Weekly Preview / January 30

Notable Events on our Weekly Watchlist:

Monday: N/A

Earnings: NXPI, SOFI

Tuesday: EU GDP Growth

Earnings: AMD, AMGN, CAT, EW, EA, XOM, MPC, MTCH, MDLZ, PFE, PSX, SNAP, WDC

Wednesday: FED Interest Rate Decision, EU Inflation, JOLT Job Openings, ISM Manufacturing

Earnings: META, MO, ALGN, CTVA, EBAY, HUM, MCK, PTON, QRVO, TMO, TMUS

Thursday: BOE + ECB Interest Rate Decision, Jobless Claims

Earnings: AAPL, ABB, BABA, GOOGL, AMZN, TEAM, BMY, GOOS, CRUS, CLX, COP, LLY, EL, RACE, GILD, GPRO, GWW, HBI, HOG, MRK, MSTR, PENN, QCOM, DGX, SBUX, X, UAA

Friday: Non-Farm Payrolls, Unemployment Rate

Earnings: AON, REGN, SNY

ETFs to watch: SPY, TLT

Stocks break out ahead of a pivotal week for the markets. “Head Fake” or is this the real deal?

Last week, the most followed equity market benchmark ETF - SPY - managed to break out from it’s recent downward sloping trading channel. Is this the top of another bear market rally akin to the March and August 2022 highs? Or is this the start of a new bull market? We explore both the technicals and the fundamentals driving the market, and what to expect in one of the most pivotal weeks for the quarter.

With Apple, Amazon, Google, Meta and AMD earnings on deck and a raft of major Central Bank decisions to look forward to, this is shaping up to be a very busy week, with potential long term implications for the rest of the year. First, let’s start where we left off, and look at how the SPY is trading.

SPY Analysis

We have previously noted significant market internals strength in our weekly articles. Not surprisingly, the S&P500 proved resilient in the face of selling pressure and continued to rally above our isolated level of resistance (now support) at 403 (M-Trend). We are now entering the zone where sellers will get squeezed, FOMO sets back in, and the beginning of a “new bull market” is confidently proclaimed. Technically, this latest advance looks very similar to how the market traded back in March and August of last year. In both cases, the market seemed to break above and defy its technical downtrend, sucking in investors that were chasing returns out of fear of missing out.

There are some notable differences between now and then, mainly in the Market Internals department. The advance that we are witnessing now seems much more solid from a technical standpoint. It is, however, flying in the face of the Federal Reserve, which is aiming to tighten financial conditions, not loosen them.

Be that as it may, there is room for upside, still. Using our breadth indicator (Market Internals, Overbought/Oversold), we are able to see that the market is not extremely overbought yet. There are still shorts to squeeze in this upside move. We suspect that the intermediate level of 417 is where the current rally could stumble and then proceed to consolidate / weaken and retest support (red box in chart above). The timeframe for this consolidation period would be the end of March. The bullish outcome would have the MACD Signal turn negative, with the price NOT trading below M-Trend Support (now 403) until the next positive crossover.

Morgan Stanley Global Risk Demand Index

Morgan Stanley’s measure of risk demand shows a stark similarity to our own instrument.

Dollar Transaction Volume is confirming the current bullish price action. Although the longer term average is sloping downwards, as liquidity gets removed from the markets by the Federal Reserve, we are seeing sustained interest in trading at current prices.

IF and WHEN we see volume start to dip below the average, we shall know that it is time to take profits and reduce exposure. For now, bulls have the wind in their sails, as the rally gets chased.

What could go wrong with a “Soft Landing”?

A "soft landing" refers to a controlled slowdown in an economy, which results in a reduced rate of inflation and minimal impact on economic growth and employment. The Federal Reserve is often credited with engineering a "soft landing" by adjusting monetary policy to moderate the pace of economic activity and control inflation, without causing a recession. Alan Greenspan coined the term during his tenure as Fed Chairman.

But what was the last time we heard of a “soft landing” in the media?

As emphasized, this article dates back to 2007. It’s worth a read here. By the time this article was published, the Fed was already on their way to lower interest rates (pivot). However, it’s useful to note the complacent tone that economists had at the time. According to Google Trends, in September 2007, there were increasing worries about a recession, but nothing that would really spark concern:

Today, we are well past the peak interest in “recession” related search terms. We have to presume that everyone is aware that 2023 holds a high probability of a recession in the US economy. Therefore, from a contrarian point of view, the market has already priced in the worst of potential outcomes. Despite the abundance of news and media headlines predicting an upcoming recession, the stock market has shown signs of stability and improvement since October, suggesting a possible alternative outcome.

Historically, stock market prices tend to reach their lowest point 6 to 9 months before corporate earnings hit bottom. This is due to the market anticipating future outcomes and reflecting them in stock prices. The point is that bulls have a lot more going for them right now than they did in previous rallies.

History tells a different tale

The risk lies in the Federal Reserve over-tightening monetary policy. In the past, whenever inflation reached levels above 5%, a recession or "hard landing" followed. This has happened in seven historical instances, including 1948, 1951, 1970, 1974, 1980, 1990, and 2008.

A rising stock market is not exactly what the Fed wants to see. Financial conditions have eased sharply since Jerome Powell’s Jackson Hole speech in August. The Bureau of Economic Analysis announced the initial estimate of the fourth quarter 2022 gross domestic product on Thursday. The report showed stronger-than-anticipated results in two areas. The actual rate of economic growth was 2.9% annually, which was higher than the expected 2.6%. Additionally, the inflation rate was also higher than expected at 3.5% compared to the anticipated 3.2%. This is music to the Fed’s ears, as they have a good excuse to keep QT going and keep interest rates higher for longer.

While “this time could be different”, history suggests that the Fed’s track record of achieving a “soft landing” has a limited chance of happening.

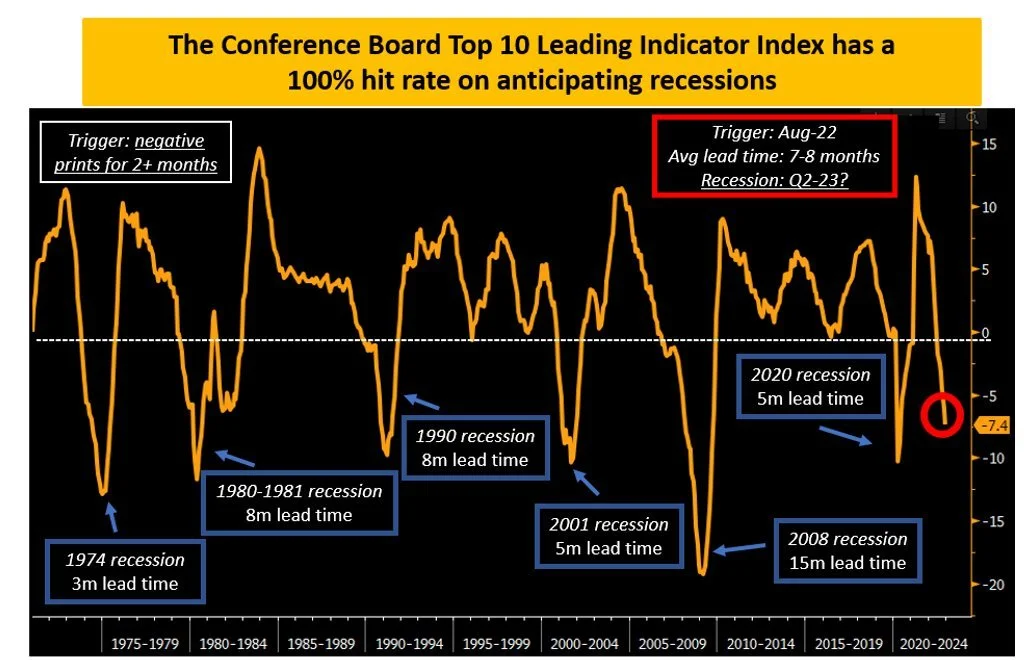

Conference Board Top 10 LEI Index

The Leading Economic Index (LEI), includes the top 10 most impactful forward indicators for the US economy. Historically, every time the year-over-year series of the LEI falls into negative territory for two or more consecutive months, it signals the onset of a recession.

Takeaway

Bulls and Bears still have a lot of fighting to do. The argument is not yet resolved.

A lot will hang in the near term on how Powell’s rhetoric will be received by the markets. Similarly, the market’s reaction to the raft of earnings reports will influence investor’s sentiment going forward. It is entirely possible that both bulls and bears are right: bears can get the recession call right, and bulls might make a good point of it having been already priced in. It is not up to us to make predictions about who will be right. Our job is to manage risk.

This is where our investing models come in. So far, we are seeing a net-positive allocation from 2 of our strategies. In the Sigma Portfolio, we are still holding a hedge position, but net exposure is similarly positive. As soon as all strategies align in being Long the market, we will remove the hedge and allocate more aggressively to risk assets.

While in the short term we will most likely underperform the main indices, the trade-off is well worth it. There is no need to be early to the next bull run. Whenever it comes and it is confirmed, we will have plenty of time to participate in it and grow our capital. For now, we are still prioritizing capital preservation.

Andrei Sota