Losing Money Fast - it’s not a bug, it’s a feature of algorithmic trading called “negative skew”

This article will briefly explain the concept of “Skew” as used in metrics related to backtest analysis of simulated trading strategies (not to be confused with options Skew).

What is Skew?

In developing algorithmic trading models, besides the usual metrics like returns, sharpe ratio and volatility, we also monitor skew. I like to think of skew as a facet of a trading strategy similar to how personality is viewed as part of one’s behaviour. Let’s start by using some (extreme) visual examples since these are the most intuitive to make the point.

Positive Skew

Positive skew is exhibited by strategies whose equity curve looks broadly similar to a staircase. These strategies do not win most of the time, but instead drift lower or even flat. However, they get a couple of short bursts in which huge returns are realized and make the time and effort pay off. These strategies tend to have the best returns in the long term.

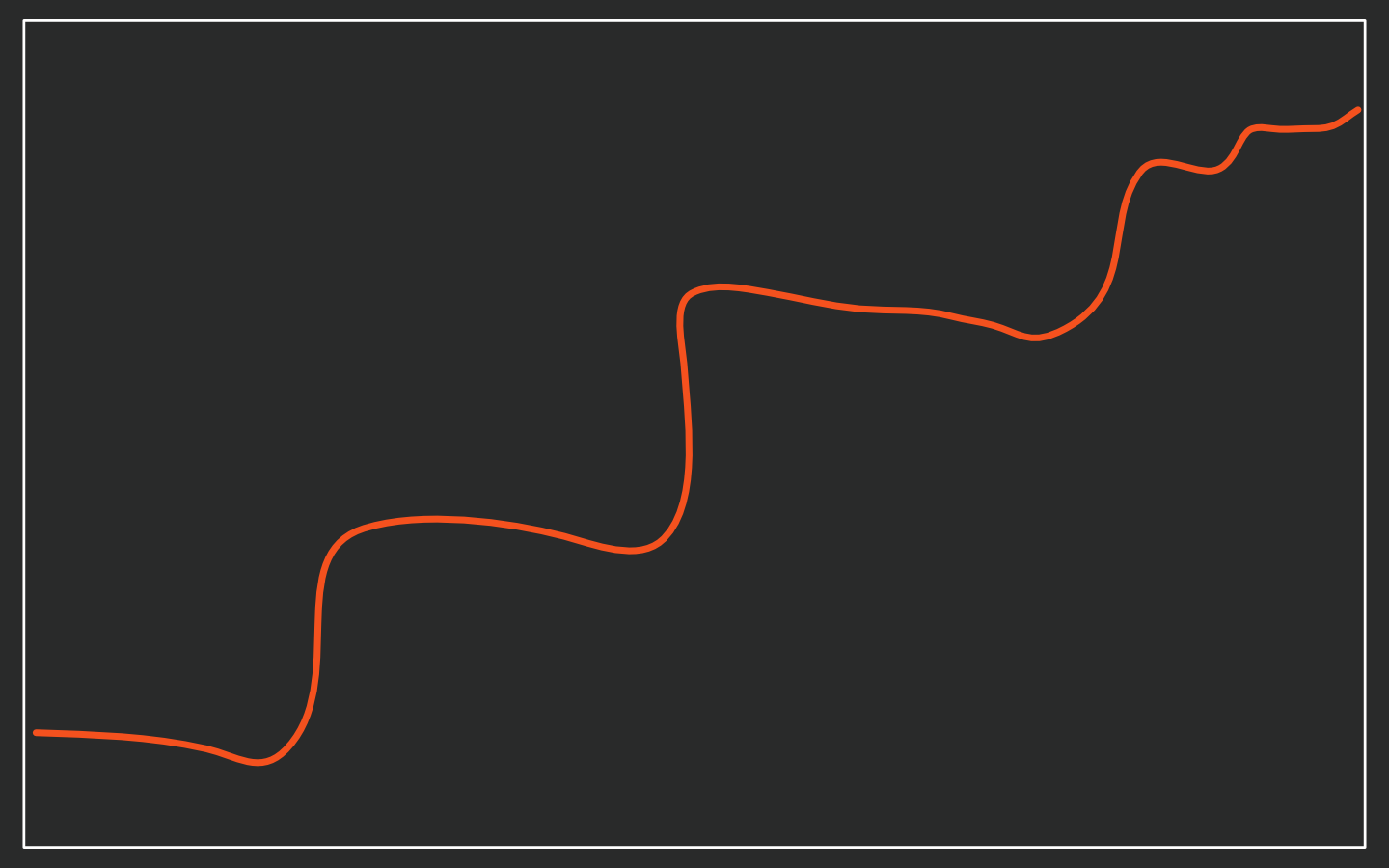

Negative Skew

Negative skew is measured in strategies whose equity curve looks more like the teeth of a seesaw. These strategies achieve a smooth equity curve with an upward drift and win small amounts most of the time. However, when they lose, they lose big! Equity indices and a lot of systematic hedge funds have returns that look like this. They tend to have good risk-reward metrics and can pay off even in the short term.

Which one is better?

There is no “better” alternative when building or following a trading strategy. Ideally, the skew of an investment model should be precisely 0. But that is obviously not possible to achieve consistently. Far more important is for you to understand the implications of your particular process, as the two extremes of skew benefit (or get hurt) by the “risk management” process that is put in place. A mismanagement of risk relative to the skew profile of a strategy will lead either to missed profits or to humongous losses (reddit style loss porn).

Managing a positive skew strategy

A positive skew strategy benefits from the following risk-management techniques:

Sizing of positions benefiting risk vs reward

Fundamental / balance sheet analysis of stocks

Long-term rebalancing (monthly or quarterly)

Buying on weakness, selling on strength

Scaling into positions incrementally rather than outright buying or selling

A positive skew strategy should not be used with the following techniques, as these will hurt performance:

Using stop-losses

Using trading signals for filling positions

Short term rebalancing (less than a month)

Managing a negative skew strategy

A negative skew strategy benefits from the following risk-management techniques:

Statistical analysis of stocks using price history, volume and volatility metrics

Short-term rebalancing (daily or weekly)

Buying on strength, selling on weakness

Using stop-losses

Using trading signals

A negative skew strategy should not be used with the following techniques, as these will hurt performance:

Not using stop-losses - this is the biggest one, as the large drawdowns that can sink a negative skew strategy can only be “controlled” by adhering to a disciplined stop-loss technique

The best of both worlds

It is certainly possible to combine portfolio management styles in a long-short equity approach. Your long portfolio could have positive skew characteristics, while the short ledger would be negatively skewing. Eg. holding a basket of fundamentally solid companies that could win big on earnings announcements and simultaneously shorting weak indices against them. Remember to use the appropriate risk-management techniques for each side of the portfolio in order for the whole approach to work.

Confusing the two has the following outcomes:

Huge losses on a negative skew strategy that does not employ disciplined stop-losses - the kind you see on reddit boards;

Missed opportunities and flat performance on positive skew strategies that get stopped out too early or don’t fill a position at all because some random signals didn’t work.

The Skew of Signal Sigma Models

While the aim was to avoid skew bias as much as possible, I set out to build strategies that employ both approaches.

Enterprise & Nostromo have negative skew. They use ETFs for analysis and trading and it makes a lot of sense to use statistical analysis and short term rebalancing in order to manage them.

Horizon, the equity model, has positive skew. It has performed poorly in backtests where trading signals were activated. So I removed them and prefer to use this strategy in real life for “core” portfolio allocation.

Know your own approach

Go to your broker’s website and pull up a long-term performance report for your investment portfolio. How does it stack up? Does it look like it’s positive or negative skewing? It may be that difficulties in managing your portfolio could come from the mis-application of risk management tools versus your strategy.

As always, I’m here to help, especially if you’re interested in building your custom process using quant model tools.

Best of luck and happy investing,

Andrei Sota