Portfolio Rebalance / April 26 2022

Observations on Signal Sigma Strategies weekly positioning

As you’ll come to know, Tuesday is the day when all of our strategies rebalance their asset class holding weights. In this article we will cover changes to target allocations, as well as necessary scenarios in order to trigger trades.

This week, we are starting to like gold… a lot!

At this point, our strategies are forced to exclude 2 major asset classes from the general allocation. Both equities (SPY) and treasuries (TLT) are considered un-investible due to their technical setups.

TLT, the proxy for treasuries has been in a pronounced downtrend for the past two years, and currently sitting below the median regression line.

SPY, the proxy for equities, closed just bellow the Z-Score -1 level (lower technical channel) and, due to the fact that it has been in an uptrend for the past two years and has been unable to reach new highs for a record amount of time (77 days since last all time high) - has also been excluded. This was a very close call. If the closing price on Monday was a dollar higher, then equities would still be considered “investible”. Given the heavy earnings calendar ahead this week and continued “bearish” sentiment, equities might as well stage a rebound and get into “investible” territory again. That is why, for now, I’m taking this allocation change with a grain of salt. But then again, this article is about quant strategies, and they work because they implement a strict set of rules, so that’s what we are about to explore.

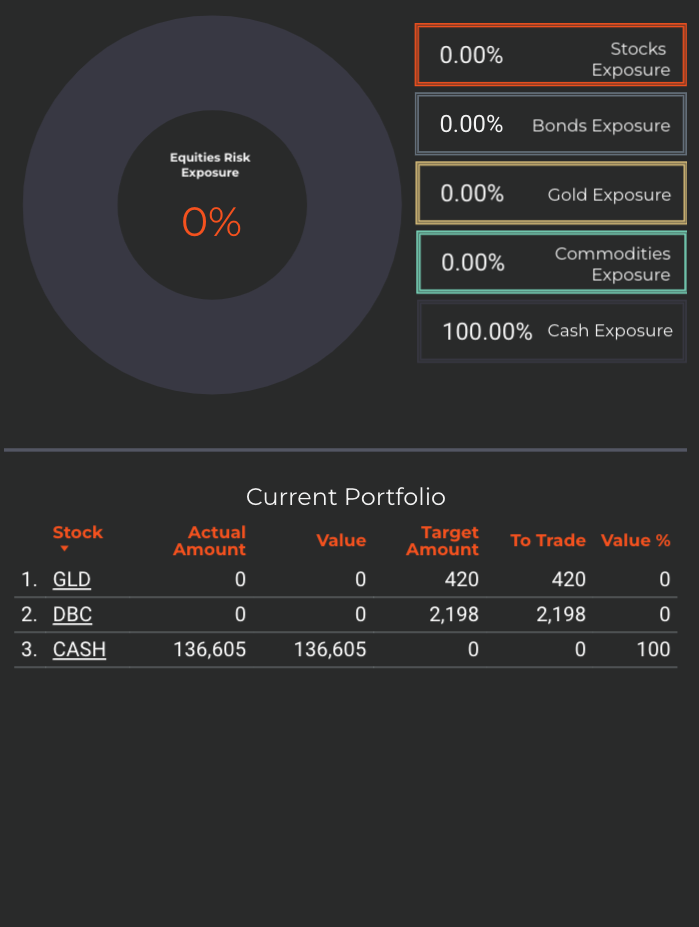

Enterprise Strategy

Enterprise enters the trading week with a 100% CASH position. It is looking to deploy opportunistically into Gold and Commodities, up to 97% of total portfolio value.

Since this model only trades 4 asset class ETFs, we use it to judge overall portfolio positioning. Right now, in order to successfully buy into GLD, we need a convincing bounce off technical support in order for a push higher. This would happen on market “fear”, with disappointing earnings.

DBC is quite extended at this point, and NOT oversold. With oil performing unconvincingly as of late, this position is unlikely to find an execution trigger soon.

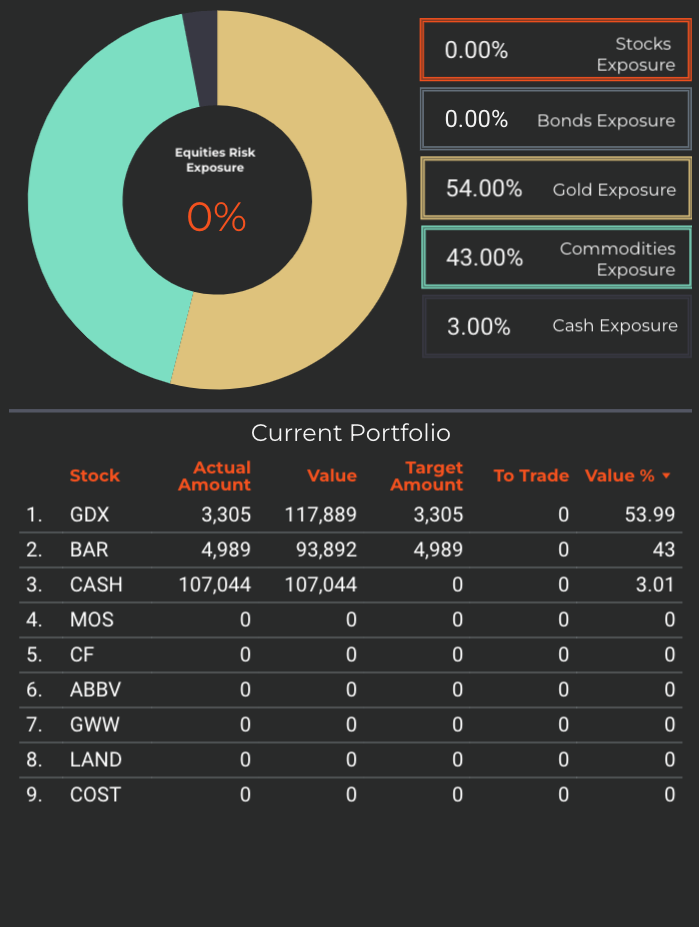

Nostromo Strategy

Similar to Enterprise, Nostromo is entering the week with a 100% CASH position.

Instead of GLD, it is trying to buy into GDX (gold miners), as these companies have shown more relative strength.

On the commodities front, out of all factor ETFs, Nostromo’s preference shifts to physical gold.

Essentially, this strategy is looking to “buy the dip” in whatever factor is outperforming its benchmark in the current environment.

Both GDX and BAR are in a short-term oversold condition, within an ongoing breakout. It is our suspicion that weak performance on the equities front will leave investors with few options to park their money. Gold might as well become the preferred reserve asset in an inflationary downturn.

Horizon Strategy

Horizon is our most aggressive model. It is always looking to gain exposure before the other models.

As such, Horizon wastes no time in executing trades, and simply allocates toward GDX and BAR, gaining heavy exposure to the yellow metal, at least until next week.

I do believe there is a fundamental case to owning gold right now, although maybe not to this extent. As with the equity situation, it will become very clear what the situation is by the end of the week.

Andrei Sota