Weekly Preview / October 03

Notable Events on our Weekly Watchlist:

Monday: ISM Manufacturing

Earnings: N/A

Tuesday: JOLTS Job Openings

Earnings: N/A

Wednesday: ADP Employment Change, ISM Non-Manufacturing PMI

Earnings: N/A

Thursday: Jobless Claims

Earnings: CAG, STZ, MKC

Friday: Non-Farm Payrolls, Unemployment

Earnings: TLRY

ETFs to watch: TLT

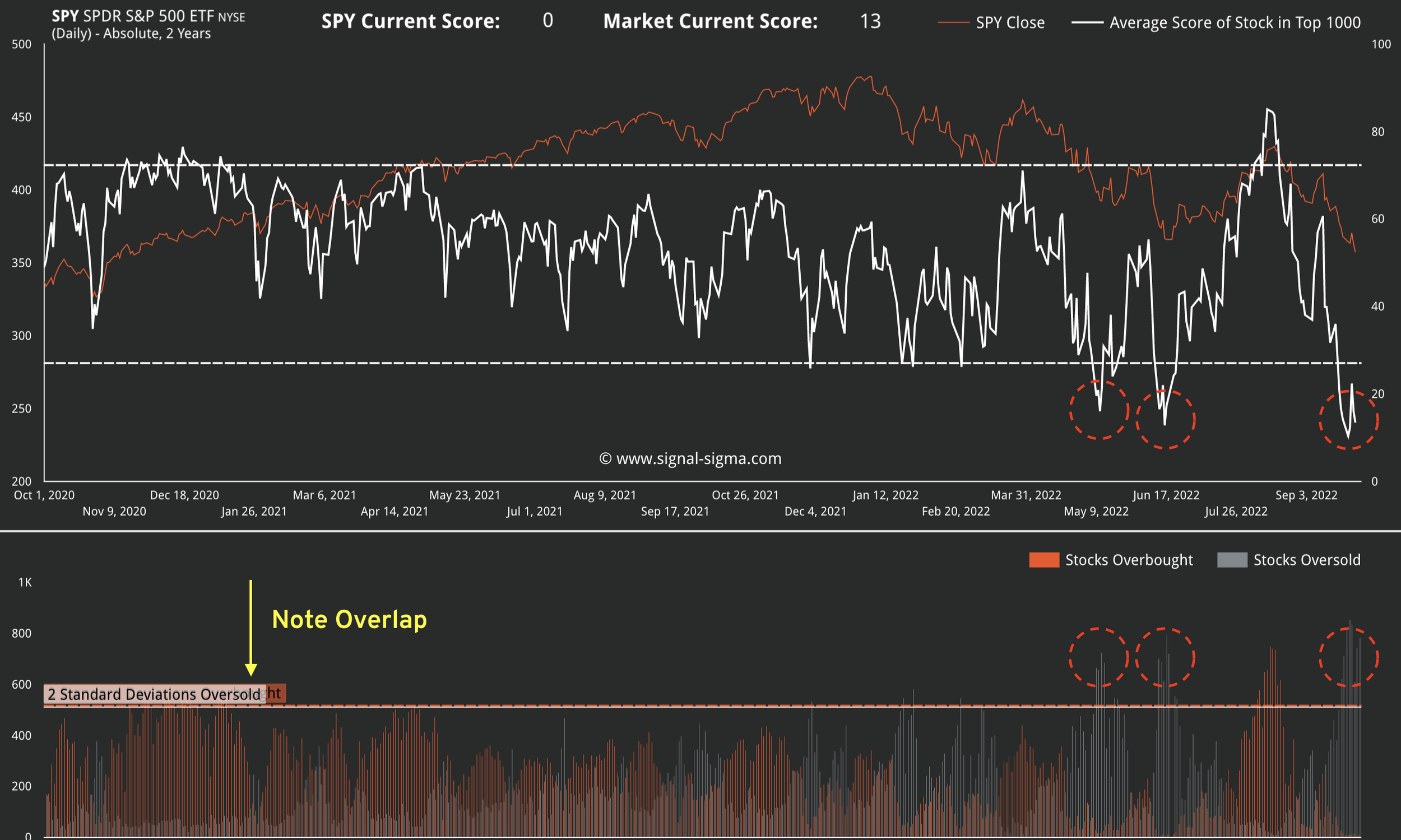

Extreme bearish positioning sets the market up for a strong reflexive rally

Oversold conditions prevailed for all of last week, as panic finally sets in with investors. The market took out June’s lows and every indicator that we are watching is screaming extreme oversold. Potential “financial stability” risk is being priced in, as the Bank of England conducts unlimited bond buying operations at the long end of the curve. The response is meant to give pension funds the time and favorable pricing they need to avoid surging margin calls and potential insolvency. It is what I would call a “soft pivot” move, one that we could see more of in the coming quarters, from other Central Banks. Don’t hold your breath, though - I do believe their intervention is temporary in nature, and not a fundamental change in course.

The extreme oversold nature of equity markets sets us up for a reasonable short-covering rally. Rarely have we seen so many factors align in terms of selling pressure. Our Overbought / Oversold indicator measures the selling pressure on a medium-term horizon on a scale of 0 to 100. We get the following readings for major ETFs:

SPY: 0 / 100

QQQ: 0 / 100

RSP (Equal Weight S&P 500): 0 / 100

MDY (Mid-Cap Stocks): 4 / 100

SLY (Small-Cap Stocks): 3 / 100

The average score for a stock in the top 1000 by volume is 13.45 / 100, as measured by our Market Internals Instrument. This is consistent with previous short term bottoming processes that occurred in May and June.

Note the number of stocks oversold is now spiking well above the 2 Standard Deviations Oversold line, as in previous instances of extreme stress. One other very important thing to note is that this line is now moving up and coinciding with the 2 Std Deviations Overbought line. What this means in practice is that we are witnessing the transition to an official bear market, as stocks spend more time being oversold than being overbought.

However, in the short term, such one sided positioning spells opportunity for the nimble trader. Our Sigma Score indicators measure normalized deviations from key moving averages. A reading of -2 or lower signals extreme selling pressure, that is unlikely to persist simply because moving averages act like “gravity” on stock prices. You can also think of the Sigma Score as an elastic band that is getting very stretched to the downside right now and is prone to “snapping back”.

All equity sectors are prone to this “snap-back” with the exception of Energy. If we were to bet on a single sector to outperform the market in a risk-on environment, it would be Technology (XLK), simply because of the very bearish positioning currently observed.

Keeping all of this in mind, we shall formulate a positioning framework for the short and medium term.

SPY Analysis

According to our methodology, there are no immediate levels of support for the market that we can bet on. The previous level that we have used as a stop-loss shall now act as resistance, starting from 385 and going up to 400 on SPY. We could very well see a reversal of prices in this area by the end of October, on any kind of positive news.

There is little downside left on the chart, with support extending from the 2020 highs at 352 on SPY.

Takeaway

With the markets getting very oversold and deviated to the downside, there is little reason to add to short positions right now. If you are heavily invested in short positions, it would make much more sense to use the current set-up to start covering (buying).

If your allocation is close to neutral or long (like the Sigma Portfolio is right now), then there is no reason to act until the market rallies. There is a better chance of exiting current positions and rebalancing risk at higher prices. I am aware there may be a lot of psychological pressure to “act” and “do something” as your portfolio decreases in value, but now is not the time to do it.

When we reach a more equitable technical set-up (385 on SPY) we will rebalance risk to market-neutral in the Sigma Portfolio, aiming to have our long positions fully covered by hedges. If a short-covering rally goes all the way up to 400, then we would be inclined to start tipping our portfolio to the net-short side, as we are getting all the technical and fundamental signals that we are in a bear-market.

Until the Fed brings interest rates down to 0, there is an increased risk of a recession in 2023. This will bode very poorly on asset prices, especially “long duration” assets like unprofitable tech stocks. Along with them, a valuation multiple compression is also expected on all fronts. There is no fundamental reason to “buy the dip” just yet, as stocks are still pricing in the coming earnings recession.

Andrei Sota