Weekly Preview / April 25 2022

Notable Events on our Weekly Watchlist:

Monday:

Earnings: ATVI;

Tuesday:

Earnings: MMM, RTX, MSFT, EW, CMG, ENPH, PII, MSCI, UPS, TXN, V, TX;

Wednesday:

Earnings: AMT, ALGN, ORLY, BA, F, EQIX, HTZ, PYPL, STX, TMUS, NIO, NOW, QCOM, FB, SPOT;

Thursday:

Earnings: AMZN, AAPL, KLAC, MRK, CAT, WDC, DPZ, OSTK, ROKU, MA, TWTR;

Economic Events: US GDP Growth QoQ;

Friday:

Economic Events: EU GDP Growth and Inflation, US Personal Income snd Personal Spending;

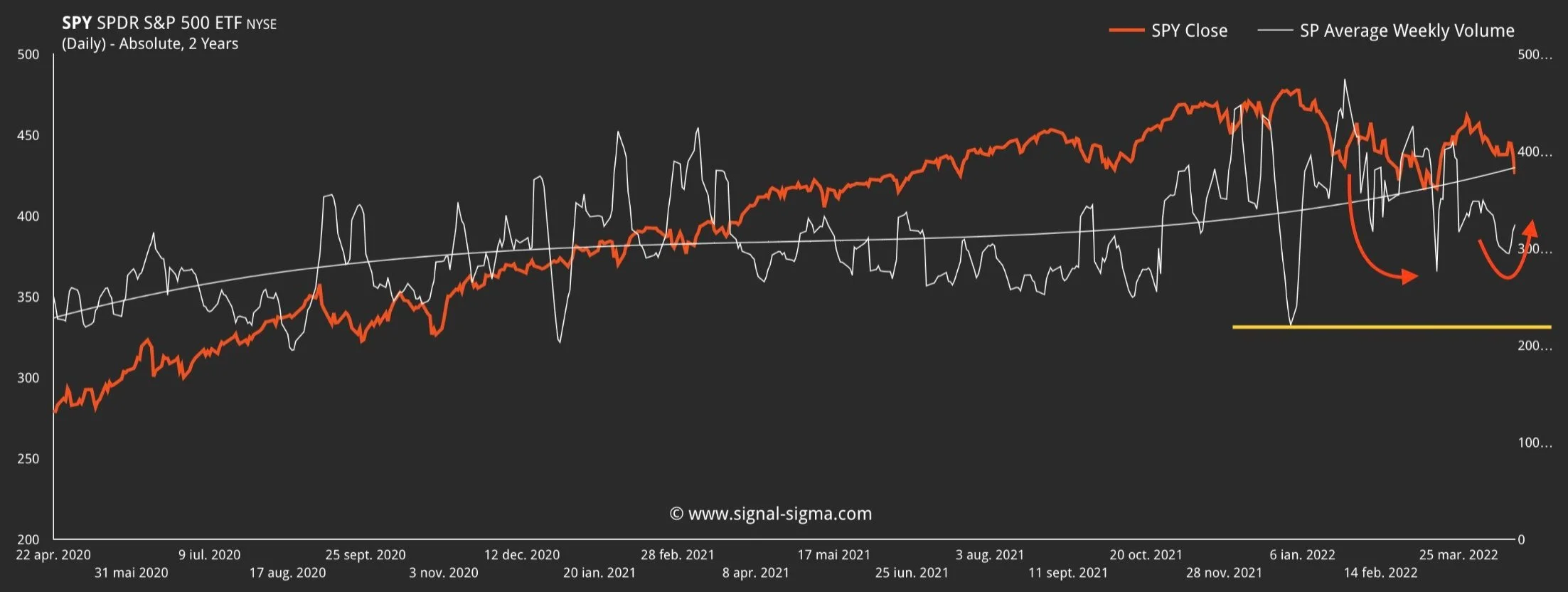

Last week, SPY closed below what we consider to be key technical support. Two questions need to be answered next week, with the backdrop of such a heavy earnings calendar. Will the SPY be able to recapture critical support? And how will dollar volume behave at these levels? Let’s explore…

SPY Analysis

SPY is testing the lower bound of its technical channel for the second time this year (the last time SPY breached its technical lower trend, highlighted, was March 15, at $417). At current prices, the level has been breached again. But given the heavy earnings calendar next week, and high potential for volatility, the real question facing traders and investors alike is if SPY can pull off a reversal and bounce convincingly. To help us better understand the odds of such a bounce, we must look at the behavior of volume as well. I will also note that our Overbought / Oversold indicator is NOT yet sitting at Oversold levels this time around (it’s currently registering 23 and it needs to be below 15 to count as Oversold). The last time SPY was trading below its technical lower trend, this indicator was firmly Oversold, with a reading in the single digits.

Market Dollar Volume Analysis

From a dollar volume perspective, the last time SPY formed a short term bottom was marked by declining volume (a real spike down in volume, I might add). Since then, the so called “bear-market rally” wasn’t able to elicit the same level of buying interest as other rallies in the past, effectively creating a “lower low” in terms of dollar volume. After the surge higher, transaction volume has remained in a lull, declining below the recent average, but not by much. At positioning extremes, volume trends to dry up, as buyers are no longer matched to sellers. What I would like to see for a credible bottom to form is a clear decline in dollar volume (marked by the yellow line), thus confirming sellers are no longer willing to sell. Instead, the most recent action points to a possible pickup in dollar volume, which would coincide with another leg lower.

Takeaway

SPY’s technical breach of support is very important to us because it would imply our strategies no longer view “equities” as an investible asset class. SPY is used as a bellwether ETF in all strategies, and trading below a -1 Z-Score after a positive trending period is viewed as highly negative. We’ll have to wait for next week to unfold for confirmation, but 2 out of our 3 strategies are already market neutral at this point.

Andrei Sota