Portfolio Rebalance / August 30

Observations on Signal Sigma Strategies weekly positioning and transactions

Tuesday is the day when all of our strategies rebalance their asset class holding weights.

This week the turn lower in SPY is affecting Horizon, which needs to completely close out all equity positions. Our process dictates that when the market (aka the S&P500 index) is trading under -1 Standard Deviations, below its regression trendline, AND is in a previous uptrend (like it is right now), all stocks positions must be closed. This safety feature exists because Horizon is an aggressive strategy that requires risk controls in order to keep drawdowns acceptable.

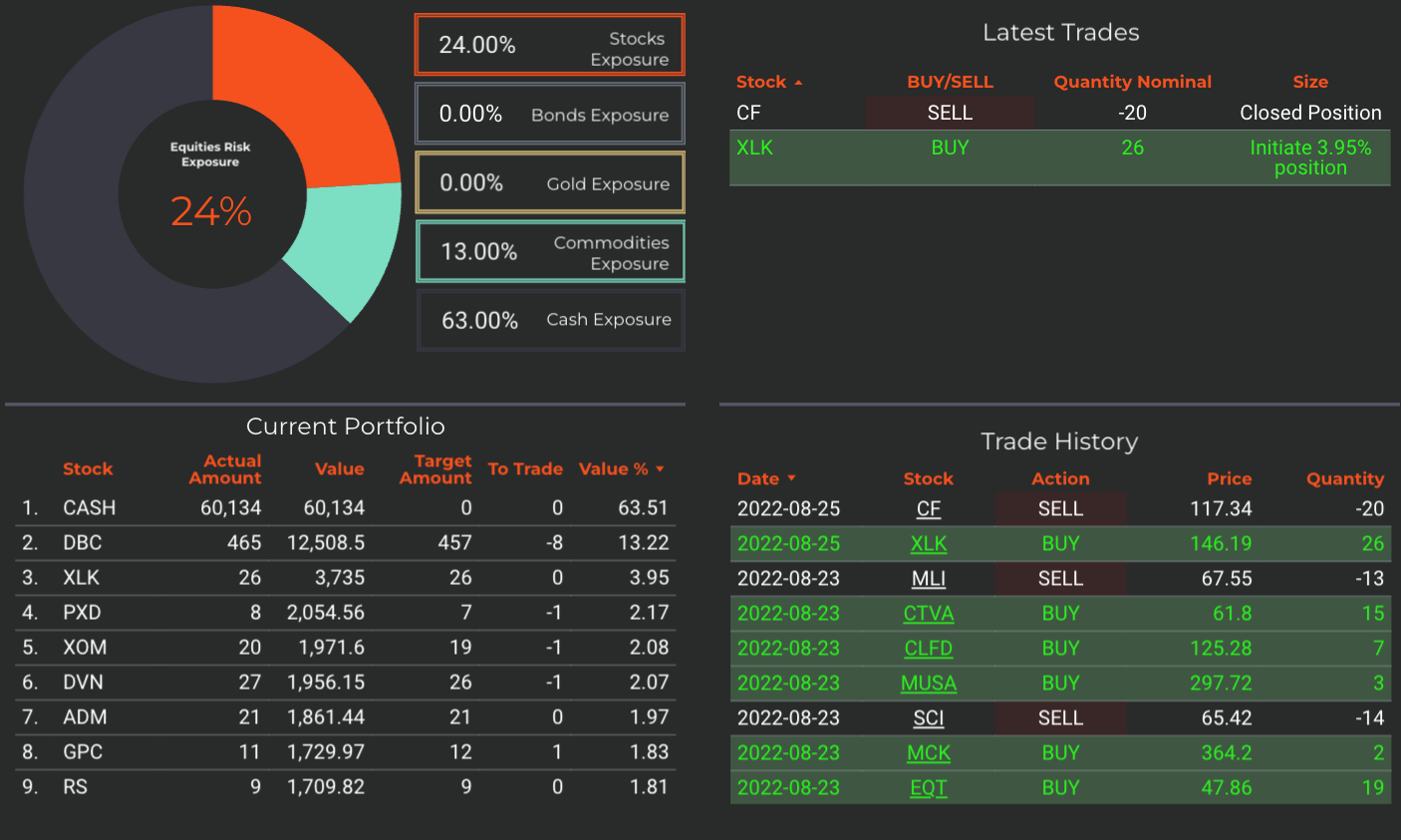

In the Sigma Portfolio (our real-life investment book), we can afford to give the market a bit of leeway right now, and keep stock positions in place (even consider adding to them). There are 2 considerations when I say this: first of all, SPY does not necessarily reflect “the market”, as you will see below. Secondly, the Sigma Portfolio, with an equity exposure of just 24% is positioned much less aggressively than Horizon (previously at 90% equity exposure).

Other trend-following models will systematically close positions just like Horizon is doing right now and add to short term selling pressure. Knowing this in advance gives us an edge,

Our other models are adjusting to SPY’s important breach of trend by simply excluding equities from overall targeting. Instead, they will attempt to add to bond positions on buy signals.

SPY chart explaining why our strategies are excluding equities from portfolios and allocation targeting

However, as stated earlier, the S&P500 is beginning to be a biased index. For “market tracking purposes”, it is not the only index that we can use. We can create our own index from a couple of ETFs that represent stock performance more broadly. If we combine the Small Caps ETF (SLY) with the Mid Caps ETF (MDY), we find that not only is the broad market outperforming SPY, but our index would be trading within its regression channel. This gives us the “green light” needed to keep exposure to equities in our real-life Sigma Portfolio for now.

A different way to gauge the market: MDY + SLY has about 1000 constituents, double the market-cap weighted SPY

Let’s explore what the recent market movements imply for our automated strategies.

Enterprise Strategy

Enterprise, our most conservative model, carries 24% commodities exposure, with the rest of the portfolio allocated towards cash.

Since this model only trades 4 asset class ETFs, we use it to judge overall portfolio positioning.

The strategy is aiming to close the position in commodities. A SELL signal could be triggered if recent strength in commodities starts to show signs of waning (both Willams%R and MACD Negative Crossover could indicate a SELL signal).

TLT will be initiated at 14% portfolio weight on the next BUY signal. There are good odds of a MACD Positive Crossover triggering a BUY; for a Williams%R signal, TLT needs to go lower first.

Cash reserves (USD) continue to perform well, giving the model ample opportunity to allocate.

Nostromo Strategy

Nostromo, our tactical allocation model is sitting in 100 % cash this week. Riding out volatility is this strategy’s strong suit.

Similar to Enterprise, it is waiting for BUY signals on treasuries.

However, Nostromo will segment the bonds according to recent performance factors. It turns out that there are multiple bond ETFs that present a better Long opportunity than TLT:

TIP (TIPS Bond ETF)

MBB (mortgage-backed pass-through securities ETF)

LQD (Investment Grade Corporate Bond ETF)

IEI (3-7 Year Treasury Bond ETF)

HYG (High Yield Corporate Bond ETF)

Nostromo will allocate between 2-4% of the portfolio to each of these positions, according to when BUY signals trigger for each.

For more info about how Nostromo targets sectors or factors within a broader asset class, read this article. The first part sheds some light on the selection process going on in the background.

Horizon Strategy

Horizon, our most aggressive strategy, is closing out all of its equity exposure positions. It will initiate the bond positions ensemble as computed by Nostromo.

Commodities are also being closed out today, for a small overall gain.

This model is simply not expressing 100% of its computing power when equities are excluded from the overall allocation. Take it as a sign of a tricky market.

Takeaway

As stocks get the rug pulled from under them yet again, we need to keep a close eye on 3 key factors:

Commodities and commodity producing stocks;

Treasuries and growth stocks;

The US Dollar and the Fed;

Correctly balancing these impactful asset classes is undoubtedly tricky and requires patience, emotional stability, and execution prowess. We can only provide our roadmap and a best guess of how things will turn out in the Sigma Portfolio (pictured below). Cash is still our #1 holding, and we will look to add to treasuries and reduce commodities according to signals provided by Enterprise and Nostromo. If support levels hold in equities, we will also add to positions until we reach 33% exposure to stocks.

Until we get a clearer picture of what lies ahead, it is not time to make any bold moves one way or another.

Andrei Sota