The Sigma Report / May 07 2022

This article covers the trading, investment performance and portfolio allocation of data-driven strategies developed by Signal Sigma. Backtested for at least 15 years, these models have outperformed the market by more than 500% providing significant risk-reward improvements over buy-and-hold positioning.

The Signal Sigma investment process takes a top-down approach to portfolio construction starting from an asset-class allocation perspective, then gradually refines positioning using specific factors and individual securities. Finally we take a look at overall model performance and find more real-world alternatives to express our investment views.

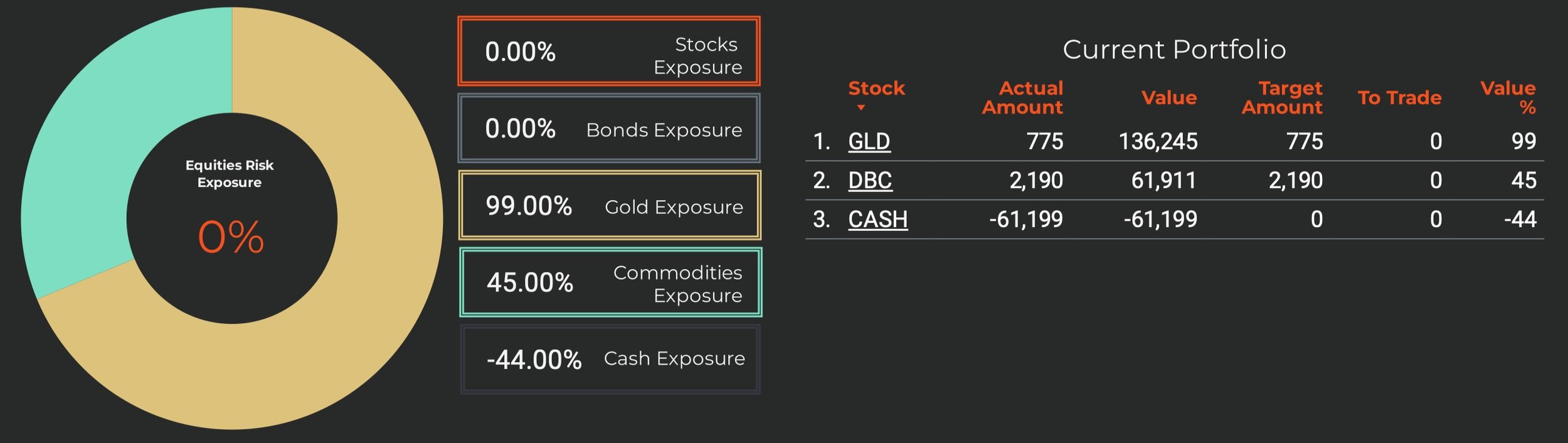

Enterprise Asset Allocation Model

Universe: 4 major asset class ETFs + Cash

Risk / Return Profile: 9.4% annual return, 1.09 Sharpe Ratio, -11.84% Max Drawdown

By improving upon the classic 60% Stocks - 40% Bonds portfolio, and using opportunistic exposure to Gold and Commodities, this model aims to simplify the allocation process. It uses just 4 ETFs (SPY, TLT, GLD, DBC) as proxies for the 4 main asset classes, with CASH as an implicit 5’th. The strategy is rebalanced weekly, on Monday’s close, and represents the backbone of Signal Sigma’s investment process.

By default, this model is looking to allocate toward a mix of equities and treasuries. However, at the present time, both of these options are excluded. To understand why, we take a look at the performance of major ETFs and the state of market breath.

SPY Analysis

Equities are excluded from the allocation process on two accounts: First, the benchmark ETF used (SPY) is sitting outside the range where our system would target it for selection. Our number 1 risk management rule is to never buy a major asset class while it’s trading below its technical lower bound (Z-Score < -1). SPY current Z-Score is -1.33 so it is not deemed investible.

The second issue that disqualifies equities from our general asset class allocation is very poor market breath. We measure different metrics computed from the top 1000 stocks by dollar transaction volume, and analyze the stats by comparison to recent past. We see higher than usual average drawdown in the market, mounting pressure in terms of “selloff” events, declining breath.

Treasuries are another major asset class that is currently excluded from our allocation. TLT, the benchmark ETF for treasuries, is in a strong downtrend, with a damaged drawdown profile and rising volatility metrics. Although we like the long term prospects of bonds, there needs to be a better technical setup to consider entering this kind of position. A consolidation period of a couple of months or a “sticky” rally would definitely put treasuries back on our radar. Currently, with a negative -1.3 Z-Score and pronounced downtrend, we will take a pass on treasuries as well.

TLT Analysis

Cash is said to be king in periods of market stress and the US Dollar was surely top dog for the past months. It has now reached levels last seen in March 2020 and the slope of the most recent leg up has us thinking the current trajectory is unsustainable. Out of the major asset classes, it is clearly the one standing out to be most overbought. Signal Sigma models have been largely allocated to cash during the recent downturn, but this past week bought some important changes to all model allocations. We see the historic extension of the US Dollar (Z-Score 2.5) to be an excellent opportunity to allocate away from it. As per our process, the safest way to play a bearish USD view is through commodities and gold.

Major Asset Class Normalized Deviation from Moving Averages (Sigma Score)

Ending Portfolio:

GLD : 99%

DBC : 45%

CASH : -44%

Recent Trades:

Bought GLD position on 05-05-2022

Bought DBC position on 05-06-2022

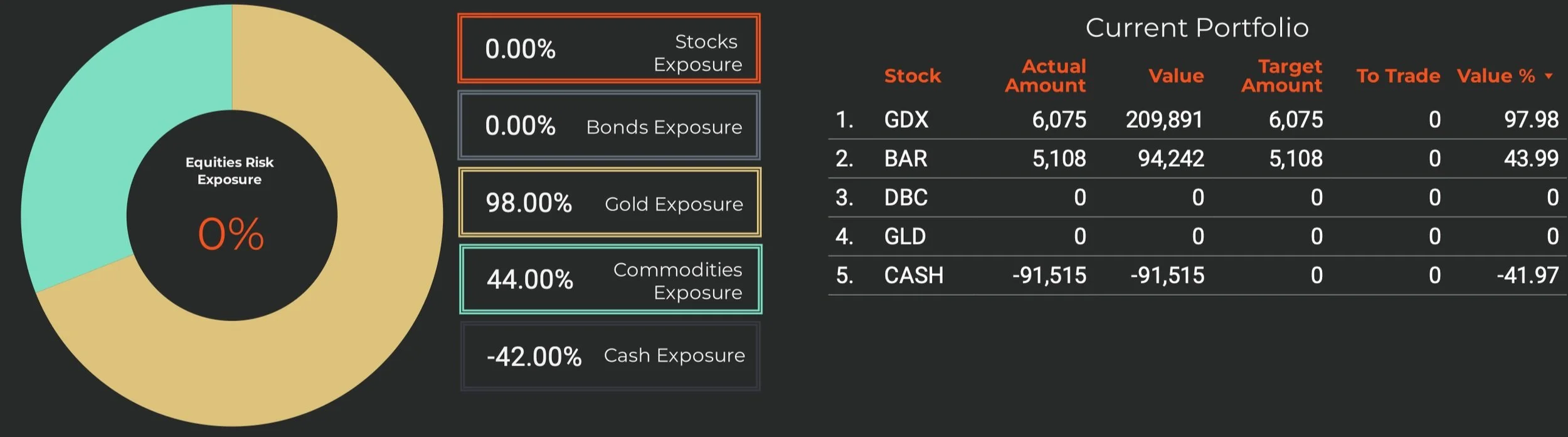

Nostromo Factor Exposure Model

Universe: 37 factor exposure ETFs + Cash

Risk / Return Profile: 13.0% annual return, 1.35 Sharpe Ratio, -12.4% Max Drawdown

The factor exposure model (Nostromo) takes the asset allocation theme one step further, by selecting exactly which Sector ETF or Factor ETF offers the best risk-reward prospect. Each of the 4 asset classes is broken down further into differing styles - this means that the investible universe is much broader in this model (37 ETFs vs just 4). Consequently, trading happens more often, and the resulting equity curve is much smoother. Overall, the strategy carries a bit more risk, with historical drawdowns larger by 1 percentage point. Similar to the Asset Class Model, this strategy is rebalanced weekly, on Monday’s close.

The themes for this model are similar (Commodities and Gold are favored) but execution differs slightly.

Gold vs Gold Factors

When selecting the preferred way to gain exposure to bullion, our system actually has a small universe of precious metals to select from and a couple of miners ETFs. It runs a comparative analysis using Gold as a benchmark in order to identify the investment with the best risk-reward profile. GDX (Gold Miners) have proven to be in this case the best alternative to owning physical gold, and targeted for exposure.

Commodities vs Commodity Factors

Just like the system for gold, the general commodities-tracking ETF (DBC) is used as a benchmark against various other ETFs that single out a particular physical asset. By using the same comparative analysis approach, Gold stands out as the physical commodity offers the best risk reward. It has been targeted for exposure as well.

Ending Portfolio:

GDX : 101%

BAR : 45%

CASH : -46%

Recent Trades:

Bought GDX position on 05-05-2022

Bought BAR position on 05-05-2022

Horizon Equity Model

Universe: 2350 individual stocks + 37 factor exposure ETFs + Cash

Risk / Return Profile: 24.8% annual return, 1.28 Sharpe Ratio, -22% Max Drawdown

This model draws upon the Asset Allocation and Factor Exposure strategies to generate the optimal mix for its own asset class allocation. It then employs an advanced stock screener to create the model portfolio.

Since equities per-se are no longer part of our general asset allocation, the equity model has no particular "view" on portfolio construction. In periods that could be described as "inflationary bear market", this model defaults to the selection of our Factor Model. Once equities become investible again according to our process, the Equity Model will construct a portfolio made up of individual stocks. But for now it follows the same portfolio construction logic as the Factor Model.

Ending Portfolio:

GDX : 97.98%

BAR : 43.99%

CASH : -41.97%

Recent Trades:

Bought BAR position on 05-03-2022

Bought GDX position on 05-03-2022

Bought GDX position on 04-26-2022

Conclusion and Reality Check

Is there really a fundamental case to owning that much gold?

We believe there is. Our portfolio positioning is optimized for the medium term, where algorithmic strategies provide the best "edge". That being said, the positioning of this past week is really a move away from the US Dollar. After many weeks of being 70 - 100% in cash, our models are starting to outright short the Dollar. Gold provides a "haven" status, performed much better that treasuries and stocks and is not very overbought like some commodities which could be ripe for a pullback. In other words, the balanced risk profile, reduced volatility and perceived safety provides the optimal risk-adjusted return on a short-USD position. And if you would like to better visualize the bull case for owning Gold, there is this chart:

After record monetary stimulus and currency debasement, the asset inflation has been especially reflected in equity prices. Not so much in gold. With the Fed still behind the curve on hiking rates and starting QT, there is a case to be made that gold will catch up, equities will catch down, or they will eventually meet in the middle.

In a rising interest rate environment, both stock and bond holders are set to suffer losses. The longer the duration of your portfolio (either via unprofitable "growth" stocks, or via long-dated treasuries or corporate bonds), the more risk you face going forward. The alternative to a commodity - gold portfolio would be to also own stocks from sectors that are traditionally defensive (or produce said commodities): Energy, Staples, Healthcare, Basic Materials. Positive-earning companies with strong and clean balance sheets, and low stock volatility are preferred.

If you need assistance with portfolio positioning, trade sizing or strategy functioning, do not hesitate to contact me directly!

Happy Investing,

Andrei Sota