Horizon Strategy Q1 Results

Returns: -9.20%

Horizon started the year being allocated rather aggressively toward equities. As the year unfolded, the strategy faced sharp losses and was forced to cut back on exposure.

After this initial decline, subsequent positioning remained light, as the relative strength of the portfolio managed to keep it afloat, despite overall market weakness.

A totally surprising move came in the middle of March, when the model completely rebalanced into Gold and Commodities, as the exaggerated moves in these asset classes formed a buy-the-dip opportunity. The timing was perfect and resulted in an increase of performance, to "save" the quarter from a more than 10% decline. As a rebound in risk assets formed, Horizon is poised to chase the market higher here, squeezing any shorts that get in the way. As usual, this is a high-risk, high-reward play here, as the market hangs in the balance and Signal Sigma strategies begin to diverge.

Horizon starts Q2 with a 51% allocation to stocks.

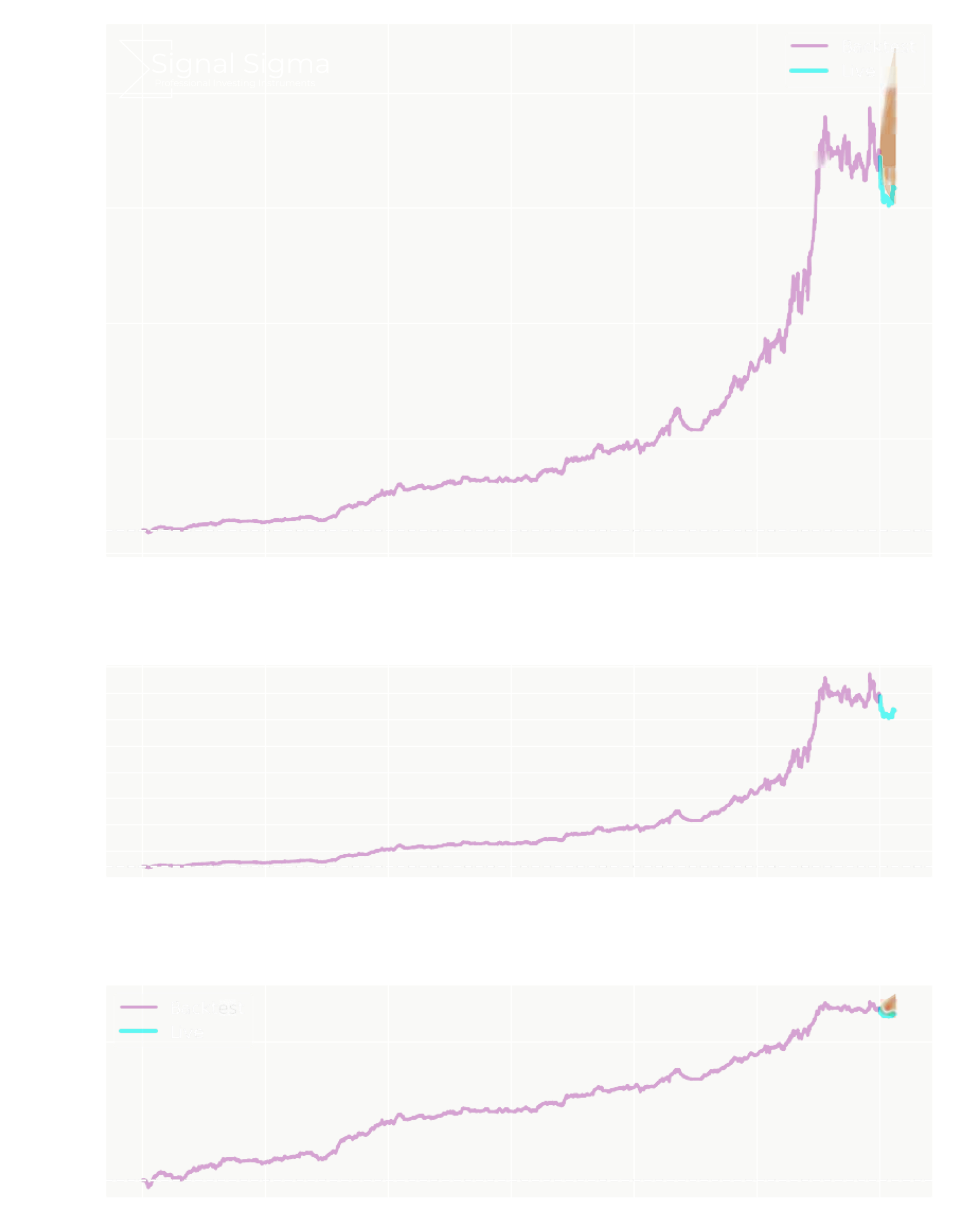

The charts below show the results of the strategy since January 2010, in order to put the current performance into perspective. Q1 equity curve is highlighted.