/ April 08 / Weekly Preview

-

Monday:

N/A

Tuesday:

N/A

Wednesday:

FOMC Minutes

10-Year Note Auction

Thursday:

PPI MoM (0.3% exp.)

Initial Jobless Claims (215K exp.)

Friday:

Michigan Consumer Sentiment (79 exp)

-

Monday:

N/A

Tuesday:

Tilray TLRY

Wednesday:

Delta Air Lines DAL

Thursday:

CarMax KMX

Constellation Brands STZ

Lovesac LOVE

Friday:

JPMorgan Chase JPM

BlackRock BLK

State Street STT

Wells Fargo WFC

Inflation Spooks Investors as Q1 Earnings Season Looms

We’ve been discussing the unstoppable bullish trend in the equity market for a while now. Marked by low volatility, grinding day-to day price action and virtually no drawdowns, this mind-numbing development has been going on for about two months. In that timespan, investors have become overly complacent, sometimes exuberant and forced to chase returns, as some needed to simply plow some cash into the market.

We’ve also been discussing what technical triggers we’d need to see in order to assume that this trend will finally break. On Thursday, the first crack appeared, as SPY closed below its key support level (20-DMA and R2). By itself, this one-day break is not enough to get us to start selling in a hurry. Since there have been a couple of occasions where SPY bounced after closing below the 20-DMA, we also need to get “confirmation” now. Usually, a confirmed trend / level break is confirmed either when a rejection occurs from that level, or when the break is maintained for several sessions.

Friday, the market rallied and barely exceeded the 20-DMA, but not the R2 retracement level. In the context of our analysis, what comes next is indeed “make or break”. Should SPY fail to trade above $517, the next logical target becomes the $500 area (-3.55% potential loss). If SPY can continue to gain ground, upside stands at $537 (High Trend-Line, +3.58%).

The MACD signal is now indicating a considerable downside deviation, only exceeded during larger corrections in the past. While the market may remain range-bound for the next month, we would expect a total drawdown episode of about 5%-10% to conclude before the November election. That would re-test SPY’s 200-DMA and M-Trend level, in the $470 price area. It would also reverse a lot of the bullish enthusiasm currently embedded in investor psychology and feel much worse than it would actually be. 5%-10% corrections are absolutely normal in any given year, but bears will come out of the woodwork and doom & gloom headlines will dominate the news cycle.

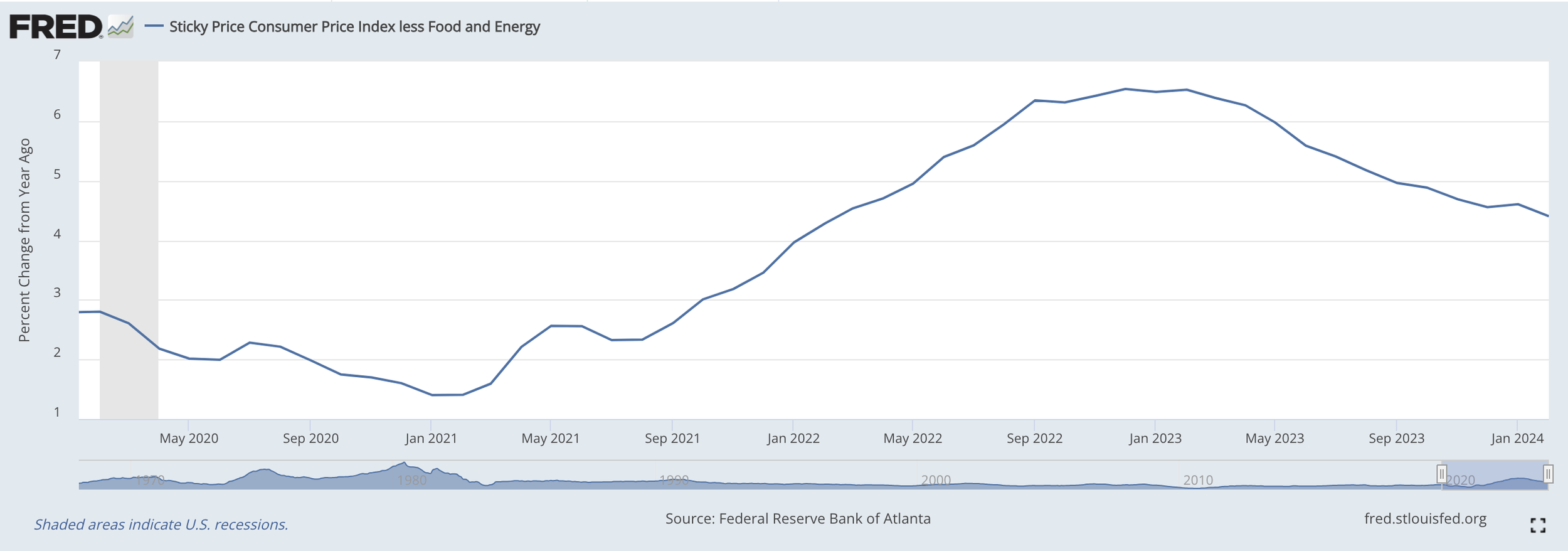

Fundamentally, the trigger for Thursday’s sell-off was a scare related to resurging inflation. Minneapolis Fed President Kashkari (not an FOMC voter) said it's possible the Fed might not cut rates this year if progress on inflation stagnates. Several commentators pointed out that the rate of slowdown in inflation, especially on the services side, is stalling. That certainly seems to be the case when looking at Sticky CPI (goods and services included in the CPI that change price relatively infrequently).

Month-on-Month percentage change in core inflation has ticked up recently as well, and has failed to go any lower since the first half of 2023. Essentially, the market is scared we’ll see a 1970’s style resurgence in inflation.

As a result, several commodity plays are blowing up. Oil (USO), which is also benefiting from Middle-East geopolitical tensions, has reached our technical price target ($82).

However, it’s agricultural commodities which have simply gone off the charts (Invesco DB Agriculture Fund - DBA), posting a +25% year-to-date performance.

We would argue that these price levels don’t really make sense just by looking at the longer term trend of inflation data. Of course, bumps appear every now and then and expecting inflation to go down in a straight line isn’t really realistic. The rate of decline is subsiding due to the year-over-year comparisons which are becoming harder, but the longer term trend is trending lower.

In the latest inflation report, there were only 3 areas to register increases: Transportation, Healthcare and Education. Meanwhile, Housing, Food and Beverage, and Apparel all registered declines. Given the situation in the housing market and the 6-month lag in the CPI reading, we would argue that there’s no real cause for concern here, despite some bearish commentators.

Truflation, a live data aggregator for the US inflation rate, supports our view. Inflation is both trending in the right direction and should be lower than currently reported.

Unfortunately, one of the key drivers of the market in modern finance is the behavior of Central Banks. As the economy relies more heavily on artificial stimulus, it’s become essential to decode FOMC language and anticipate monetary policy changes. That’s the reason for all of this inflation talk to begin with. Remember that last year’s -10% correction in October happened simply as a result of disappointment with the Federal Reserve keeping rates “higher for longer” than Wall Street wanted. There was no other “major” catalyst.

Today’s setup is likely similar: an over-exuberant market waiting for the right catalyst to trigger a sell off. That catalyst might also be a disappointment in earnings, as Q1 season officially starts on Friday.

Our Trading Strategy

We’ve already taken profits and raised cash in some extended positions. On the treasuries side, we would be inclined to add to holdings as soon as technical conditions allow for a more meaningful allocation.

On the equity side, we still need to wait for the market to make up its mind. Ultimately, what causes the market to break a bullish trajectory is entirely unknowable in advance. We can only assess conditions and make preparations for such a scenario. Commodities and Gold are starting to become very stretched as well, with only several pockets of potential out-performance left (Nat Gas, possibly Silver).

When we’ll see a clear break in technical patterns, we will take action accordingly. Until then, following some of our core trading rules should prove helpful.

1. Cut losers short and let winners run. Scale up into positions that work, rarely vice-versa. Refer to our Removals guide.

2. Set actionable goals. Decide the proper position sizing, Profit Taking and Stop Loss price for each position, when doing your investment planning. Do this when the market is closed. In the “heat of the moment”, during the live session, consult your pre-set plan. Use the Portfolio Tracker to monitor positions and risk.

3. Abstain from emotional mistakes. Emotionally driven decisions void the investment process. Use the Sentiment indicator to avoid buying in Greed and selling in Fear.

Signal Sigma PRO members will be notified by Trade Alert of any live portfolio changes (if subscribed). If you’re not on this plan yet, you can get a free trial when you join our Society Forum. If you need any help with your trading strategy (or would like to implement one on your account), feel free to reach out!