Weekly Preview / July 25

Administrative Notice: the editorial team will be on vacation July 28 - August 7; the usual updates and articles will pause in this period. We are constantly monitoring market developments and system functioning.

Notable Events on our Weekly Watchlist:

Monday: N/A

Earnings: CDNS, NXPI, RYAAY, SQSP

Tuesday: New Home Sales

Earnings: GOOGL, MSFT, MMM, CMG, KO, ENPH, MSCI, MCD, MDLZ, PII, RTX, TXN, UPS, V,

Wednesday: Fed Interest Rate Decision, Durable Goods Orders

Earnings: META, ALGN, BA, BMY, ETSY, F, ORLY, NOW, SHOP, SPOT, UPWK

Thursday: GDP Growth (Q2),

Earnings: AMZN, AAPL, MO, AMT, CC, DXCM, EW, FSLR, HSY, INTC, KLAC, MA, NOC, OSTK, ROKU, SO, TXRH, X,

Friday: EU GDP Growth, EU Inflation (July), Personal Income / Spending

Earnings: ABBV, CVX, XOM, PSX, GWW

ETFs to watch: SPY, TLT

We are headed into one of the most pivotal weeks of the summer. Earnings for Google, Microsoft, Meta, Amazon, and Apple will surely grab headlines, while the FOMC’s decision on rate increases (and especially guidance) will overlap with Q2’s Advance GDP reading and the Eurozone’s inflation figures for July. The only thing that could make the week more volatile would be an OPEX event, but fortunately, we don’t encounter one. That being said, the market is bullishly poised to start Monday’s session, but what matters most is how we will close on Friday. Our gut feeling is that the bullish thesis right now circles around a 75bps increase in the target rate and a “wait and see” guidance from the Fed. This, coupled with “not so bad earnings” could give the market a boost.

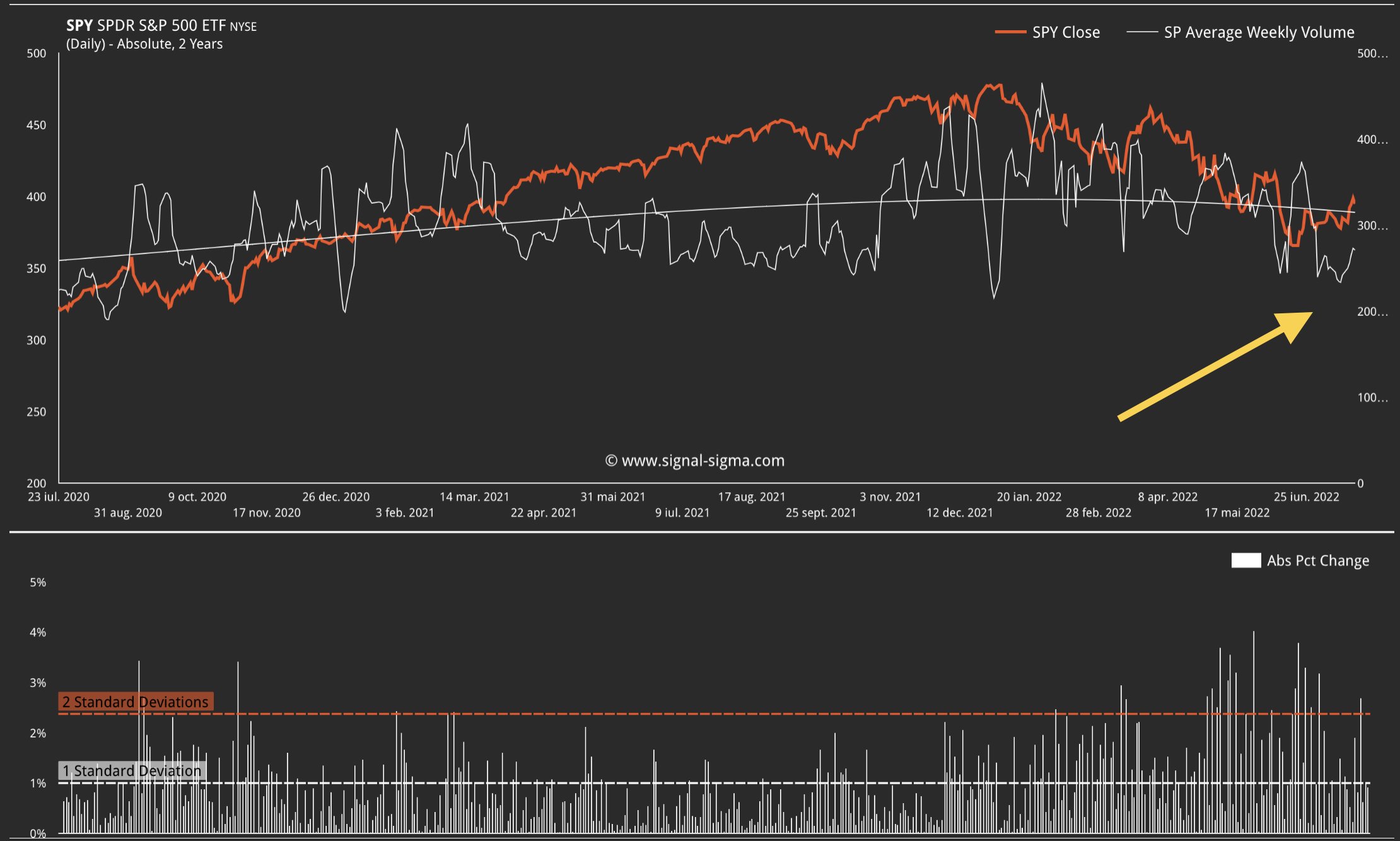

SPY Analysis

SPY has managed to break above the 50-day moving average, is on a short term buy-signal and is poised to break out above the short term technical channel. The target for a potential rally would be the 411 level, where we would start to add hedges (up to the 420 level, where we expect heavy resistance). Last Friday’s selloff could actually prove to be bullish for the market, as a pullback to the 50-day MA (at 390) could turn that level into key support going further.

The question on every investors mind is wether we are headed into a recession or not. Either way, the markets tend to bottom before the economy does. We are looking for signs that “not too bad” earnings are met with “not so much” selling. From our perspective, as long as the long term technical channel creates a positive slope, we are in a “correction” and not a bear market. We have noted the recent basing pattern and support managing to hold at the 375 level as a point for the bulls. The outlook for equities remains neutral overall.

Market Dollar Volume Analysis

Transaction Dollar Volume remains unusually weak at the moment. The polyline volume average is starting to slope downwards, as liquidity is slowly drained from the system. Such developments do not bode well for the equity market as long as this dynamic stays in place. In other words, in the absence of a Fed pivot, lower liquidity will translate into lower valuations. The current rally is not confirmed by our volume analysis.

Market Breadth Analysis

We are focusing on the Market Internals > Overbought/Oversold instrument as it has been the best at calling out significant pivot points in the equity market. On this front, we observe a high reading, that is overshooting our technical channel, into overbought territory. Going by the theory that extended readings on this instrument are signaling points where contrarian positioning makes sense, we are now in the zone where portfolios could be hedged.

Valuation Analysis

During earnings season, we will analyze different aspects of valuations and aggregated company fundamentals (updated at the end of every week). So far, P/E ratios are trading in a reasonable range, with earnings still at cycle highs. The only problem here is that analysis are still expecting earnings to grow in 2H 2022, justifying these valuations to a certain extent. In the event we enter a recession, growing corporate profits would be a gravity-defying stunt.

Takeaway:

Equities are currently on a short term buy signal, as we enter a pivotal week. Surprises can come from either the long or short side, as earnings will be digested and the FOMC offers guidance. We will stay true to our neutral approach, and add hedges if the market gets extended to the upside. Otherwise, our preferred asset classes remain treasuries and commodities for the moment.

Andrei Sota