Weekly Preview / May 01

-

Monday:

ISM Manufacturing PMI (46.7 exp.)

Tuesday:

EU Inflation (7% exp.)

JOLTS Job Openings (9.68M exp.)

Wednesday:

FED Interest Rate Decision (0.25% hike exp.)

ISM Services PMI (51.8 exp)

Thursday:

ECB Interest Rate Decision (0.25% hike exp.)

Continuing Claims

Friday:

Non-Farm Payrolls (180K exp.)

Unemployment Rate (3.6% exp.)

-

Monday:

Avis Budget CAR

CF Industries CF

Logitech International LOGI

NXP Semiconductors NXPI

ON Semiconductor ON

Vornado Realty Trust VNO

Tuesday:

Advanced Micro Devices AMD

Pfizer PFE

BP BP

Ford Motor F

Herbalife Nutrition HLF

Incyte INCY

Marriott MAR

Match Group MTCH

Simon Property Group SPG

Starbucks SBUX

Uber Technologies UBER

Wednesday:

Albemarle ALB

Barrick Gold GOLD

Builders FirstSource BLDR

CVS Health CVS

Fastly FSLY

Lemonade LMND

Phillips 66 PSX

TripAdvisor TRIP

Upwork UPWK

Yum! Brands YUM

Zillow ZG

Thursday:

Apple AAPL

ArcelorMittal MT

Atlassian TEAM

Block SQ

Booking Holdings BKNG

Carvana CVNA

DraftKings DKNG

Dropbox DBX

Expedia Group EXPE

Ferrari RACE

Microchip Technology MCHP

Peloton Interactive PTON

Regeneron Pharmaceuticals REGN

Shopify SHOP

Zoetis ZTS

Friday:

AMC Entertainment AMC

Dominion Energy D

Hope priced in ahead of key week

Last week, the market fell close to our designated support level by Wednesday, then recovered all losses by Friday in an aggressive rally with all the markings of short-covering activity. The risk-off mood that prevailed initially was caused by growth and economic slowdown concerns, which were confirmed by Thursday’s weak Q1 GDP growth number (1.1% vs 2.0% exp.).

The market took the news in stride, with investors betting on a Fed Pivot, and some better than feared earnings calls. Microsoft led the way in the mega-cap space as generative AI creating a ton of excitement, while Amazon and UPS disapointed with their outlooks.

“United Parcel Service and Packaging Corp’s first-quarter earnings reports carried an ominous warning for e-commerce companies preparing their own quarterly results: Americans are ordering fewer things online. Both UPS and Packaging Corp. of America saw sales drop compared with the same period last year—a move the companies attributed to lower box and package volumes. Packaging Corp. produces boxes and other packaging solutions.”

Nevertheless, the market rallied into the end of the week, without reversing sell signals. SPY is now highly overbought and pushing the limits of its trading channel. The broad market, however, is nowhere near as extended, showing a very high divergence to the SPY.

Near term resistance sits at $417 (Trend-Line), with support at $403 (S1 level).

SPY Analysis

The MACD Signal triggered from a lower level, and is still in negative territory.

As discussed earlier, there is a very wide divergence between the broad market and SPY. We visualise this by plotting a mix of mid and small caps ETFs MDY and SLY (white line) against SPY below:

The divergence is the largest one on record in the past two years and drives home the point that this market remains exceptionally narrow, and driven by a handful of mega-cap stocks. While this gap could close with the rest of the market rallying to “catch up” to SPY in performance, there is little fundamental evidence supporting this thesis.

The economy remains shaky

“The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2023 is 1.1 percent on April 26, down from 2.5 percent on April 18. After recent releases, the US Census Bureau and the US National Association of Realtors, the nowcasts of first-quarter real personal consumption expenditures growth and first-quarter real gross private domestic investment growth decreased from 4.2 percent and -5.8 percent, respectively, to 2.7 percent and -8.0 percent. In contrast, the nowcast of the contribution of the change in real net exports to first-quarter real GDP growth increased from 0.26 percentage points to 0.30 percentage points.”

This was the commentary associated with last week’s GDPNow report. Our market outlook from February ‘23 puts into perspective just what the current risk-reward set up is for investors chasing the market currently (4.58% upside vs -17.05% downside). We’ll revisit this outlook at the end of May, but there seems to be little reason for an outsized change in price targets.

The lag effect of monetary policy and a consumer running out of savings are not particularly encouraging. Moreover, the Fed is not done raising interest rates, with a (last) 0.25% hike expected to be delivered on Wednesday.

Using another comparison between ETFs reveals that a defensive mix (Utilities, Healthcare, Staples - orange) has fared much better than the broad market (Mid-Caps + Small Caps - white). This set-up is atypical in a healthy risk-on environment, where one would expect defensives to lag.

Takeaway

Medium and longer term technicals remain bullish, suggesting we are still in “risk-on” mode until further notice. Last week, we have reduced exposure slightly, without changing the risk profile of the portfolio too much. There is no reason yet to become overly defensive in terms of equity exposure, since the market has not done anything “wrong” yet.

With cash levels slightly raised, we are looking for the next opportunity to deploy capital. Typically, we would expect either a breakout of SPY above $417 (a bullish signal), or a better opportunity to re-enter the market at $403 or $390. A recession is not priced in at current levels, with analysts clamouring to project a return to previous growth rates in Q4.

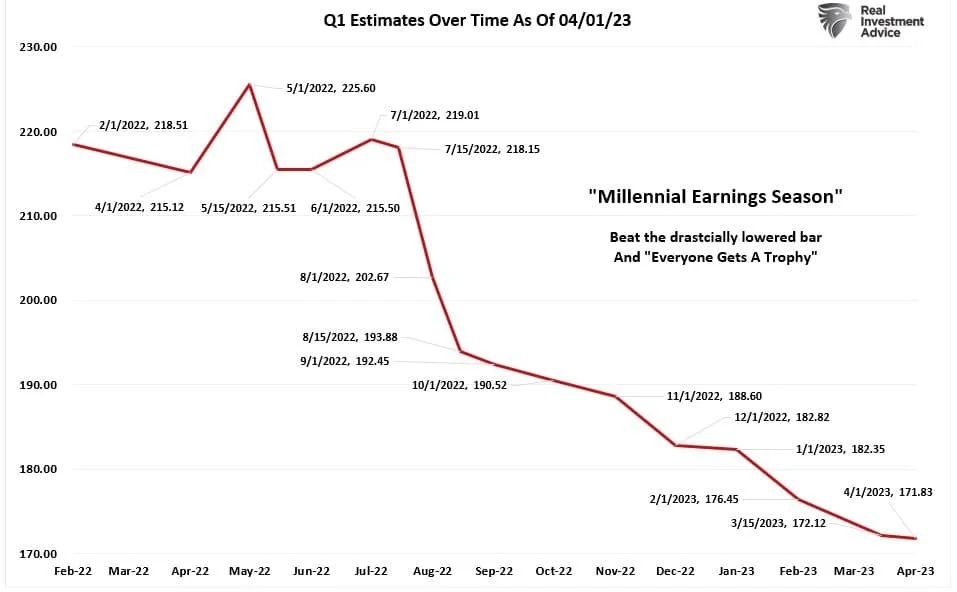

Speaking of analysts, we’ll leave you with an excellent graph courtesy of Simple Visor, showing the dramatic way analysts have walked back their initial earnings projections for Q1’23. It’s no wonder we only hear of companies “beating” top and bottom line expectations. When the bar is so low, everyone gets a trophy.