CF Stock Report

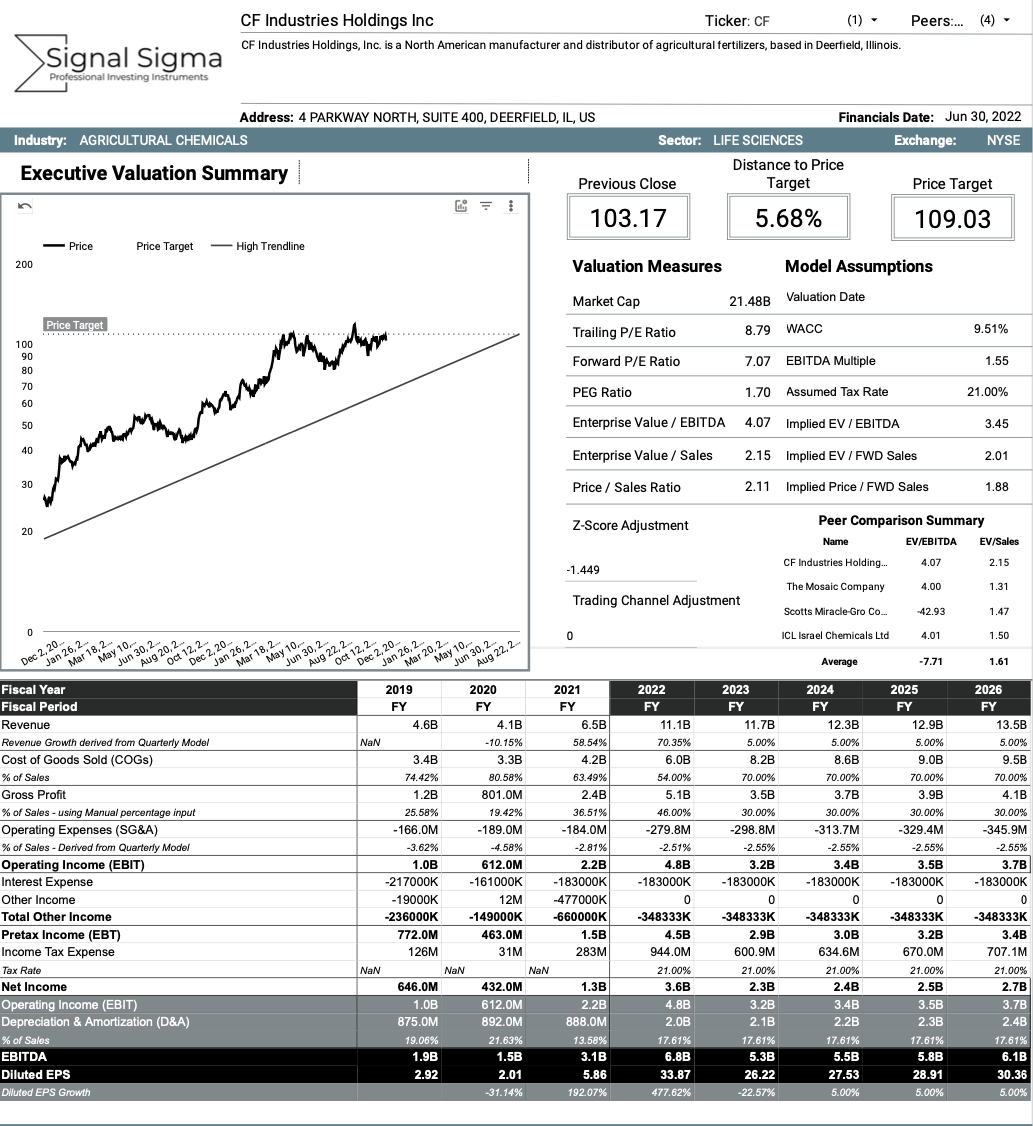

Following yesterday’s Q3 Earnings Report, we ran CF’s latest results through our DCF Model Projector (a feature of PRO memberships). Here’s what we found:

Revenue

Revenues of 2.3B came in below the lower bound of our projection for the quarter, marking a 70% increase YoY. We have projected revenues accordingly for the next 7 quarters, resulting in below trend growth.

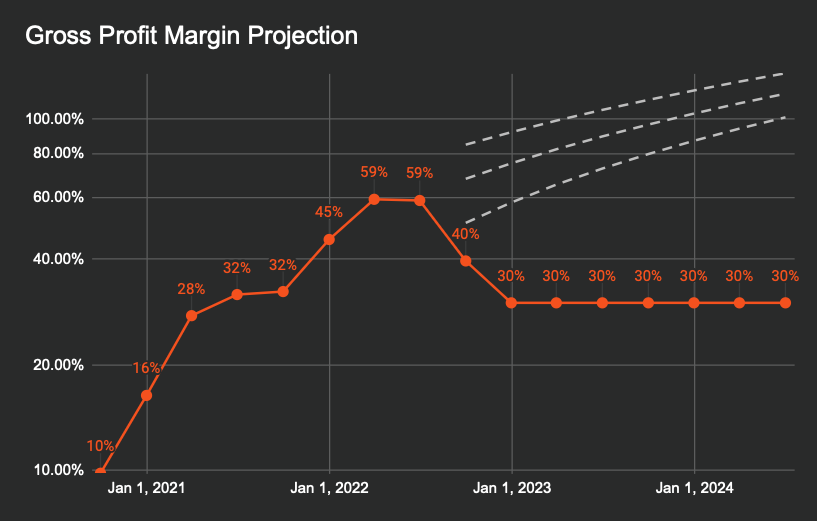

Gross Margin

Gross profit margin came in at 39.5%, below the lower bound of our projection. We are working with the assumption this metric will stay flat at 2021 levels (around 30%) going forward.

Operating Expenses

The company has kept Operating Expenses in check, near the midpoint of our projection. We have modeled the following 7 quarters accordingly.

Valuation

Our assumption is that CF’s valuation will decrease, according to the recent trend. The low end of the implied trend gets us to 2.01 EV / Sales (which is an industry high as it is).

We will work with this number in order to compute the price target.

Conclusion

Our system outputs a price target of $109, using the provided assumptions. Due to declining revenue growth and deteriorating margin profile, we are downgrading the stock to a HOLD rating. It would constitute an attractive buy at prices below $90 / share.

You can find a table of all published stock reports and ratings here. You can also request a similar stock report for any ticker, using the same page.

CF - CF Industries