Portfolio Rebalance / June 22 2022

Observations on Signal Sigma Strategies weekly positioning and transactions

Tuesday (or in this case, Wednesday, as the market was closed on Monday) is the day when all of our strategies rebalance their asset class holding weights.

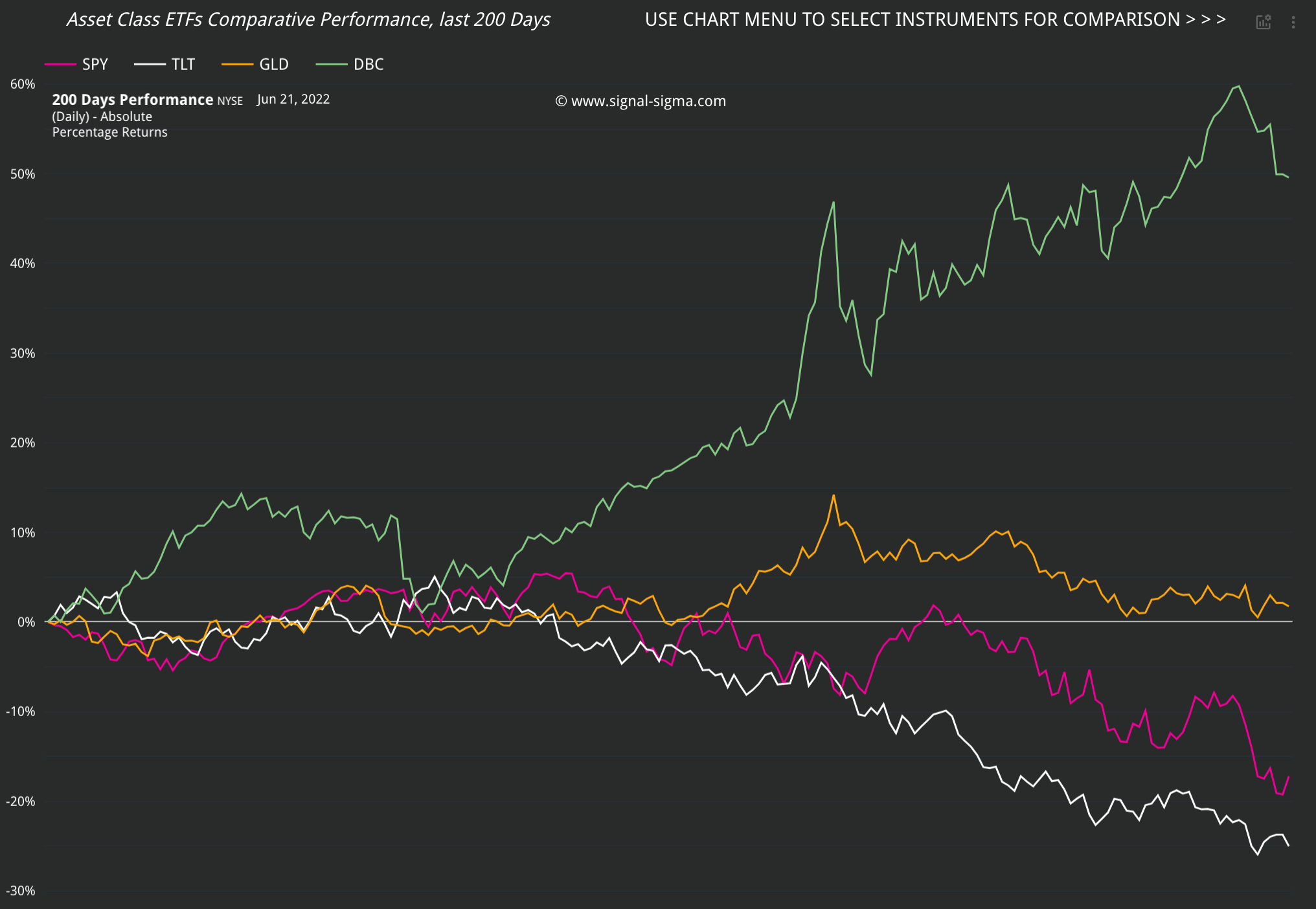

After one of the worst weeks on record for equities, we are starting to notice abrupt profit taking in the commodities space as well. Our models have taken note of that, and are planning to reduce exposure. In the Sigma Portfolio, we might just take on a speculative net-long position in equities, as a technical bounce could be underway. You will get notified via email if you are a Research Plan subscriber! But first, let’s take a look at the recent performance of the most important asset classes:

For all the lead they have taken in 2022, commodities have started to retrace to more normal levels. Equity markets will breathe a sigh of relief as perceived inflation pressures recede. Our technical analysis suggests downside to 26.9 for DBC, while SPY might enjoy a temporary bounce (as high as 400). Gold has been languishing with no particular direction as of late, causing our models to vacillate between adding exposure to removing it. Finally, long dated treasuries are still under a lot of pressure, enjoying no safety bid as of late. In the chart below, we plot a portfolio of equal-weight SPY, TLT, GLD, DBC and compare its performance against the U.S. Dollar, the only other alternative in portfolio allocation.

Again, the chart starts to resemble a mirror image from March 2022 onwards, as a strong negative correlation begins to show. Cash is competing (and winning) in terms of portfolio allocation against everything else. If commodities join the strong decline, then there really is no place to hide when it comes to rising interest rates.

Another way of looking at asset class relative performance is through the lens of the distance from near and long term moving averages, expressed in standard deviations. This is what we call a “Sigma Score” and it measures how extended (or unusual) the recent price is, on a scale of -3 to 3. Any score above 1.8 or below -1.8 is deemed excessive. We can see that SPY and TLT are both significantly deviated to the downside, while DBC, GLD and UUP (dollar index ETF) are trading in a more “normal” range.

To sum up, our algorithms are buying what’s working (Gold, to a certain extent) and are selling what’s not working (Stocks and Treasuries). Commodities have started a decline and are currently vulnerable, so our models are prone to closing that position if they have it.

Enterprise Strategy

Enterprise, our most conservative model, only carries 26% commodities exposure, with the rest of the portfolio allocated towards cash.

Since this model only trades 4 asset class ETFs, we use it to judge overall portfolio positioning.

DBC allocation is completely above target and the position will be closed on any signal. While previously waiting for a more opportune moment to increase exposure, our strategy has shifted targeting due to the very sharp pullback experienced by commodities. If the situation improves without triggering a sell-signal, the model will adjust higher most probably.

GLD is also in the mix, with a target exposure of 22%. A sell signal has been triggered, as gold has again flirted with our stop-level for instruments that are in a downtrend (and Gold is in that position right now, barely so). Enterprise will close its 7% GLD position today.

Cash reserves (USD) stand at 74%, adequate to hedge volatility.

Nostromo Strategy

Our cash-loving Nostromo strategy has managed to successfully navigate the current macro environment. Quite simply, there has been no better asset class as of late, and this model has taken full advantage of it. Plain and simple.

For now, this model tells us that it’s best to remain neutral in our approach, as there are no buy triggers on the horizon. If there were any, allocation would go toward Gold.

Horizon Strategy

Horizon, our most aggressive strategy is always looking to gain exposure before the other models have a chance to trigger trades.

This week, Horizon is doing the opposite of Enterprise - holding 22% Gold instead of Commodities.

The two strategies coalesce when it comes to the Cash allocation, with Horizon holding 78% U.S. Dollars.

Horizon has no current plans to initiate a position in any other asset class.

We will use all the models when composing the final allocation of the Sigma Portfolio.

Andrei Sota