Portfolio Rebalance / September 27

Observations on Signal Sigma Strategies weekly positioning and transactions

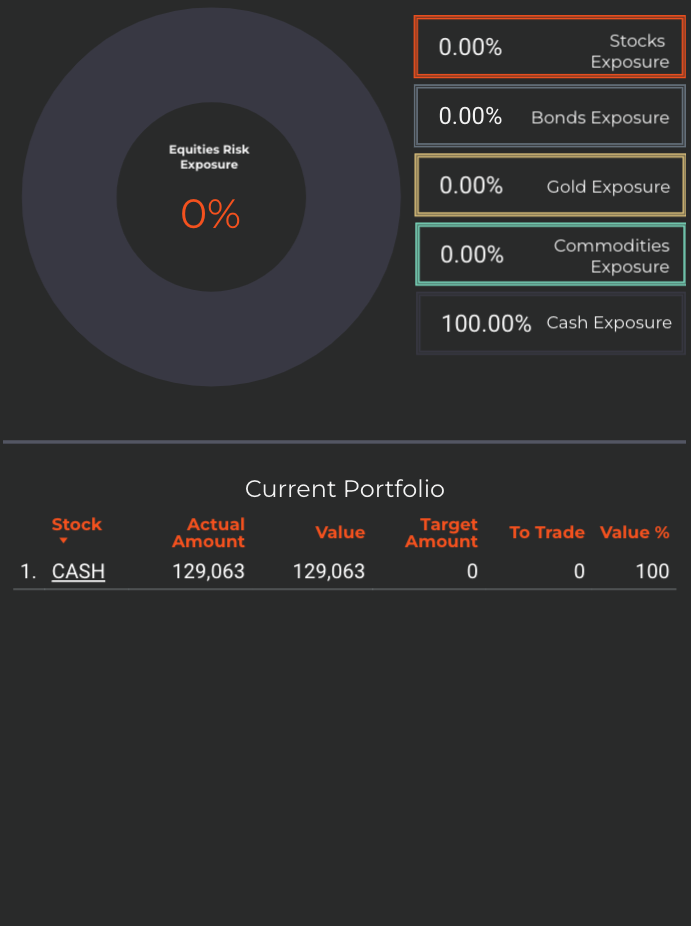

Tuesday is the day when all of our strategies rebalance their asset class holding weights. This week features the core targeting module of Signal Sigma switching to 100% cash for the first time this year.

It’s very likely this article series will get very boring in the medium term future, as our system goes into full stop-loss mode for all asset classes. The reasoning is simple enough. Take a look at the chart below:

The US Dollar (white: UUP) vs a combined asset class portfolio (orange: SPY + TLT + GLD + DBC)

The combined asset class portfolio (orange) has completely broken down, while the dollar (UUP - white) has gone vertical. For the moment, there is no signal that would determine our models to buy anything. The allocation will remain completely flat, and model description will be almost identical.

Let’s observe the changes in all of our models.

Enterprise Strategy

Enterprise, our most conservative model, is 100% allocated to cash.

Since this model only trades 4 asset class ETFs, we use it to judge overall portfolio positioning.

The strategy will keep allocation flat this week, regardless of market developments.

Cash reserves (USD) are at the maximum allocation.

Nostromo Strategy

Nostromo, our tactical allocation model is starting the week with 100 % cash positioning.

The strategy will keep allocation flat this week, regardless of market developments.

For more info about how Nostromo targets sectors or factors within a broader asset class, read this article. The first part sheds some light on the selection process going on in the background.

Horizon Strategy

Horizon, our most aggressive strategy, just got stopped out of all commodity positions. They will be liquidated today, at the end of the session.

The strategy will keep allocation flat this week, regardless of market developments.

Takeaway:

In the Sigma Portfolio, we are looking to reduce equity risk exposure to 0% (be completely hedged in a long-short book). Furthermore, on a rally that takes the combined asset classes to overbought conditions (and the US Dollar to oversold) we will aim to switch to a net-short allocation.

Andrei Sota