/ July 03 / Weekly Preview

-

Monday:

ISM Manufacturing PMI (47 exp.)

Tuesday:

N/A - Markets Closed

Wednesday:

FOMC Minutes

Thursday:

Initial / Continuing Claims

Friday:

JOLTs Job Openings

ISM Services PMI (51 exp.)

-

Monday:

N/A

Tuesday:

N/A

Wednesday:

N/A

Thursday:

N/A

Friday:

N/A

Administrative Notice: This week, our “Weekly Preview” newsletter will include elements from the “Portfolio Rebalance” article, which is temporarily on pause until the platform re-launch.

Optimism brings traders back into the market

Last week, we noted a SELL signal triggering from a fairly elevated level, with sentiment getting extended into “extreme greed” territory. We were a bit early in reducing exposure, as the correction was shallow in nature and only served to reinforce the R1 support level that coincides with the 20-DMA. We may see this signal turn positive again, from an elevated level, a not uncommon occurrence during a bull market advance.

With the first half of the year in the history books, portfolio managers and traders will start playing “catch up” to the broad market indexes into year-end. The pressure to chase performance creates real FOMO for anybody with a benchmark to beat.

As the WSJ notes:

“If you started the year bearish, you’ve been really under-allocated. Investors are looking at a market that’s rallied 14% and, almost not by choice, they feel the need to hop on the train.”

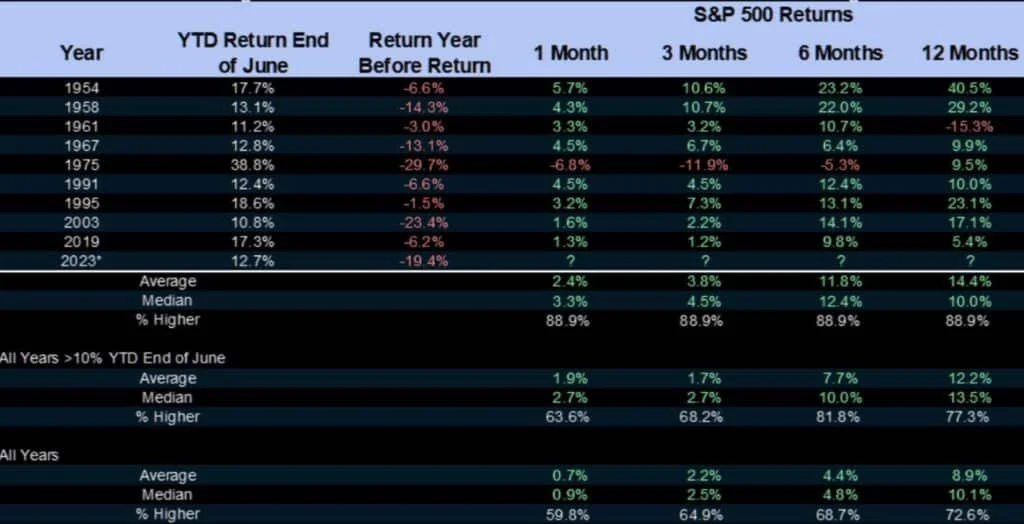

This is an environment where equities will be supported by a fairly strong bid, even when sentiment turns. Our thinking is to use a “regular” 5-10% correction, in the $431 - $419 price band to add exposure to portfolios. Second half returns tend to be strong, when the market is up 10% in the first 6 months.

While this holiday shortened week holds no major economic releases or conference calls, the next important catalyst will be Q2 earnings season, which starts in about 2 weeks.

SPY Analysis

The MACD has triggered a SELL, but the successful test of support and ongoing optimism provides fuel for a BUY signal. If this occurs, our automated strategies will add equity risk to portfolios.

Our sentiment measure is now back into “Extreme Greed” once again, confirming last week’s observation - namely that readings in extremes usually last for about 2-3 weeks. We expect Overbought conditions to prevail for now.

While the market continues its run, we think these price points are best exploited by selling into strength and taking profits. A much better place to add exposure in the near term would be a 5-10% correction, which is normal in any given year. This would “cool” our sentiment gauge to levels last seen in March, and provide a much better entry point.

We can’t completely dismiss the risk of a more significant decline, however. Should the market violate its 200-DMA, with a correction larger than 10%, it would indicate that an “unexpected” event has changed investor’s perception about risk. This should also “catapult” the VIX out of its recent slumber, once investors start buying protection for their portfolios.

For now, the fear is not about losses in P/L, but about losses in relative performance.

“It has now been more than three months since the S&P 500 has pulled back at least 3%, one of the longest such stretches since World War II, Deutsche Bank research shows. The average weekly move for the benchmark has been less than 1% in either direction since the end of March, according to FactSet. In late 2022, the index averaged swings of roughly 2.6% each week.” – WSJ

While we can’t time volatility or use technical analysis on the VIX itself, the historical message is clear: periods of low volatility lead to periods of high volatility. These alternating periods have become more common recently, as monetary interventions skew risk perception on the part of investors.

Speaking of relative performance, there is still a huge gap between SPY and every other stock. The Z-Score divergence is sitting at very elevated levels, and should revert sooner rather than later. This can happen in one of two ways:

The SPY corrects, while the average stock doesn’t

The broad market breaks out in an advance, while SPY doesn’t move much to the upside

In any case, this unresolved divergence drives home the point that index-level returns have been generated by only a handful of stocks. The market is still lacking in true breadth, and in order for a more solid advance, improved participation is needed.

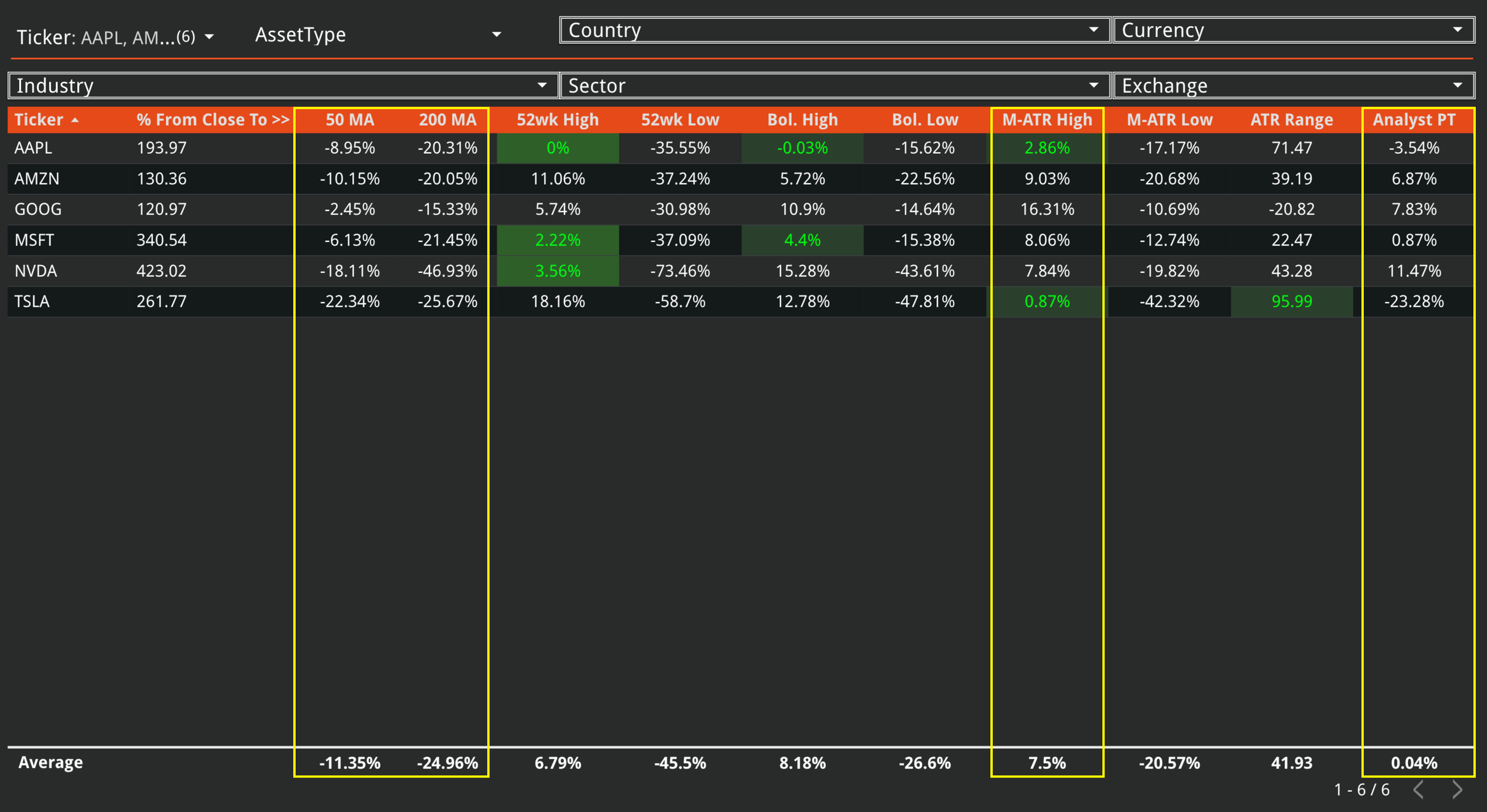

It always pays to look at risk, before considering reward when investing. We used the Risk Explorer to look at potential moves for the top stocks driving index level performance lately: Apple, Amazon, Google, Nvidia, Microsoft and Tesla. When averaging out the potential move to analysts price targets, we find a 0.04% potential reward - meaning these stocks are priced to perfection right now.

Instead, we need to consider that a very common “retracement to the 50-DMA” scenario entails a -11.35% drop, while a more uncommon (but still likely) “retracement to the 200-DMA” brings an almost 25% potential loss. Statistically, using the Monthly Average True Range measure, there could be a 7.5% upside.

If you were in a casino, would you take these payouts?

Sectors Performance still looks extended for Tech (XLK), but we are getting better participation overall.

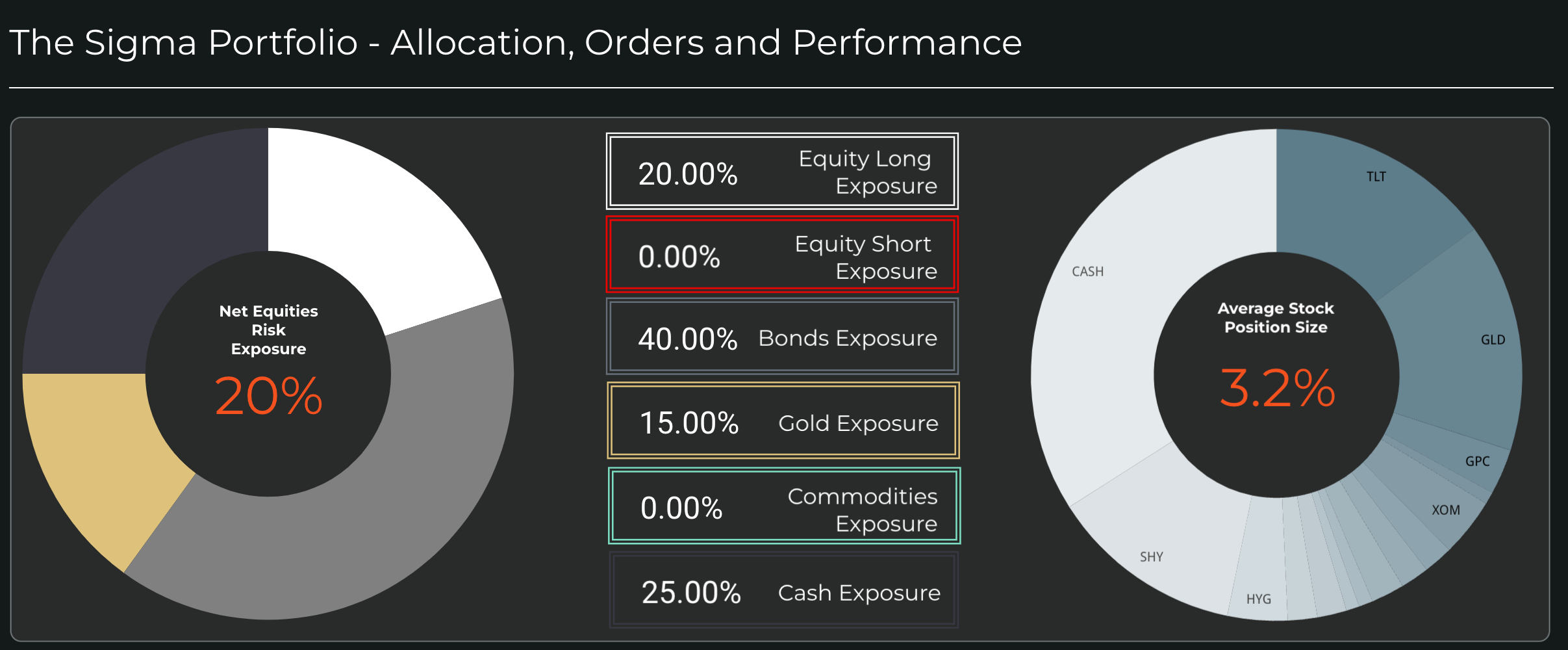

Our Trading Strategy

As mentioned at the start of this missive, our active trading strategies (Enterprise and Nostromo) will add back equity risk to portfolios on a positive MACD signal. This is not the best entry point that we can identify right now, as you probably realized. Yet automated strategies do what they are programmed to, and it is our job to interpret their positioning and use them as a tool, rather than mindlessly follow instructions.

Bottom line: despite economic weakness concerns related to the Fed’s overtightening and a potential recession around the corner, stocks exhibit a bullish behavior. This is an environment where we would like to “buy the dip” when presented with the opportunity. The only fly in the ointment when committing to equity risk right now is that many stocks that drive the SPY are priced to perfection and don’t warrant exposure.

In the broad market, there are still many decent opportunities. We’d rather take a patient approach and use our screeners and smart beta portfolios to buy under-rated stocks when sentiment takes a hit. Bonds also offer terrific risk-free yields that create a very real competition to stock returns (2-yr yield at 4.88% and 10-yr yield at 3.82%).

Meaning you can afford to get paid while waiting for the next opportunity. There’s also this (the bonus chart) - SPY relative to TLT, a visual on stocks-bonds ratio. This measure, which is highly mean-reverting, is now pushing elevated levels. When reaching extremes, rotating from stocks to bonds and vice versa makes a lot of sense.

For now, we remain underweight equity risk. This will protect our portfolio from more pronounced declines in the near term. While our performance is also taking a hit, we won’t let FOMO dictate our approach to the markets. We suspect we’ll get a good opportunity to rebalance risk, add exposure and “catch up” in terms of performance as we move into 2024.