Introducing the true no-code solution for your quantitative investment needs

Our software can run a hedge fund. It can also run your personal portfolio.

Tell us your risk tolerance and preferred benchmarks and we’ll code a custom strategy to fit your objectives.

Explore the strategies that we’ve built

Millennium Alpha / Vol Target / Momentum and Vision

4 different passive investment themes for portfolios that are always allocated to equities

Starting from “Alpha”, our top performing model, to “Vision” a tech-focused approach to portfolio construction, our models have something for everyone.

These portfolios are designed to generate uncorrelated returns and provide exposure to various factors so you can pick and choose the right approach in order to meet your financial goals.

NOSTROMO

A tactical allocation investment strategy that focuses on ETF selection

Using Enterprise as a starting point, Nostromo takes the asset allocation theme one step further, by selecting exactly which Sector ETF or Factor ETF offers the best risk-reward prospect.

Each of the 4 asset classes covered by Enterprise is broken down further into differing styles - this means that the investible universe is much broader in Nostromo (37 ETFs vs just 4 in Enterprise).

Consequently, trading happens more often, and the resulting equity curve is much smoother. Overall, the strategy carries a bit less risk, with historical drawdowns better contained.

ENTERPRISE

The backbone of all Signal Sigma Strategies

By improving upon the classic 60% Stocks - 40% Bonds portfolio, and using opportunistic exposure to Gold and Commodities, this strategy aims to simplify your allocation process.

It uses just 4 ETFs (SPY, TLT, GLD, DBC) as proxies for the 4 main asset classes, with CASH as an implicit 5’th. The strategy is rebalanced weekly, on Monday’s close, and represents the core of Signal Sigma’s investment process.

A Message From Andrei Sota, Founder & CEO of Signal Sigma

Take your research to the next level with Signal Sigma

Featuring Advanced Instruments tailored to Professional Investors

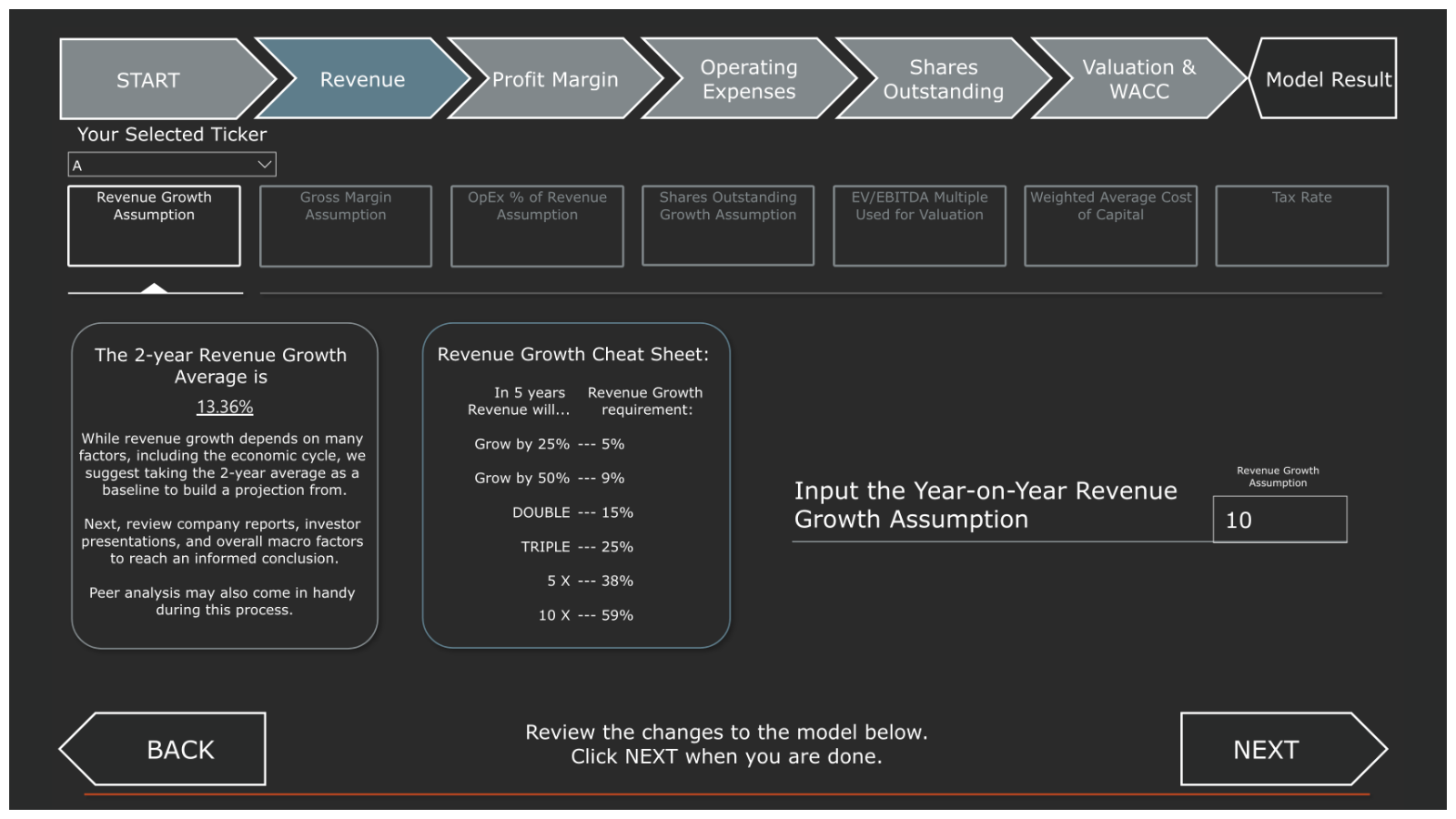

DCF Model Builder

Take a guided, step-by-step approach to projecting company fundamentals

Wall Street PROs spend hundreds of hours building models for the companies they cover.

Our Discounted Cashflow model builder lets you quickly and efficiently work with the same projections and same variables in order to reach a Price Target and an EPS Growth Rate.

These are essential in figuring out if the risk-reward is right for the stock.

Comprehensive Company Fundamentals

View the Income Statement and Balance Sheet in a way that makes intuitive sense

Immediately understand how a company creates value and how it can translate revenues into profits.

See accounting red flags with ease, before anyone else. Easily analyze different timeframes and compare each metric quarter-by-quarter or year-by year.

Understand which company is poised to perform in its industry when it’s so easy to connect the dots. With Signal Sigma, Fundamentals just POP!

Unparalleled Stock Screener and Peer Finder

Generate investment ideas and position your portfolio with this unique tool

Our stock screener makes use of over 140 Fundamental and Technical parameters. You can input a portfolio in order to learn various characteristics about it, or screen for a particular set of factors.

You can even gain insight into emerging market trends if used more broadly.

Daily Briefing E-mail, Weekly Preview Newsletter

Stay on top of macro positioning, from your inbox

Our daily briefing newsletter covers all of the important economic and earnings-related developments of the day.

We write a Weekly Preview article that offers short and medium term insight into the direction of the equity market, supported by metrics and observations from various instruments in the platform.

The Signal Sigma Society is a community forum where even more research is posted and discussed, and where you can directly connect with Andrei and other members.

Powerful Technical Analysis driven by Machine Learning

Understand every trend that matters through the lens of our accurate machine learning technical model

When used in a standardized and proven way, technical analysis can be a very powerful tool. Our system makes use of linear regression, Fibonacci retracements and various other techniques to pinpoint inflection points in each instrument.

Every day the analysis is computed all over again, using identical parameters, so you can make sound decisions across a whole range of financial assets.

30 Day Risk Free Trial

Try our Research Plan and see if it’s right for you.

Media & Social

Let’s Chat

Send a message

Need more information? Interested in a product demo or collaboration? Get in touch using the contact form below.

Set up a consultation

If you prefer a more personal approach, feel free to set up a Zoom call using the button below.

The Signal Sigma platform is world class, is powerfully built, and keeps adding analytical features that just blow me away. Andrei and his team ceaselessly produce market summaries that are tradable. ⭐⭐⭐⭐⭐