Enterprise Strategy Q1 Results

Returns: -4.93 %

The first quarter of 2022 proved to be rough for many long-only funds and strategies, Signal Sigma being no exception.

Enterprise started the year fairly allocated to equity risk and started reducing overall exposure by selling bonds (TLT) and reducing the position in SPY by mid-January. This proved to be a prescient move, as both ETFs saw hefty declines in the months that followed.

The strategy then proceeded to see-saw in and out of bonds, and reducing equity exposure in SPY even further, as prices declined. At the start of March, Enterprise made an attempt at a rebound, but the timing was a bit off, as it was stopped out of the position before any gains could materialize.

Enterprise starts Q2 with a 100% CASH allocation, and is currently looking for a better entry point into SPY. This would coincide with a decline in the current rally that would not violate support.

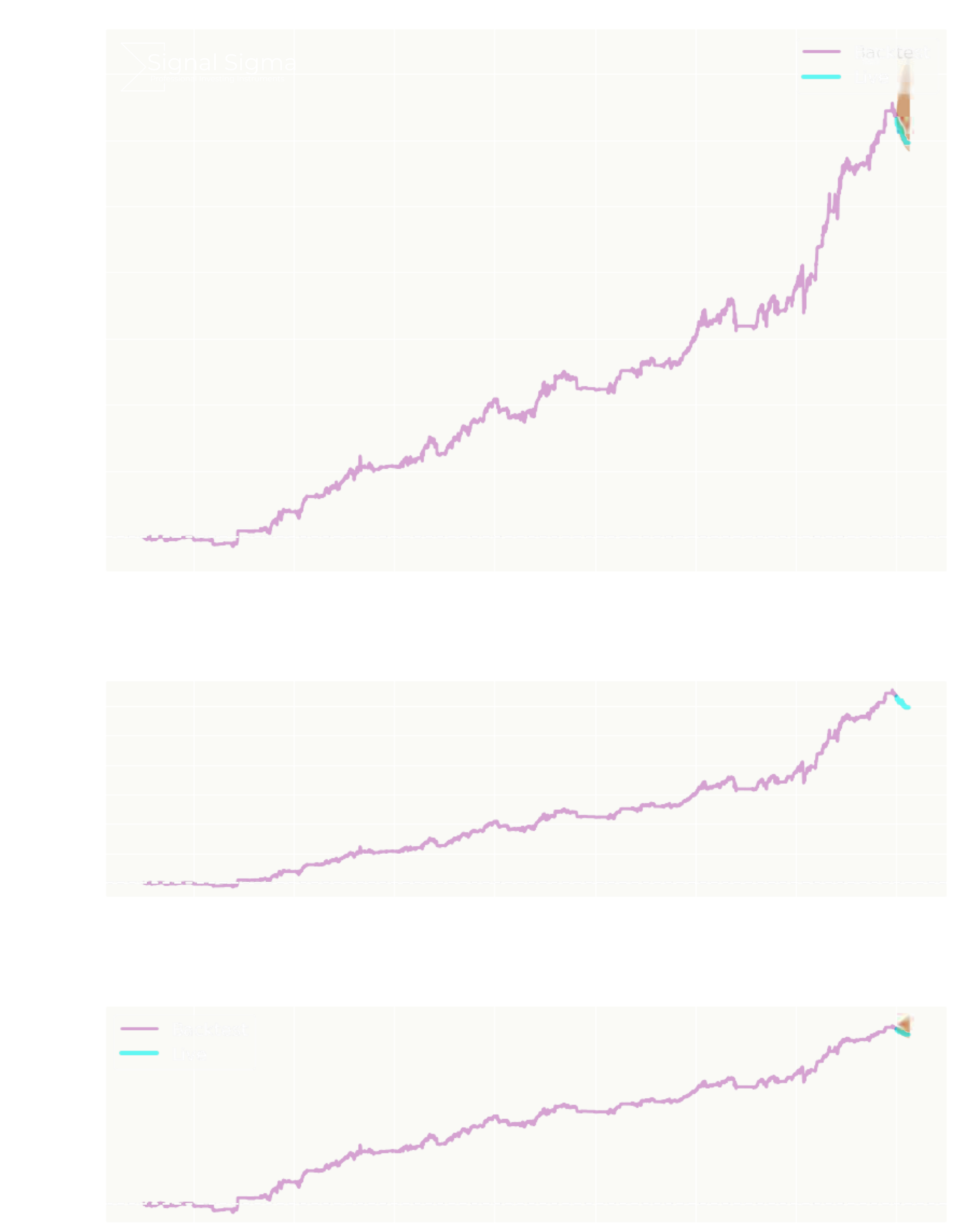

The charts below show the results of the strategy since January 2007, in order to put the current performance into perspective. Q1 equity curve is highlighted.