/ October 09 / Weekly Preview

-

Monday:

Fed Speakers: Logan, Barr, Jefferson

Tuesday:

Fed Speakers: Bostic, Waller, Kashkari

Wednesday:

PPI MoM (0.5% exp.)

FOMC Minutes

Thursday:

Core Inflation Rate YoY (4.1% exp.)

Inflation Rate YoY (3.8% exp.)

Initial Jobless Claims (208K exp.)

Friday:

Michigan Consumer Sentiment (68 exp.)

-

Monday:

N/A

Tuesday:

PepsiCo PEP

Wednesday:

N/A

Thursday:

Delta Air Lines DAL

Domino's Pizza DPZ

Friday:

JP Morgan Chase & Co JPM

Wells Fargo WFC

BlackRock BLK

Citigroup C

UnitedHealth Group UNH

Market Rebounds, but Test lies ahead

Brace yourselves for a volatile and busy week ahead! Tensions in the middle east flare up as the conflict between Israel and Gaza turns into a hot war. Investors may blow the dust off the classic “safe haven” playbook favoring Gold, Treasuries and the Japanese Yen. Oil is expected to surge out of the gate on Monday, which will play into inflation expectations for the quarters ahead. Speaking of which, the latest core and headline inflation figures will be released on Thursday, along with PPI (Producer Price Index) on Wednesday. And Q3 earnings season starts on Friday, as banking majors JP Morgan (JPM), Wells Fargo (WFC) and Citigroup (C) report on the latest results.

But first, let’s review last week’s price action. The market fell -1.5% on Tuesday, with SPY testing the 200-DMA at the $420 level, on a hot JOLTS reading (job openings firmly beat expectations, prefacing a similarly hot NFP print). Support held throughout Thursday, until the large reversal rally on Friday sparked by the Jobs Report data release. Despite the surge in risk assets, the market did not manage to clear overhead resistance, and continues to trade in the same interval: $431 - $420.

SPY Analysis

The MACD Signal is turning up from very oversold conditions; it is looking to trigger a BUY from the lowest crossover point in 2023;

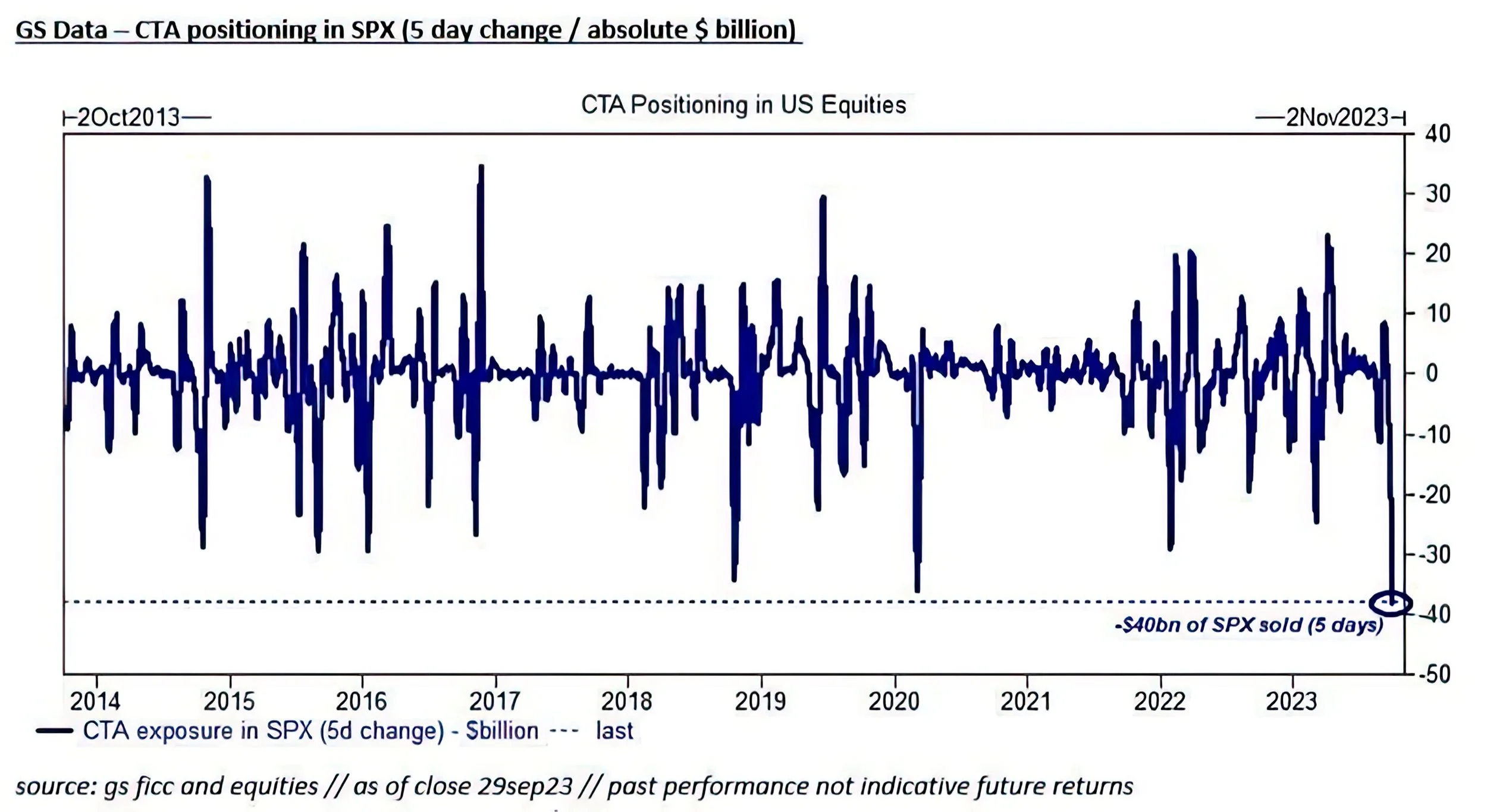

The selloff that kicked off the week looked like a liquidation event, similar to other episodes in March 2020 and late 2018. Data from Goldman Sachs suggests CTA positioning (hedge funds that use systematic trading) is highly extended to the negative side, with 40B of S&P500 futures sold over the last 5 days - a recent record.

Unusual weakness was picked up by our sentiment measure as well. This aligns well with seasonal fluctuations at the start of October and sets the market up for a rally off Q3 earnings, into year end and further into Q1 2024.

Keep your eye on Interest Rates

Despite various headlines that are set to bombard you in the following days, interest rates are what matters most at the moment, and have been the main driver for risk assets in the past month as well. Going back 10 years, we are witnessing a record short positioning from computerized hedge funds (courtesy of the The Commitment of Traders Report). The green line on the chart below represents Non-Commercials or Large Speculators and it is sitting at the lowest level ever recorded in the report’s history.

This heavy short position is set to aggressively unwind, given the right catalyst (the nature of these positions is speculative after all, and it is a certainty traders are looking to cover at a certain point). Could war be the catalyst to drive spark a rally in bonds?

Our own system will re-rate treasuries as “investible” when TLT breaks above $86.9 on a closing basis. We will speculate that this is the tipping point for an eventual rally, as part of a “flight to safety” type trade, on geopolitical risk headlines.

Gold could also make a comeback from similarly oversold levels, as a traditional safe haven. The chart speaks for itself, as GLD is touching the lower trend-line. Opportunistic traders can find a favorable entry point with plenty of upside, especially if prices don’t exceed $174 to start the week. Anything higher than that, and we can say “the train has left the station”.

Taking a closer look at the Jobs Report

As the main catalyst of last week, the Jobs Report seemed to blow the doors off expectations. At the headline, US Employment surged, with 336K new jobs added in September, vs official expectations of 150K. However, there are 2 different jobs reports that are telling wholly different stories.

The 336K number is derived by looking at company payrolls. But there is a second way that jobs are calculated, and this one surveys individuals instead of employers. It’s called the household survey. This report shows that only 89,000 jobs were added the past month. The only plausible explanation is that people are holding more than one job (when one person has two jobs, that looks like 2 employees when you look through the eyes of the payrolls. But it’s the same person working at two different companies). As a consequence, the Labor Force Participation rate has remained unchanged, at 62.8%:

Essentially, we are seeing workers swap jobs between one another. This does not represent meaningful growth, as could be inferred by looking at the headline report figure alone. Furthermore, full-time employment numbers have actually declined by 692K over the past 3 months. This makes September’s report look even worse, as it means people are working more jobs, but only part time.

Our Trading Strategy

In the face of rising geopolitical risks and uneven job growth, the Fed’s appetite for hiking interest rates should be subdued. Of course, inflation data to be released on Thursday will provide a definite answer to weather we’ll see another rate increase in 2023. The knee-jerk reaction to the Israel - Gaza war will drive up oil, gold, treasuries and the dollar. Risk assets will sell off.

Generally speaking, the opportunity in these types of scenarios is to do the reverse of the knee-jerk reaction. We like gold longer term, irrespective of the war. We’ll also buy equities on a MACD buy signal, as well as treasuries as soon as they become investible. Essentially, it’s the dollar we’ll underweight in portfolio for the coming period.

Signal Sigma PRO members will be notified by Trade Alert of any portfolio changes (if subscribed). If you’re not on this plan yet, you can get a free trial when you join our Society Forum. If you need any help with your trading strategy (or would like to implement one on your account), feel free to reach out!