Portfolio Rebalance / December 06

Following the Signal Sigma Process

Tuesday is the day when all of our strategies rebalance their asset class holding weights. The approach to this article follows the step by step process described here.

This week features a reduction in targeted exposure for Enterprise and Nostromo. Their aggressive plan of action that included leverage (a negative cash balance) has been replaced by a slightly more conservative approach. The reduction is most evident in long term treasuries (TLT), as the overbought condition there is causing our strategies to take a more cautious approach. Horizon is holding onto equity risk exposure this week as well, since SPY is trading comfortably above the lower trendline ($385), and it’s still in an Up-Trend.

Asset Class Allocation

The first step in determining optimal portfolio positioning is taking a look at the performance of the main asset classes, and determining which are suitable for investment. The Asset Class Overview Instrument gives us a clear macro picture.

Although technically still in an Up-Trend, equities (SPY) are forming a trading channel that is very close to flat. If price action does not improve soon, equities will start forming a Down-Trend.

According to our methodology, all major asset classes would be fit to receive allocation from our system: Equities, Treasuries, Commodities and Gold.

The US Dollar has taken a leg lower in the past week. We will modify the assumptions used for the technical analysis below with more realistic assumptions than currently implied by the price action: CAGR set at 5% and a Price Target of 30 for UUP (USD bull ETF).

The US Dollar is still Oversold, bouncing slightly on yesterday’s risk-off day. The risk range for UUP still appears wide, given the current climate (upside to $29.19, downside to $27.96). The medium term risk-reward for the US Dollar has now become better, as the reserve currency has come down to more manageable levels.

We are still trading in an environment where there is a high negative correlation between the USD and every other asset class combined. The disposition of investors to choose between CASH or ANYTHING ELSE so categorically suggests to us that the bear market can rear its head at any moment (and we should not be surprised).

A weakening correlation is preferred in order to make the case for a new bull market.

Enterprise is looking for that favorable juncture to close out the position in commodities. DBC is trading dangerously close to its stop-level, but it has not breached it so far. In its place, the strategy will aim to purchase a long position in TLT, but we are a ways away from any BUY signal there.

Equities (SPY) are still in consolidation mode as expected. While a SELL signal has not yet triggered (this would be the precursor to the BUY signal we are looking for), a downturn is starting to take shape as pressure is mounting in the equities space.

The Enterprise Strategy

Enterprise, our most conservative model, holds 40% exposure to commodities, and 60% cash.

Since this model only trades 4 asset class ETFs, we use it to judge overall portfolio positioning.

The strategy will aim to close out the position in commodities on the next available SELL signal. That could come as a result of a stop-loss, by breaching the lower trendline of DBC, at $24.10. DBC is already under selling pressure, and both the MACD and the WR% are near the lows - we would need to see these come back up first, before they can signal a SELL.

Equities are targeted for allocation at 90% of portfolio value. This sizable chunk of exposure will be bought on the next available BUY signal for SPY that DOES NOT VIOLATE support at the lower trendline ($385).

Additionally, SPY also needs to be in an Up-Trend.

We will most likely need to complete the consolidation phase first, which is just starting. As of this writing, both the MACD and the WR% are currently positive. In order to signal a BUY, these have to turn negative first.

SPY seems to be unable to clear the 200-day Moving Average resistance convincingly. Delta hedging algorithms employed by options traders will buy SPY above 400 and sell it below this level.

Treasuries are targeted for allocation via the TLT ETF, at 7% of portfolio value. Getting a BUY signal for TLT is still highly unlikely, because both the MACD and the WR% are very extended and short term overbought. We would need to see a consolidation first, but that would most likely coincide with TLT trading below it’s stop level. We will have to wait for a couple more weeks before committing to this position.

Cash reserves (USD) are at 60%, offering plenty of optionality. If all trades would trigger, CASH would be negative, as the strategy would employ leverage.

2. Sector / Industry Selection

The next step in creating our portfolio positioning is to break down each broad asset class into more granular groups of assets. This will help us understand which pocket of the market is outperforming or underperforming and make our selection accordingly.

Since Equities are now a viable asset class for investment, we will first take a look at how the different Factors are performing and see if there are any notable opportunities.

On the Factors front, we are noticing a bit of a cool-down in the Dow Jones, which we have signaled as being too overbought and extended. The same can be said this week as well, but to a lesser extent. Developed market non-US stocks (EFA etf) have performed very well, mostly due to the weakening dollar.

Similar to last week, with the exception of QQQ (Tech), IVW (Growth), every equity factor has been outperforming the S&P500 (See Z-Score Relative column and the positive pink columns in the right panel). This would give us plenty of options to choose from, if there would be any dip to be bought. However, there is no dip to be had for the moment. All factors are trading above their 50-day Moving Average, denoting broad strength.

The plan is to wait for more selling pressure to accumulate and put these factors to the test. Then we can determine which of them are trading with a Relative Z-Score in positive territory AND are still holding above the 50-day Moving Average,

For now, it looks like the Dow remains overextended and ripe for a pullback. EFA is also on watch for being Overbought, but from a Z-Score perspective (right panel) the deviations are not so extreme. In a rotation scenario, money could flow from the Dow to the growth part of the universe that is currently underperforming (QQQ, IVW). We will keep an eye out for this sort of action, although yields will surely play an integral part to any serious capital flows to growth stocks.

The same situation is found when looking at Sectors as well.

This week, we are seeing Energy (XLE) and Transports (XTN) join Financials (XLF) in trading below their 20-day Moving Average. The whole structure of the market appears to be weaker. Only Healthcare (XLV) and Industrials (XLI) seem to still trade in Overbought territory. Consumer Staples have also begun a consolidation process.

The only sector trading below its 50-day Moving Average is XLY. It is not on the list of relative out-performers (Z-Score Relative is below 0), so it will not make it into Nostromo’s selection.

The same logic applies to bonds as well, with TLT being targeted. No other bond factors are out-performing.

The Nostromo Strategy

Nostromo, our tactical allocation model is starting the week with 100 % cash positioning.

The strategy will perform almost identically to Enterprise this week.

The only difference between the two models lies in the exposure to commodities. Enterprise needs to close that position, while Nostromo does not need to bother with commodities almost at all (the residual position is a hedge from former positioning and is not material).

For more info about how Nostromo targets sectors or factors within a broader asset class, read this article. The first part sheds some light on the selection process going on in the background.

3. Individual Stock Selection

This week, our focus for stock selection will be the Beaten Up + Quality Screener. While not the type of screener Horizon employs, it will give us some additional ideas that could fly under the radar. This screener takes into account the following factors:

Piotroski F Score => 6; this ensures the “Quality” component

Current Drawdown of 50% or more from All Time High; this represents the “Beaten Up” component

In addition to these standard metrics, we have selected an expanding gross margin from the last 2 years (columns A, B, C), an operating leverage of at least 1 , a Beta to SPY < 1.2, and NOT primarily correlated to QQQ and IWV

The point is to screen for companies that are expanding their gross margins, have a high operating leverage, while simultaneously experiencing a relatively low Beta to SPY (less volatility for the stock). These companies are still down 50% or more from their all time highs, and could serve as interesting ideas for more in depth research.

Here are the results:

SOHO, AVNS, BFAM are the names that stand out to me from the list. The ability to grow one’s gross margins in an inflationary environment is quite a feat and should not be dismissed. Yet the market has cut their share price in half. This could be warranted, or the market could be missing something. It’s up to us to investigate.

At current levels, Horizon will form a portfolio of 10 stocks and rebalance them at the close. This model is the most aggressive and has no need for any other confirming signals. The logic by which its internal selection process works is similar to the new Momentum + Quality Stock Screener.

Horizon Strategy

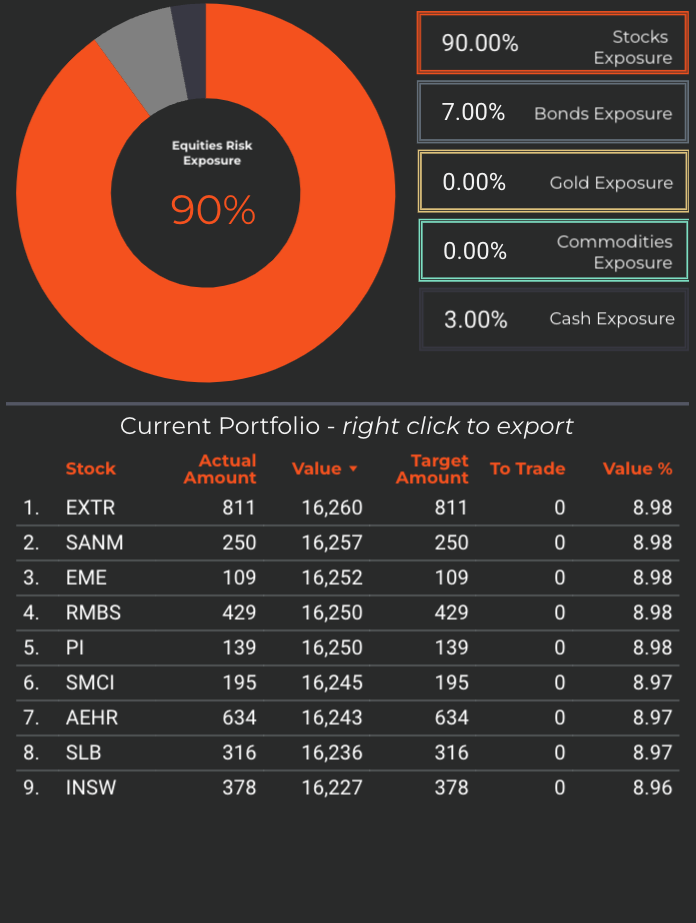

Horizon, our most aggressive strategy, will rebalance the equity portfolio so that each position keeps its equal weight (9% of NAV).

Favoring a risk-taking approach, Horizon will not wait for any other signal and simply fill the orders at the end of today’s session.

The portfolio overall keeps the same composition as last week. The most notable changes come by selling SLB and RMBS after good runs in order to keep these positions in line with our equal weight approach.

The position in TLT will also be culled, with a -51% sell order. Profit taking is in order after the stellar run that TLT has enjoyed.

CASH will sit at 3%.

Horizon’s equity portfolio will be primarily correlated with the Industrials and Basic Materials sectors - showing the best momentum so far. It should be noted that Industrials seem overbought at this point (BDC, EME, EXTR, RMBS and SANM positions).

4. Market Environment

The next step in our process is to take into account the type of market environment that we are currently trading in. For these purposes we use the Market Internals and the Market Fundamentals Instruments. Comments on the overall state of the market can usually be found in our Weekly Preview Article.

Overall, we find that conditions are still Overbought and extended both on a market-wide basis and an individual stock basis, even after yesterday’s retreat. The current rally must be put to the test and it must succeed, if we are to give it credence. There are two developing bullish signals occurring underneath the surface of the market.

Bullish Signal in Stocks trading above their 200-day Moving Averages

During this latest rally, the number of stocks trading above their 200-day Moving Average has increased versus the last time we had similar overbought conditions. We recorded 497 / 1000 stocks above their 200-day MA on August 16 (the peak of the previous rally), and registered 572 / 1000 stocks last week. This week, the numbers are a bit weaker, coming in at 536 / 1000 stocks above the 200-day Moving Average. Still, this is a high and healthy number.

Since the start of 2021, while SPY was rising, the number of stocks above the 200-day MA was slowly grinding lower in what is known as a bearish divergence. Now, the opposite is occurring. This improvement in breadth is undeniably a bullish divergence.

Bullish Signal in Market Internals Z-Score

Another bullish divergence can be observed in the average Z-Score of a stock in the market versus the Z-Score of the SPY itself (the Z-Score measures how many standard deviations a certain reading is above or below a computed trend).

While the SPY’s Z-Score readings have been grinding lower and lower since the start of the year, the average stock is faring much better. The divergence in Z-Scores starting in the middle of June is obvious on the chart. Put simply, the average stock has been doing much better than the SPY itself. Again, an undeniably bullish development below the surface. This divergence is persisting this week as well. It will be interesting to see this put to the test in a downturn.

Bearish signal in Average Dollar Transaction Volume and Volatility

Dollar transaction volumes have been trending lower, as the Fed removes liquidity from the market. A byproduct of lower volume is higher volatility, as shown in the panel below. Even with the latest surge in trading volumes, the trend is headed lower, while volatility is still high.

Simply put: people (+funds and banks) are taking money out of their brokerage accounts and 401k’s. If there’s less money to invest, there’s less of a push higher in prices. All other things being equal, less liquidity and higher volatility mean lower valuation premiums and prices.

In conclusion, if Enterprise or Nostromo start to get long equities, we will close all short positions in the Sigma Portfolio and start to tilt bullish as well. Such may not be the case this week.

5. Trading in the Sigma Portfolio

After reviewing all of the above factors, it’s time to decide on the actual investing strategy for our real-life portfolio.

First of all, we will take an average of CASH position sizing from all of our models. This will come down to roughly 54%, with a minimum and maximum of 100% and 3% respectively. We are at a stage where our models are in dissonance with each other in terms of actual allocation, but starting to converge on the same target portfolio.

The Market Environment view is still defensive this week. While taking note of bullish developments below the surface of the market, this rally seems to be running out of steam. As such, there is little evidence that we should initiate new long positions right now.

In the Sigma Portfolio, we are comfortable with the exposure that we have. More specifically, the portfolio is 9% Long, 21% Short and 4% allocated to Commodities. We will let the market dictate our next move.

The equity market COULD consolidate successfully AND maintain a positive technical channel trend. In this case, Enterprise and Nostromo will get long equities, while we will close all short positions in the Sigma Portfolio and start building long positions.

However, the chances of this happening are getting slimmer by the day. There should be more buyer conviction heading into the “Santa Rally” at year end.

If we get another surge in equities, without triggering a MACD SELL signal first, we will acquire more inverse exposure (SH, PSQ, RWM).

If the consolidation fails at the lower trendline support or the 50-day Moving Average support, we will also look to sell the remaining long positions, so that our portfolio turns completely short.

According to the Correlation Screener above, the Sigma Portfolio contains a position that might be prone to a technical pullback: GPC. This is highly correlated to DIA - a factor that is highly extended. We will look to trim this position in favor of more general exposure. If any short-term trading is to be done, it will be done at the ETF level.

Andrei Sota