Weekly Preview / September 19

Notable Events on our Weekly Watchlist:

Monday: N/A

Earnings:

Tuesday: Housing Starts, Building Permits

Earnings:

Wednesday: Fed Interest Rate Decision

Earnings: N/A

Thursday: BOE Interest Rate Decision,

Earnings:

Friday: N/A

Earnings: N/A

ETFs to watch: SPY, TLT

Bear case gathers steam as the market plunges following a hot CPI print; Central Banks meetings take center-stage

In our September 06 Weekly Preview article we laid out 3 probable short term paths for the market:

A - a direct breakdown to lower lows;

B - a rally that fails at trendline resistance and then proceeds to break lower;

C - a sustainable rally above trendline resistance that we can build upon;

Last week started off on the right foot, with scenario A dropping out of the picture, as a short term rally took the market just above resistance. One of our automated strategies (Horizon) was “fooled” into buying at this particular juncture, as the macro picture looked to brighten ahead of the CPI report. On Monday, I wrote the following:

“It seems we are now in scenario B or C, where the rally from short-term oversold conditions will be put to the test. This week, we will get the latest inflation figures on Tuesday, which will move the markets significantly. We will either get a convincing breakout above the lower technical trendline, or the rally will fail at this important juncture.”

We now know how that turned out. The 8.3% inflation print spooked buyers out of the market and the S&P plunged more than 4% in one session (the most significant one-day decline since June 2020). Our prognosis for scenario B appears to be spot-on, as significant weakness continued throughout the week. Our designated equity-stop level got triggered on Thursday (SPY 392), and on Friday we decided to deploy hedges in the Sigma Portfolio and rebalance positions.

Let’s take a look at where last week’s price action leaves us:

SPY Analysis

The market is now in Oversold territory, but that situation is no longer enticing, since we are trading below our last level of support. This is not the type of setup where “buying the dip” works. Rather, it is the type of technical backdrop that often leads to further weakness. Our intention is to stay well clear of further downside and use any rally this week to further reduce exposure in the Sigma Portfolio.

If SPY does not clear the 407 level by today’s close (highly unlikely), ALL Signal Sigma strategies will cut equity exposure to 0%. Such alignment between models is a major bearish signal that we are not going to ignore in real life.

To complete the technical picture, our Market Internals analysis confirms the fact that there is indeed further room for stocks to fall, as previous extremes have not been reached yet.

Market Internals / Overbought - Oversold

The amount of stocks “Oversold” is higher than average, but still well off the last 2 peaks that marked short term “bottoms” in the market. The strange thing about the current price action is the apparent disconnect between volatility measures and investor sentiment.

Market Internals / Volatility

Neither Realized, Implied or the spread between the two measures is extreme at this point. This suggests that despite the bearish fundamental and technical backdrop, market participants are not hedging to an unusual degree. Fear is absent from the options market, a fact that totally contradicts the sentiment surveys as shown below:

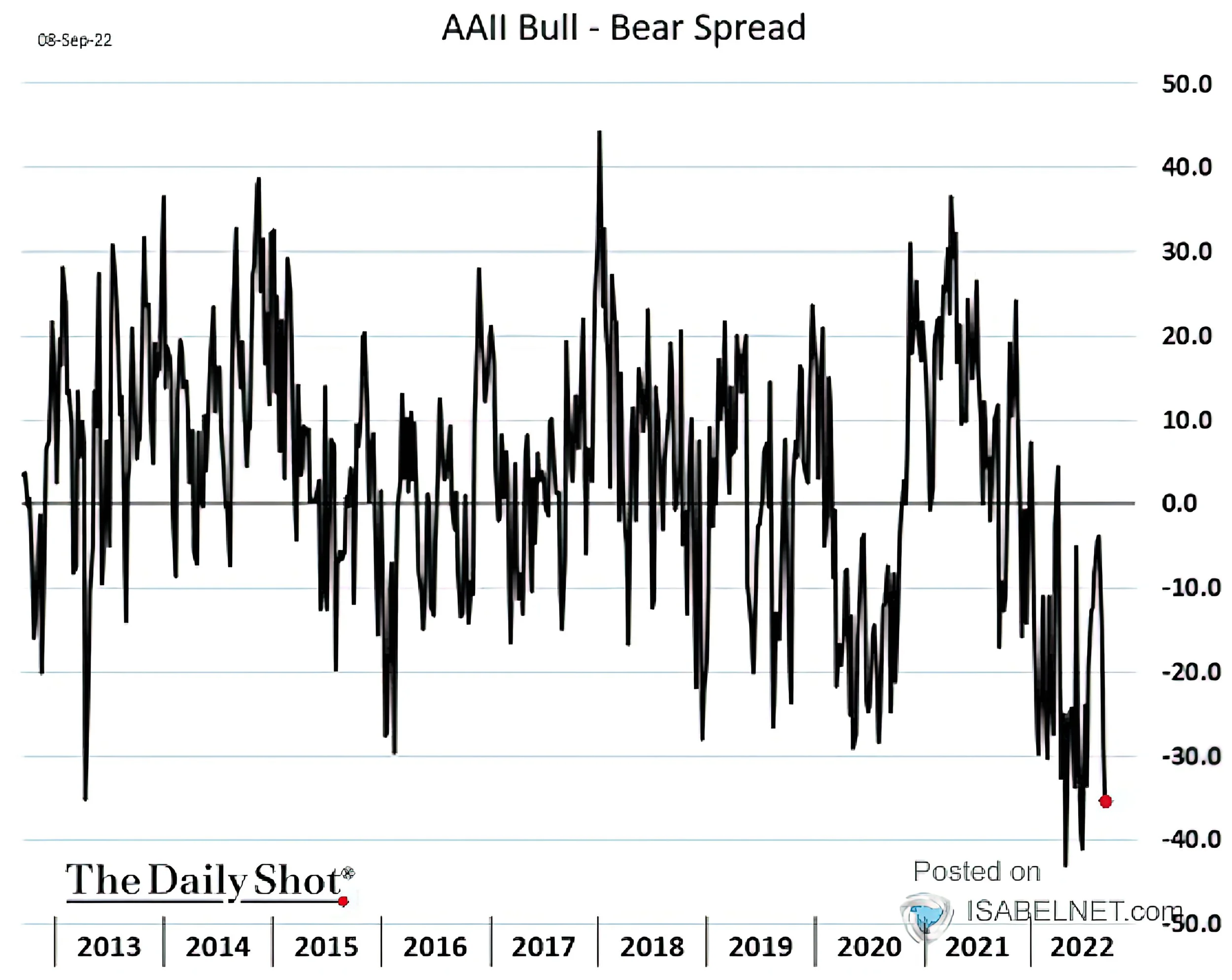

AAII Bull - Bear Spread

The latest reading of the AAII survey takes the spread at -20 (higher than shown on the chart). But putting all readings into perspective still gives us a very bearish picture of the past 10 years.

Investors say they are fearful, but they are not acting on that fear by selling stocks. Anecdotal evidence points to the contrary, with speculators still trying to fish for a bottom.

The real culprit of the last week are, of course, interest rates and the Fed’s actions. Market participants view of the path of rate hikes has changed swiftly:

The Fed is now expected to raise the benchmark target rate by 75bps on Wednesday, with a 20% probability of a 100bps increase. 13 Central Banks, including the BoE and BoJ are on course to release the latest policy adjustments this week. While aggressive tightening is being priced in, we are keeping an eye on long-dated treasuries (TLT). There is a limit to the extent long term yields can rise before investors start choosing the safety of bonds over the risk of owning equities.

At some point during the next 6 months, we fully expect a “flight to safety” narrative to give a boost to bond prices. Our next important “BUY” will probably be bonds, not stocks.

Takeaway:

The transition from bull to bear market is taking shape, as technicals are starting to deteriorate and give way to the fundamental reasons this environment might lead to lower stock prices.

Our automated models are starting to converge on a very defensive, cash heavy asset allocation. We are not keen to “buy the dip” at this juncture, as weakness begets weakness in momentum and prices. There is one bright spot - Energy - with oil apparently capped to the downside at $80 (where the White House will start becoming a buyer to refill the SPR reserve), this sector is looking like an out-performer. Otherwise, we will use rallies to further reduce equity exposure via hedging.

Andrei Sota