Weekly Preview / August 08

Notable Events on our Weekly Watchlist:

Monday: N/A

Earnings: GOLD, CARG, D, LMND, PLTR, TTWO

Tuesday: Inflation Expectations

Earnings: COIN, ARMK, RL, RBLX, SAVE, U

Wednesday: Inflation Rate, CPI

Earnings: BMBL, FOXA, SONO

Thursday: PPI, Jobless Claims

Earnings: BIDU, GOOS, NIO

Friday: Michigan Consumer Sentiment

Earnings: N/A

ETFs to watch: SPY, TLT, XTN, CRUZ

Since our last update the market has managed to rally considerably. At the same time, entry levels that trigger exposure to equities have turned lower, resulting in a setup that will determine our Horizon strategy to form a portfolio of stocks on tomorrow’s rebalance if current levels hold. To be sure, there are multiple other trend-following strategies turning bullish, so Signal Sigma is not an outlier at this point. There are only 2 problems with aggressively adding exposure now: the market is clearly overbought short-term and there is a thorny inflation report out on Wednesday that will make any large directional bet very risky. We will detail our real-life approach below, starting from the broad market analysis.

SPY Analysis

SPY is now back in its regular regression channel, with a Z-Score of -0.98 (the limit being -1.00); it’s a very tight situation that can turn on any piece of news. If these levels hold at Monday’s close, our Horizon strategy will create a portfolio of stocks and buy them at Tuesday’s session close, right ahead of Wednesday’s inflation report. Enterprise and Nostromo will simply target equities for exposure and wait for a buy trigger to emerge, before adding exposure. Our real-life approach will straddle these two extremes, in the Sigma Portfolio.

The good news is that such technical setups have preceded periods of healthy equity market recoveries. Holding risk exposure now makes sense, as options driven algorithms have switched from selling the rip to buying the dip. Additionally, gauges of breadth have improved significantly.

Market Breadth Analysis

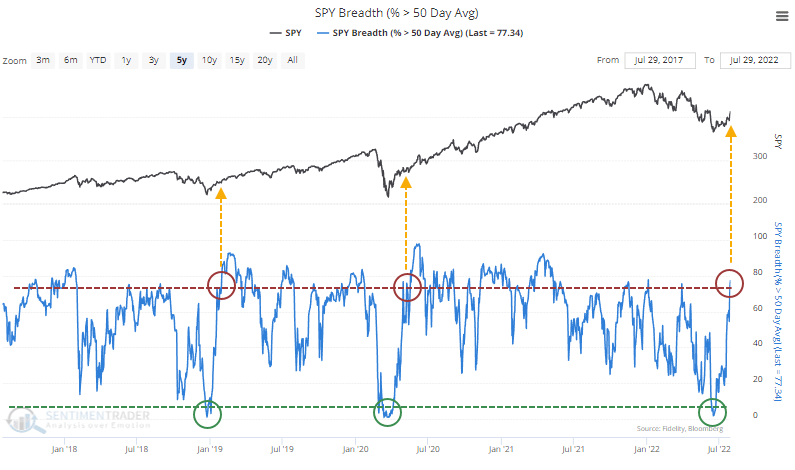

742 stocks out of the top 1000 by volume are now trading above their 50-day moving average. Just 45 were doing so on June 17. Recently, such abrupt reversals of breath have signaled the beginning of fairly extended bull runs, as pictured below.

Has a new bull market begun? While the technical underpinnings of the equity market have certainly improved in the short and medium term, there are also 2 important pieces of “bad news” to consider.

The first and most important one is obviously linked to the Federal Reserve and their actions. The Fed is aiming to get the target rate as high as possible for this cycle, before needing to cut rates again in order to support growth. In the scenario of a recession, rate cuts are the Fed’s ammo. It makes sense therefore, that they are trying to stockpile their ammo now, while equity prices and credit measures are not in crisis. For the Fed, lower but not crashing equity prices are a godsend, since they can keep pushing rates up. The market is currently betting on a Fed pivot (pause in hikes). Wether they can do that or not depends entirely on inflation readings and expectations. From the Fed’s point of view, the market is still 41% higher than 3 years ago, in August 2019, keeping the “wealth effect” (and the so called 3’rd directive) intact. There is no reason for them to stop hikes and QT now. You can actually see the subtle effect of QT in our declining median of transaction dollar volume below. Less overall dollars in the stock market is not a good thing.

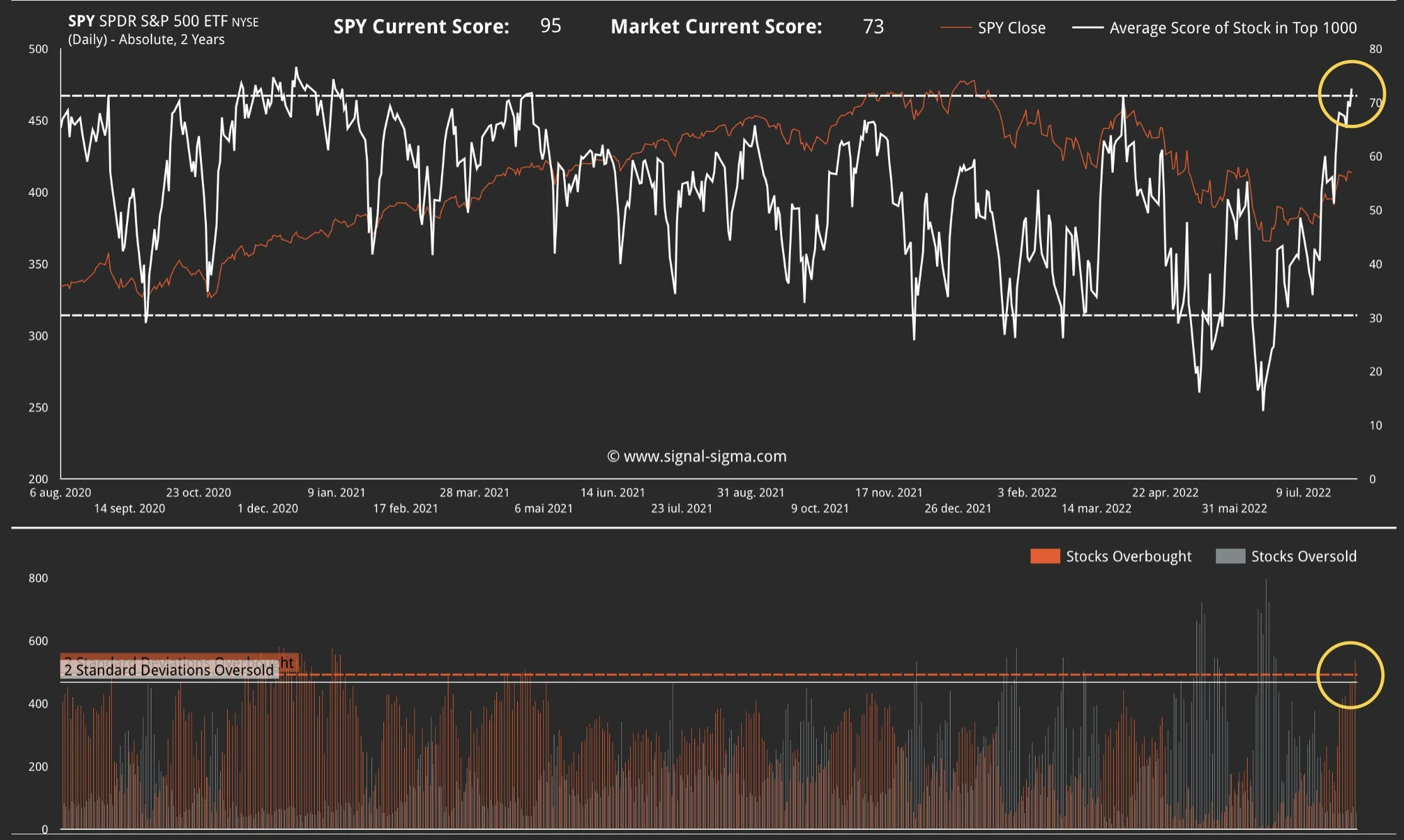

The second piece of bad news is short term in nature, as the current rally has FOMO written all over it. Algos and human traders alike have panic-bid equities (except energy). Consequently, we are sitting at extreme overbought levels, with the number of stocks overbought reaching a 2 standard deviations level.

Takeaway:

The equity market is showing signs of a healthy, but potentially fragile recovery. My instinct is to not jump straight in, and wait for confirmation of this rally on a potential pullback to the 50-day DMA. Support must hold at the S3 level (currently 380). I would then proceed to add exposure more aggressively. Meanwhile, I will honor Horizon’s push (if it comes to that) with much smaller orders. But all of that rebalance talk is the subject of tomorrow’s article and trades.

Andrei Sota