Portfolio Rebalance / July 26 2022

Observations on Signal Sigma Strategies weekly positioning and transactions

Administrative Notice: the editorial team will be on vacation July 28 - August 7; the usual updates and articles will pause in this period. We are constantly monitoring market developments and system functioning.

Tuesday is the day when all of our strategies rebalance their asset class holding weights. We analyze these model portfolios as something that a “machine would do”, then decide when and how to incorporate their positioning within the manually directed Sigma Portfolio. This week features a wholesale move for Horizon and the closing of a great (if small) trade by Nostromo.

2 out of 5 asset classes are deemed un-investible (equities and gold). Our strategies have opened up a new asset class for allocation - treasuries. We were able to correctly anticipate this move, and front run the whole system in the Sigma Portfolio. Selecting treasuries as an asset class automatically disqualifies commodities from portfolio targeting (strategies are designed to be directional in nature, and going long treasuries implies lower inflation, which implies lower commodity prices). In practice, I will keep an eye on when Enterprise closes out commodity exposure, as the trend still looks strong for the moment.

Let’s take a look at one of the most featured charts within this article, that compares an equally weighted Commodities + Gold + Equities + Bonds portfolio (orange) against Cash (white). With the USD making new decade highs, keeping an eye on this chart will prove valuable.

Chart showing the closing performance gap between Cash and every other asset class combined

The US Dollar has proven to be a macro force to be reckoned with. After closing the performance gap with a multi-asset class portfolio, the recent week saw a bounce higher for assets and a 2% drawdown for the greenback. Let’s put that drawdown into perspective.

The average drawdown for UUP (US Dollar ETF) is 3.65% for the last 2 years. The 2% drawdown that we are seeing right now, could definitely go even further in the short term, thus validating the bullish thesis for stocks (and a bounce in commodities). It is a rally we will most likely sell into, by adding market hedges and closing out the commodity allocation in the Sigma Portfolio.

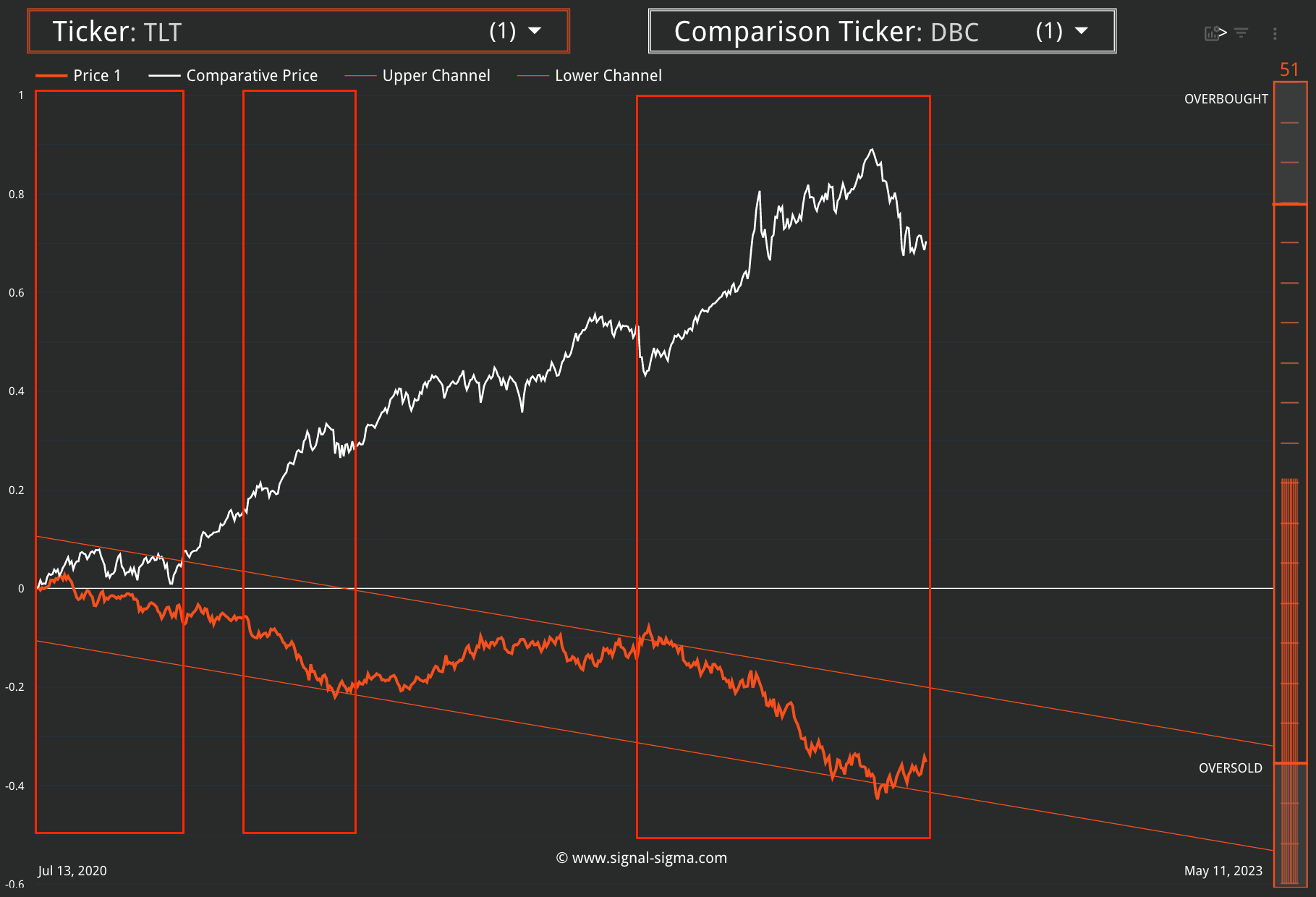

Let’s check if removing commodities makes sense given the addition of treasuries! (let me know in the comments if you’d like us to develop a correlation tool!).

Treasuries (orange) vs Commodities (white), with periods of negative correlation highlighted

Since November 2021, treasuries have had a long stretch of inverse correlation with commodities. We expect this relationship to continue for the time being, as a tectonic shift in inflation and rate hike expectations took hold in investors’ mindset right about that time. It is also a relationship worth monitoring, but for now we agree with our algorithms. These two asset classes will not go in the same way for the time being, and directional strategies (like ours) need to decide between the two. In the Sigma Portfolio we are keeping options open for now, and keeping allocation to both.

Let’s now take a look at each automated strategy and see how portfolio positioning and targeting has evolved from last week.

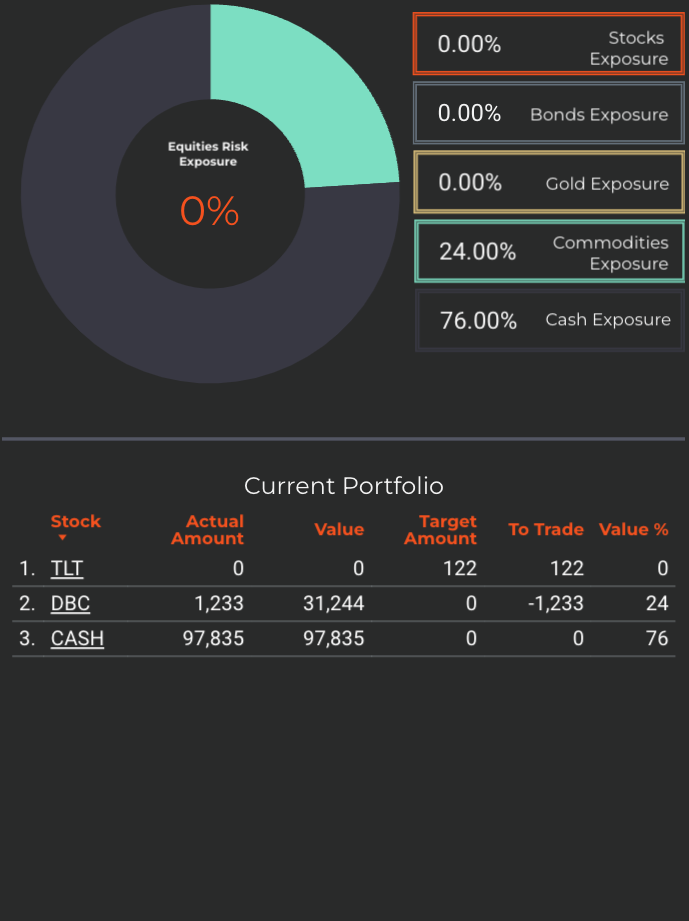

Enterprise Strategy

Enterprise, our most conservative model, carries 24% commodities exposure, with the rest of the portfolio allocated towards cash.

Since this model only trades 4 asset class ETFs, we use it to judge overall portfolio positioning.

The strategy is aiming to close the position in commodities completely, on the first available sell signal. This will not be so easy to come by without a breakdown in prices however. DBC is barely above “oversold”, but a MACD BUY signal has triggered. The signal is a couple of days old and could take some time before turning into a SELL.

TLT will be initiated at an 11% allocation. This makes sense given the fundamental and technical backdrop, and the two positions could co-exist for a while. It is only the targeting logic that removed commodities.

We are glad that we were able to correctly front run the system in the Sigma Portfolio by adding TLT early. So far, this has played out to our advantage.

Cash reserves (USD) continue to keep this strategy out of harms’ way with a hefty 76% position.

Nostromo Strategy

Our cash-loving Nostromo strategy has managed to successfully navigate the current macro environment. Quite simply, there has been no better asset class as of late, and this model has taken full advantage of it. Cash (USD) is King, plain and simple.

A significant shift is occurring for Nostromo, as portfolio targeting will aim to buy TLT on the first available signal. That signal could take some time to develop as well, since TLT is nearing overbought short term and a MACD signal is already triggered on the long side. That signal should first turn into a sell before Nostromo will decide to initiate.

Nostromo will also liquidate the small position in oil (USO) on the first sell signal.

For more info about how Nostromo targets sectors or factors within a broader asset class, read this article. The first part sheds some light on the selection process going on in the background.

Horizon Strategy

Horizon, our most aggressive strategy is always looking to gain exposure before the other models have a chance to trigger trades.

This week, Horizon is acting like a Nostromo that had all its orders triggered and filled. This strategy should create a stock portfolio in “regular” times, but in bear markets it is set to default to the allocation provided by the other models. It does not wait for buy or sell triggers, it just rebalances weekly.

Horizon will sell all commodity-related positions today, and will initiate an 11% allocation to treasuries. 89% of the portfolio remains in cash.

We will use all the models when composing the final allocation of the Sigma Portfolio.

Takeaway

As long-only strategies adjust to the difficult trading environment, models average 87.33% cash allocation. Playing defense is the name of the game here, until conditions normalize. In the Sigma Portfolio, we have finished adding a 10% core position in treasuries, successfully front running our algorithms. We are keeping commodities at 6% until a better opportunity to offload them emerges. Cash is still our number 1 position, at 83%.

Andrei Sota