the S&P 500 in the next year, leaving plenty of room for upside.

Automated Strategies and Market Outlooks

The Sigma Portfolio (Live)

We have already executed the following orders yesterday, in order to increase the equity exposure in our portfolio:

Click here to access our own tracker for the Sigma Portfolio and understand how the positions contribute to the overall exposure profile.

In total, we stand to gain $15.374 by risking $7.858 if our targets are correct. The risk-reward equation is now good, as for each $1 of potential risk, we stand to gain almost $2.