Portfolio Rebalance / November 1

Observations on Signal Sigma Strategies weekly positioning and transactions

Tuesday is the day when all of our strategies rebalance their asset class holding weights. This week, our systems are downsizing targeted exposure to the commodities sector, as the US Dollar has softened as anticipated.

However, after one of the largest drawdowns since November 2021, the US Dollar seems to be holding support and bouncing. This behavior is making our models treat the current set-up more cautiously. Of course, except Commodities and Cash, there is no major asset class whose performance allows for allocation.

Putting the 2-year performance of major asset classes into perspective, Commodities stand out as the only investible option, as DBC is trading within its positive sloping regression channel; Equities might join next week on a push higher.

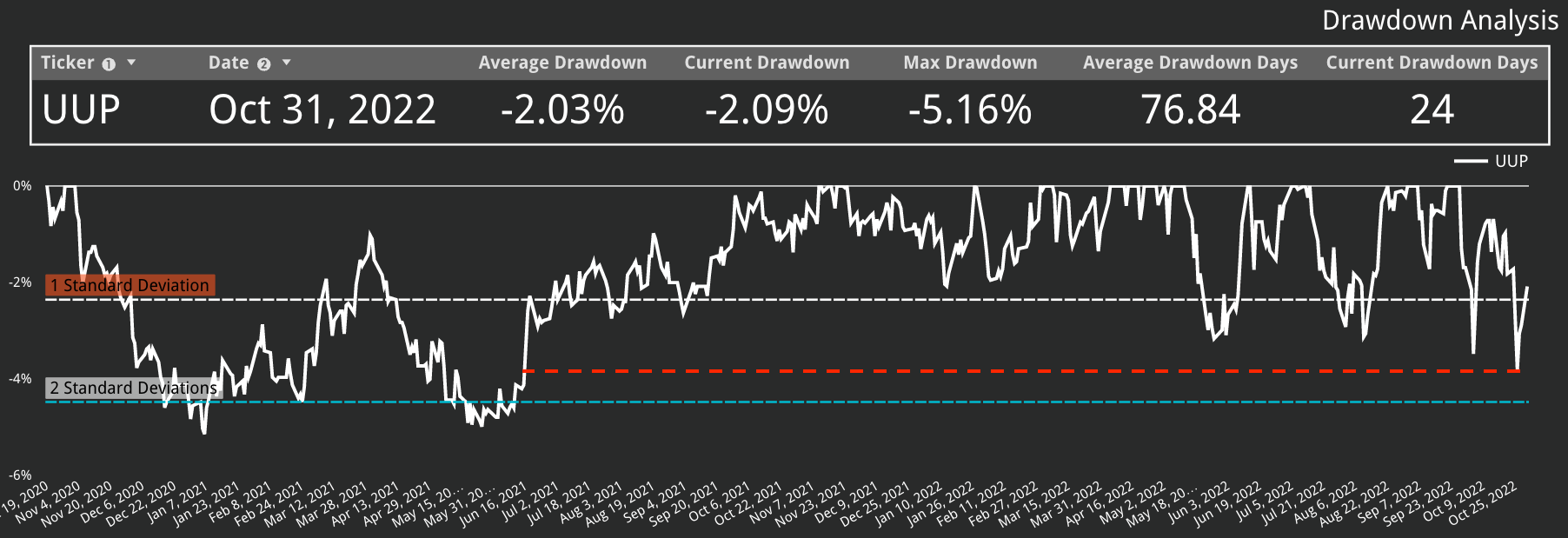

The US Dollar (UUP) shown bouncing off support…

…following one of the largest drawdowns on record since June 2021.

However, the most important aspect regarding the US Dollar and the asset class allocation process is wether we are trading in a market regime where the correlation to the US Dollar is positive or negative. The chart below shows a portfolio mix of major asset classes (orange) versus the US Dollar (white), overlayed with positive and negative correlation regimes.

March 2022 market the moment we have entered the current negative correlation regime, where the US Dollar has traded counter to everything else. It has been the only major asset class to outperform since then, despite inflation eroding purchasing power. In order to see a material shift in market dynamics, we are watching for this correlation to break down. Until then, it’s only a story of the Dollar (and the Fed) versus everyone else.

Let us review the latest positioning from our models:

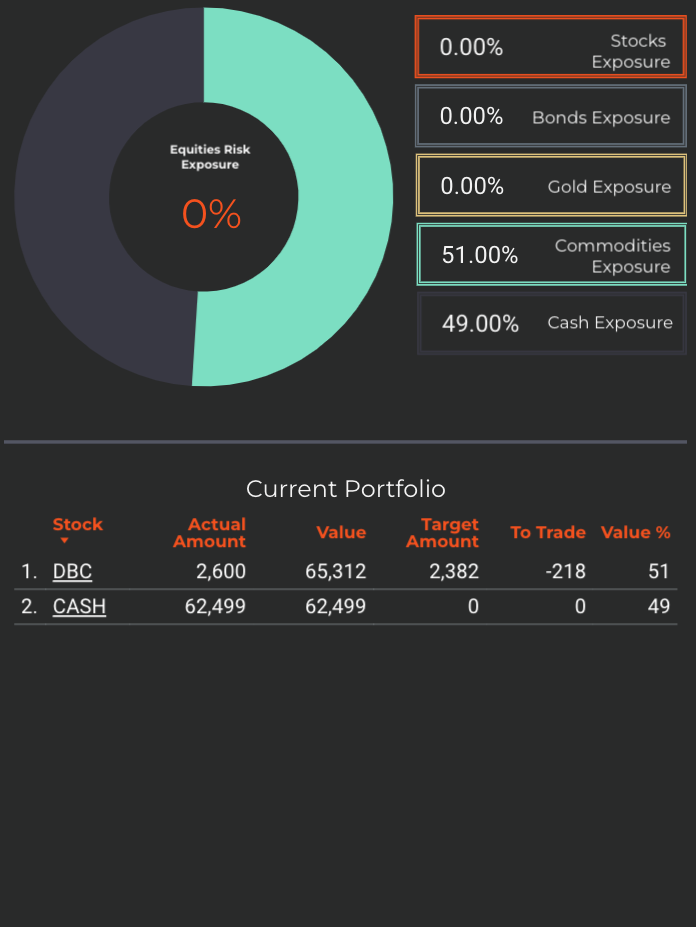

Enterprise Strategy

Enterprise, our most conservative model, holds 51% exposure to commodities, and 49% cash.

Since this model only trades 4 asset class ETFs, we use it to judge overall portfolio positioning.

The strategy will aim to decrease exposure to commodities on the next available SELL signal. The decrease will be incremental (-5% of NAV).

The logic behind the trade was that commodities should benefit from a lower US Dollar. As it turned out, equities were the only real beneficiaries.

Cash reserves (USD) are at 49%, offering plenty of optionality.

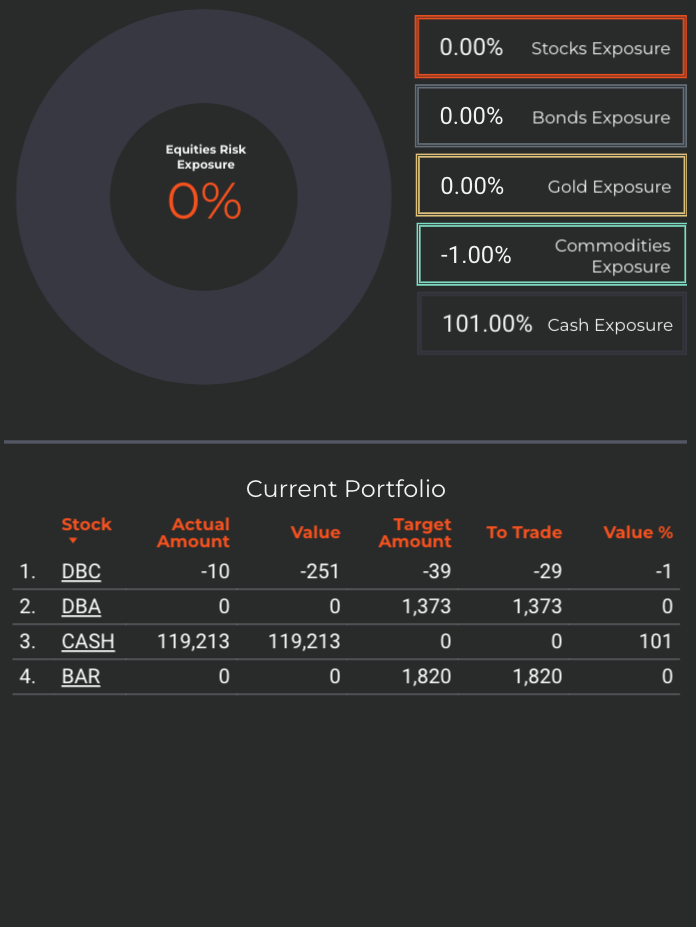

Nostromo Strategy

Nostromo, our tactical allocation model is starting the week with 100 % cash positioning.

The strategy will look to buy gold (BAR) on the next available BUY signal.

This is likely to occur in the following trading week, as the ETF is currently trading with a negative MACD signal (a positive crossover has a fair chance of occurring).

The strategy will also deploy up to 22% of portfolio NAV to agricultural commodities via DBA (also on a signal that is likely to trigger soon).

For more info about how Nostromo targets sectors or factors within a broader asset class, read this article. The first part sheds some light on the selection process going on in the background.

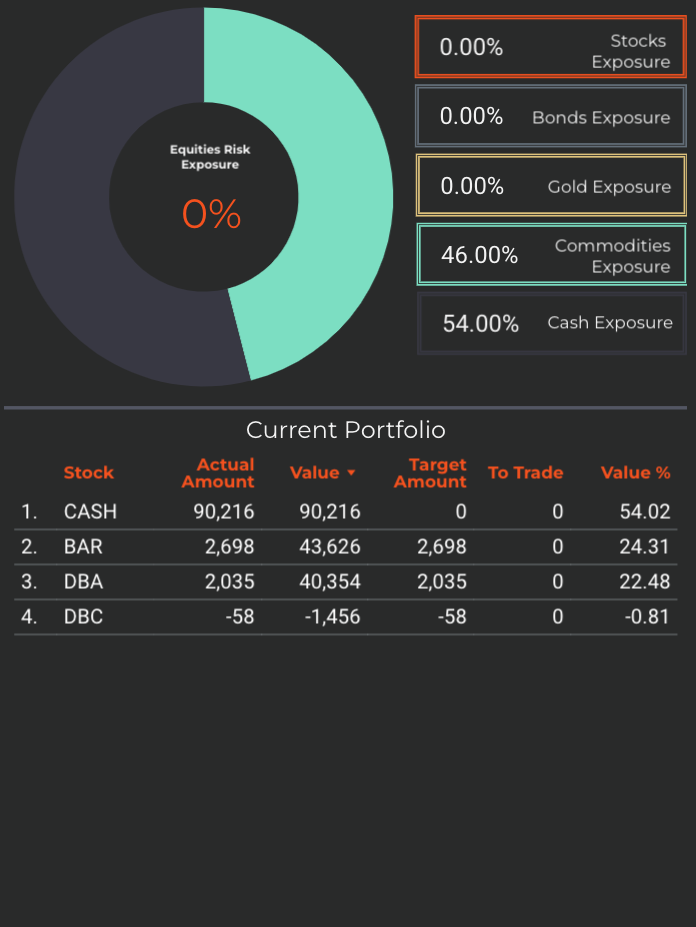

Horizon Strategy

Horizon, our most aggressive strategy, will rebalance commodities exposure to 46% of overall portfolio value, and split this allocation between BAR (Gold) and DBA (agricultural commodities).

Favoring a risk-taking approach, Horizon will not wait for any other signal and simply order the increase at today’s close.

If SPY closes above 392 by next week’s portfolio rebalance, equities will be selected for allocation in this model.

Horizon is the type of trend following strategy that is currently on a “short-squeeze” rampage, in a move similar to August.

Takeaway:

The Sigma Portfolio is starting to be significantly deviated from our investment models. Soon, our plan is to flip allocation net short, on a leg higher in equities.

This will seem counter-intuitive to our followers, since most are expecting us to trade in exact lockstep with the strategies. However, by understanding how our strategies are “thinking”, we can better adapt to real life investing circumstances. This represents an edge.

In August, Horizon got “fooled” into buying a “bear market rally” (Horizon has no extra guardrails). This time around, in our Sigma Portfolio account, we will not make the same mistake. Instead, we will wait for the proper opportunity, when both human and systemic traders are “all in” on a new bull market. Most likely this is just a phase in what has otherwise been a year-round decline.

If fundamental or technical conditions change, so that a more constructive approach is warranted, then so we will adapt our approach.

Andrei Sota